Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Thursday, crude oil lost 1.08% as Wednesday’s disappointing readings on supply-demand fundamentals, U.S. gross domestic product data in combination with U.S. consumer spending and weekly jobless claims numbers triggered a sharp decline. As a result, light crude tested the strength of the support zone once again. Will oil bears be able to break it this time?

Yesterday, the Commerce Department reported that personal spending rose 0.2% last month, below expectations for an increase of 0.4%. The report also showed that personal income rose 0.4% in May, in line with forecasts and after gaining 0.3% in April. At the same time, the U.S. Department of Labor showed that the number of individuals filing for initial jobless benefits in the week ending June 21 declined by 2,000 to a seasonally adjusted 312,000, while analysts had expected jobless claims to fall by 4,000 to 310,000 last week.

These disappointing numbers in combination with much worse-than expected GDP reading and bearish the EIA report pushed the commodity to its major support zone. Will we finally see a successful breakdown below it? Let’s check technical factors, which could drive crude oil in the nearest future (charts courtesy of http://stockcharts.com).

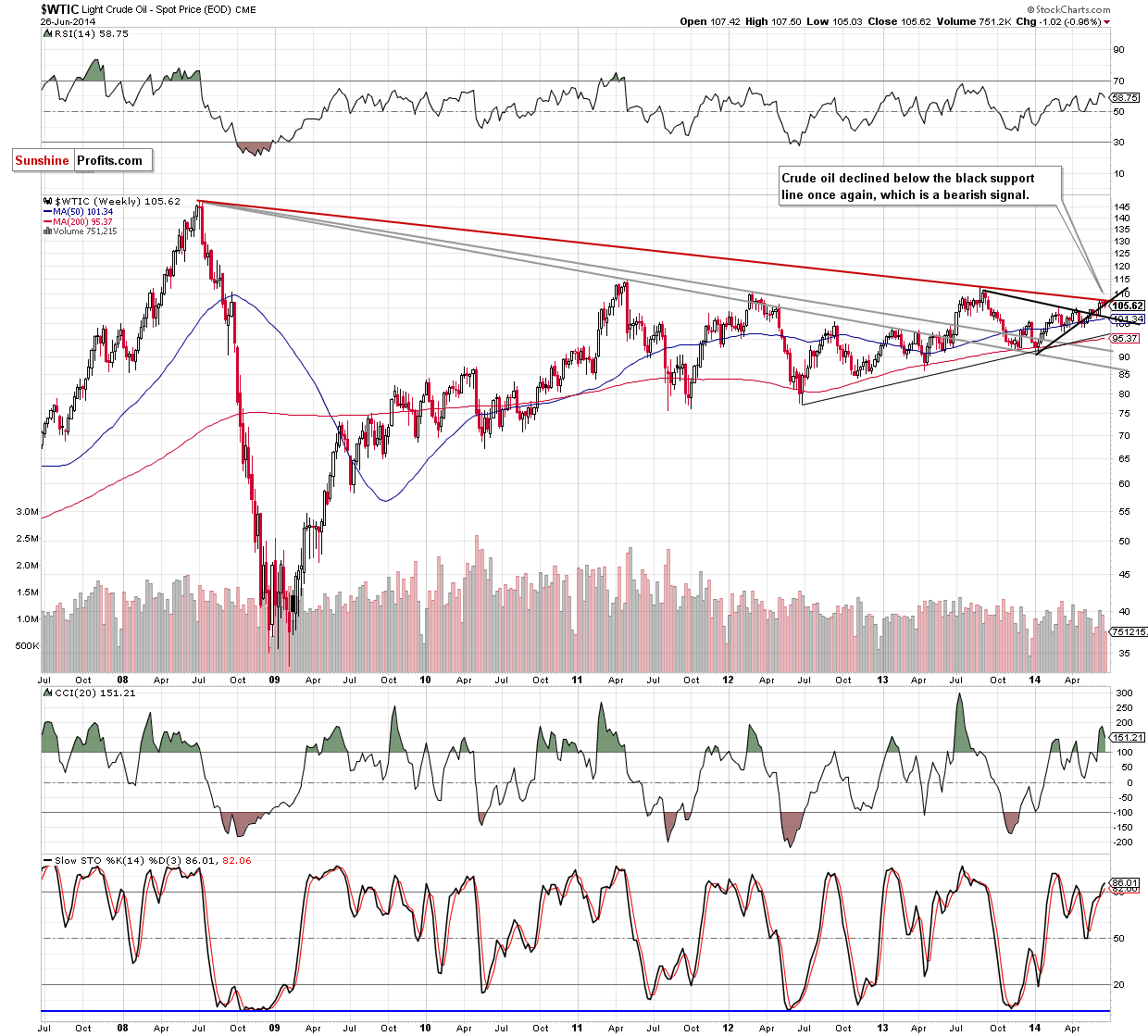

The situation in the medium term has deteriorated as crude oil dropped below the medium-term black rising line. In our opinion, if the commodity closes this week below this key support/resistance line, it will be strong bearish factor, which will likely trigger further deterioration in the coming week. If this is the case, we’ll see a downward move to around $102, where the declining black medium-term support line and the 50-week moving average are.

Having discussed the medium-term picture, let’s focus on the daily chart.

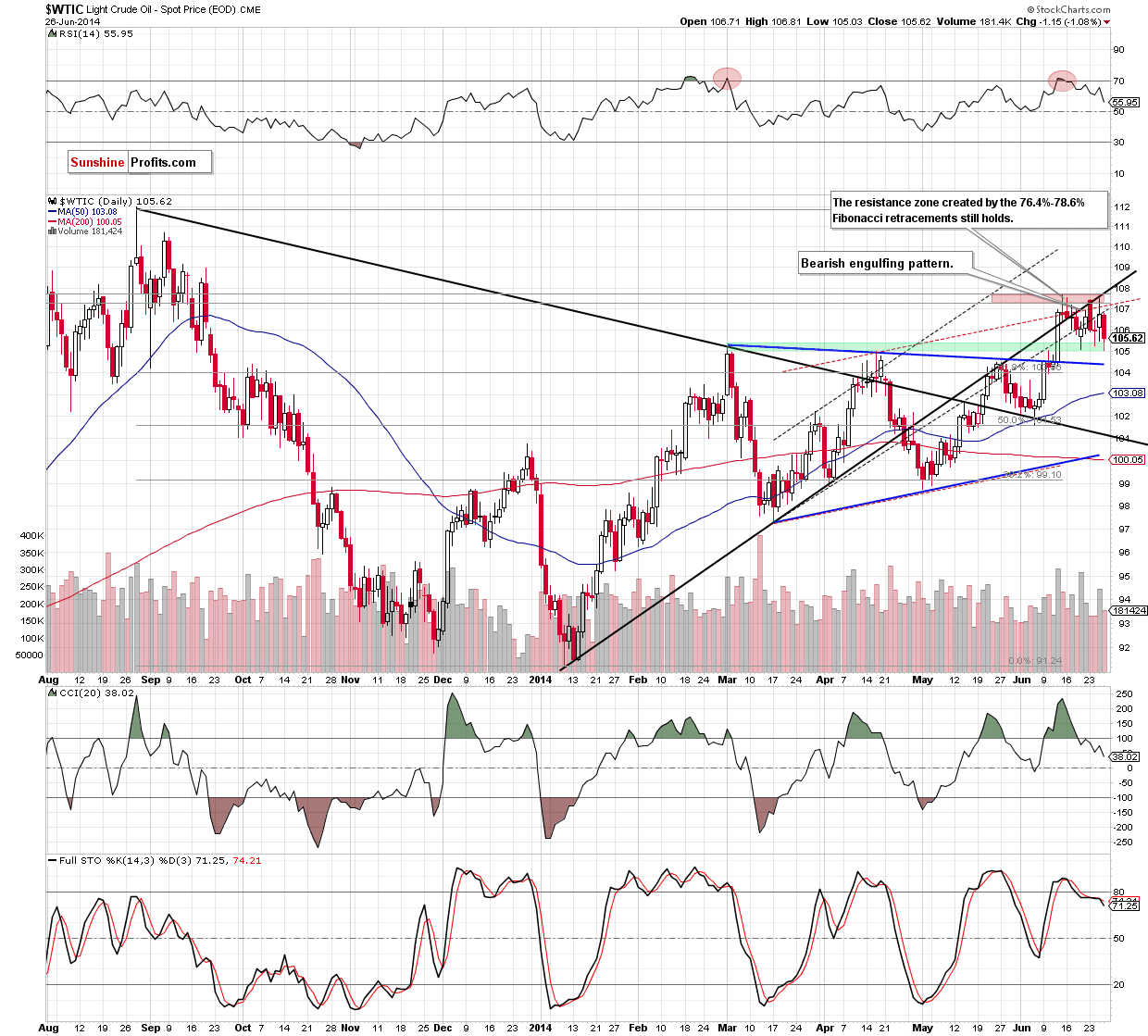

Quoting our last Oil Trading Alert:

(…) the combination of the resistance zone (created by the 76.4% and 78.6% Fibonacci retracements) and the black resistance line successfully stopped further improvement – just like on Monday and also in mid-June. In both previous cases such price action triggered a correction, which took light crude to the green support zone. Taking this fact into account, it seems to us that history will repeat itself once again and we’ll see similar pullback in the coming day (or days).

Yesterday, we noticed such price action as crude oil reached the above-mentioned downside target. If this support zone holds, we’ll see another corrective upswing to around $107.30-$107.68, where the resistance zone is. On the other hand, if oil bears do not give up and show their claws one again, we will see a breakdown in the nearest future and a correction to at least the previously-broken blue support line (currently around $104.40). Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish scenario.

Summing up, we still remain bearish as the commodity declined sharply and moved away from the strong resistance zone and the medium-term black rising line. Therefore, we think that further deterioration and lower values of crude oil are still ahead us (even if we’ll see a rebound later today).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts