Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

Let’s examine the charts below to find out what can we infer from them (charts courtesy of http://stockcharts.com).

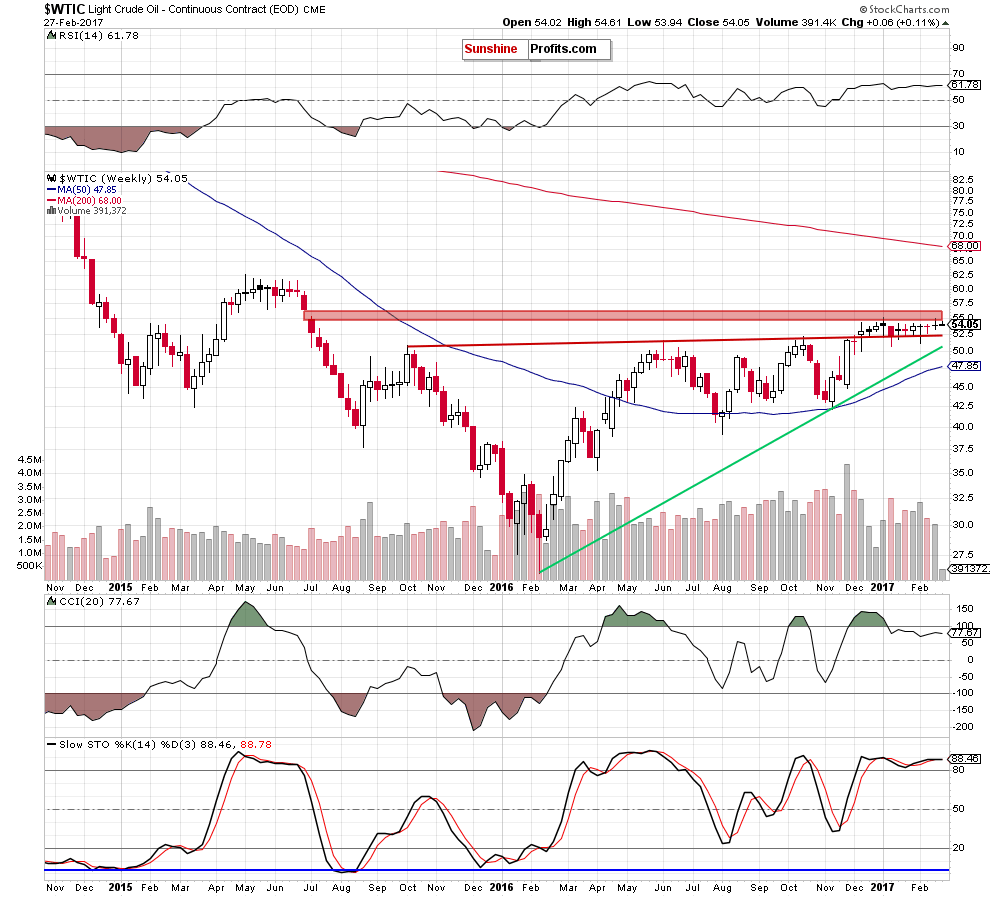

Based only on Monday’s price action we can write that the overall situation remains almost unchanged, because although crude oil increased above the upper border of the blue consolidation, the commodity reversed and closed the day under this line – similarly to what we saw in previous days.

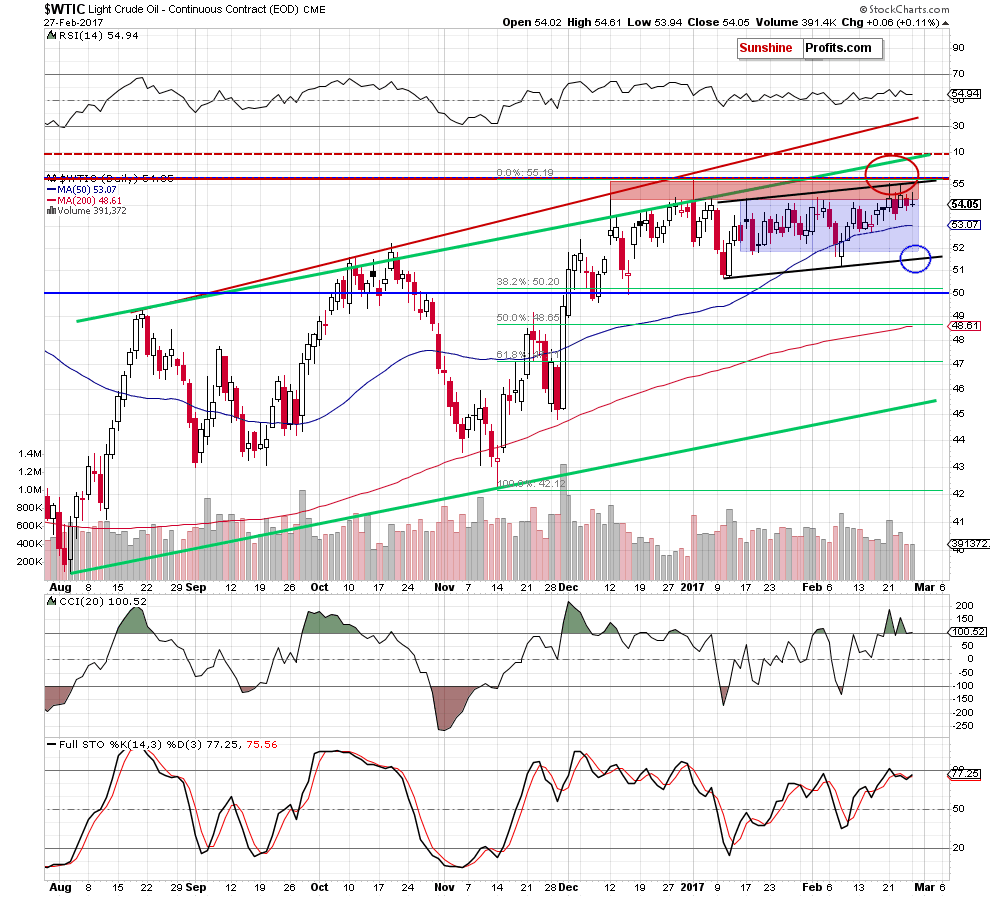

However, earlier today, crude oil futures moved lower and dropped to an intraday low of $53.41, which suggests that crude oil will also decline after the market’s open. If this is the case, we’ll see (at least) a test of the February 22 low of $53.35. If this support is broken, the next target for oil bears will be the 50-day moving average (around $53.07) or even the lower border of the blue consolidation and the lower line of the black rising trend channel (around $51.62-$51.80).

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts