Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Monday, crude oil lost 0.66% as worries over swelling crude oil supplies outweighed upbeat U.S. housing data. Despite this drop, light crude remains in the consolidation, slightly above the important support zone. Is this a sign of strength?

Although the National Association of Home Builders/Wells Fargo Housing Market Index increased to a seven-month high of 55.0 in August, beating expectations for a reading of 53.0, the price of crude oil declined below $97 once again. The major driving force behind this decline were ongoing concerns that crude supply far outweighs demand - especially as tensions between Ukraine and Russia appeared to wane (please note that the flow of humanitarian aid deliveries into Ukraine from Russia continued, which eased nerves in global markets). Will crude oil drop any further? Or maybe we’ll see a rebound from here? Let’s check the technical picture and find out which scenario is more likely at the moment (charts courtesy of http://stockcharts.com).

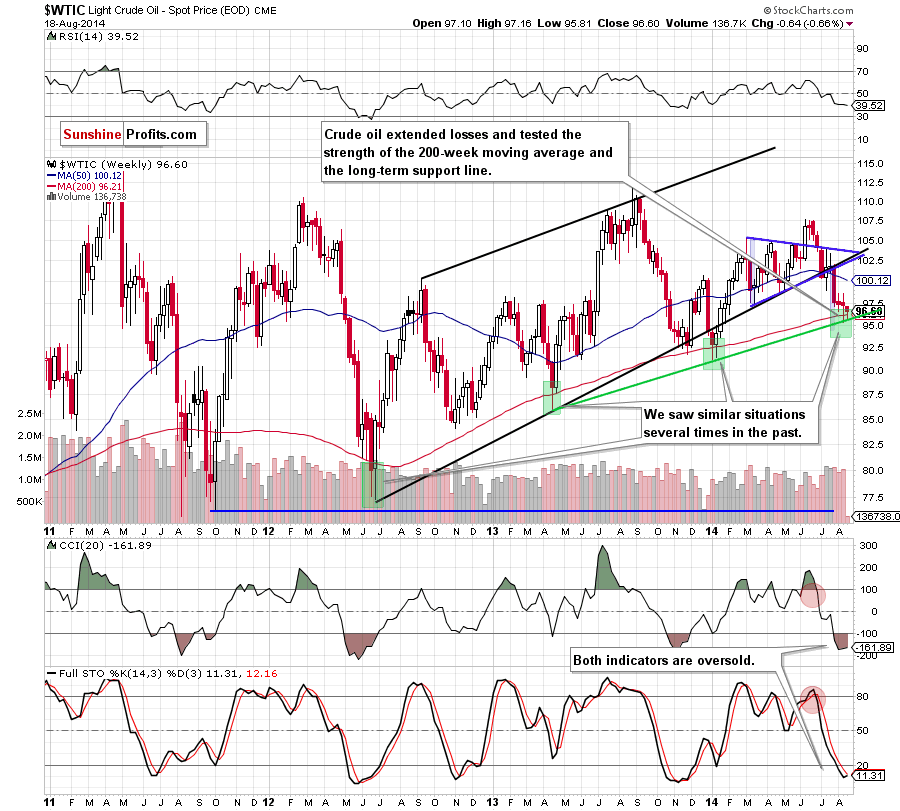

The medium-term picture remains unchanged as crude oil still remains above its major support levels – the 200-week moving average (currently at $96.21) and the rising, long-term support line. Therefore, what we wrote yesterday is up-to-date:

(…) the commodity rebounded – just like in the past (we marked these points with green). As is well known, the history tends to repeat itself, therefore, we believe that crude oil will move higher from here in the coming week (or weeks).

Did the short-term outlook change? Let’s check.

Quoting our previous Oil Trading Alert:

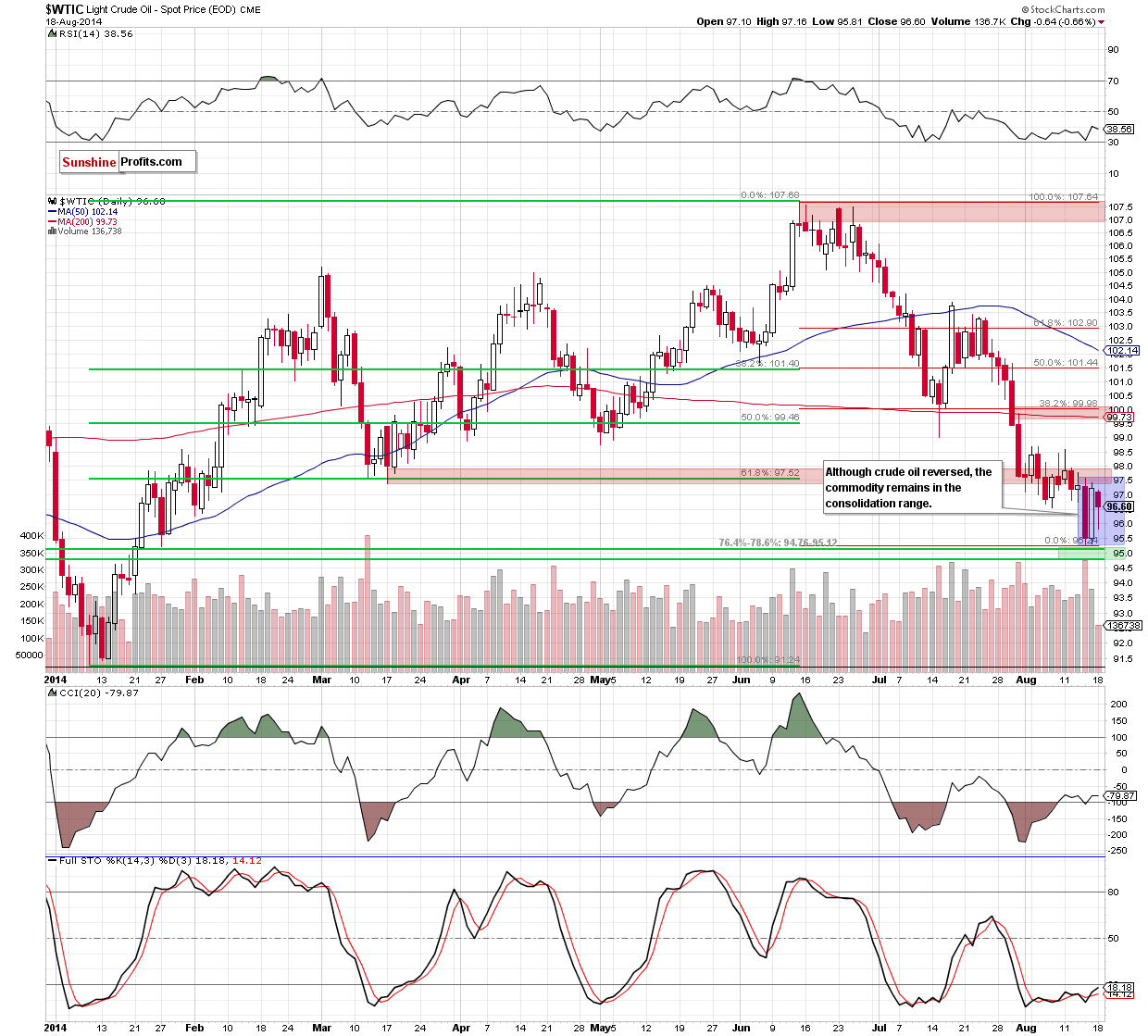

(…) the commodity still remains below the resistance zone created by the March low and the recent highs, which suggests that we may see a pullback later in the day. If this is the case, light crude could re-test the strength of the green support zone.

As you see on the above chart, although oil bears tried to break the support zone, they failed and crude oil rebounded. Despite yesterday’s price action, the overall picture hasn’t changed much as light crude remains in the consolidation range (marked with blue). This is the point where we should consider two scenarios. On one hand, if the commodity breaks above the upper line of the formation (and the nearest resistance area), we’ll likely see further improvement and an increase to around $99.73-$99.96, where the very strong resistance zone(created by the 38.2% Fibonacci retracement evel based on the entire June-Aug decline, the 200-day moving average and the black declining resistance line) is. On the other hand, if oil bulls fail in the coming day (or days), crude oil will test the green support zone once again. Which scenario is more likely at the moment? Taking into account positive divergences between all three indicators and the price of light crude, buy signals generated by the CCI and Stochastic Oscillator and all similarities to November (we discussed this issue yesterday), we remain convinced that bigger corrective upswing is just around the corner.

Summing up, yesterday, crude oil pulled back and erased some Friday’s gains, but despite this move, the commodity still remains in the consolidation. Although light crude could go both north or south from here, we believe (basing on all similarities to November and bullish position of the indicators) that crude oil will move higher from here in the coming week (or weeks). If we don't see a continuation of the decline today, we will strongly consider opening long positions tomorrow or in the following days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts