Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

Let’s examine the charts below to find out what can we infer from them (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

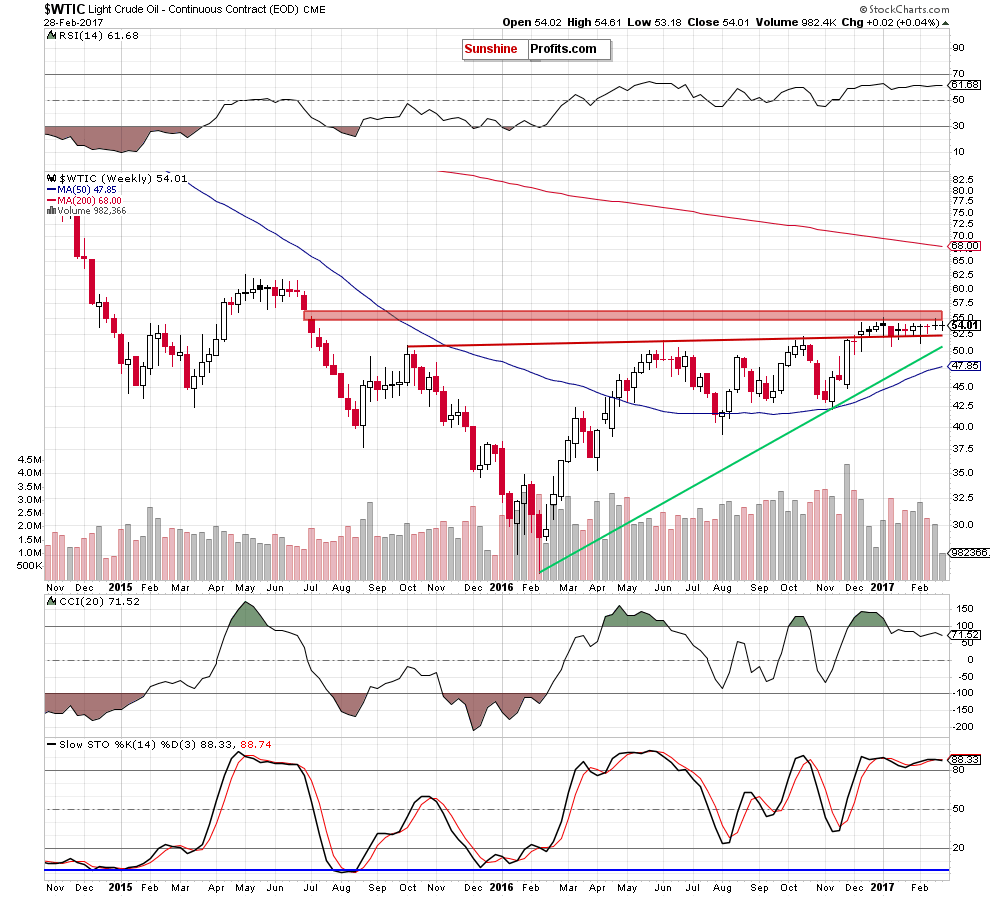

(…) earlier today, crude oil futures moved lower and dropped to an intraday low of $53.41, which suggests that crude oil will also decline after the market’s open. If this is the case, we’ll see (at least) a test of the February 22 low of $53.35. If this support is broken, the next target for oil bears will be the 50-day moving average (…)

From today’s point of view, we see that crude oil slipped to the 50-day moving average as we had expected. This support encouraged oil bulls to act, which resulted in a rebound, which took the commodity to slightly below the Monday’s closing price.

What’s next? Taking into account yesterday’s rebound from the 50-day moving average and today’s crude oil futures moves (they increased to an intraday high of $54.30), we think that the black gold will move higher once again and re-test the red resistance zone, the previous highs and the upper border of the black rising trend channel later in the day.

Nevertheless, in our opinion, it will be just a temporary increase – similar to what we saw in the previous week after the EIA inventory report, which will precede another (this time much bigger) downward move. If this is the case, light crude will meet the lower border of the blue consolidation and the lower line of the black rising trend channel (around $51.62-$51.80) in very near future. Finishing today’s alert, it is worth noting that this scenario is also reinforced by the sell signals generated by the daily and weekly indicators.

Summing up, short positions continue to be justified as crude oil bulls have problems with the key resistance levels, which suggests another attempt to move lower in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts