Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil extended losses and hit a fresh 2014 low weakened by disappointing Chinese economic data. Although the commodity rebounded slightly in the following hours supported by the EIA weekly report, light crude posted its biggest annual loss since the recession in 2008. Is the worst behind oil bulls?

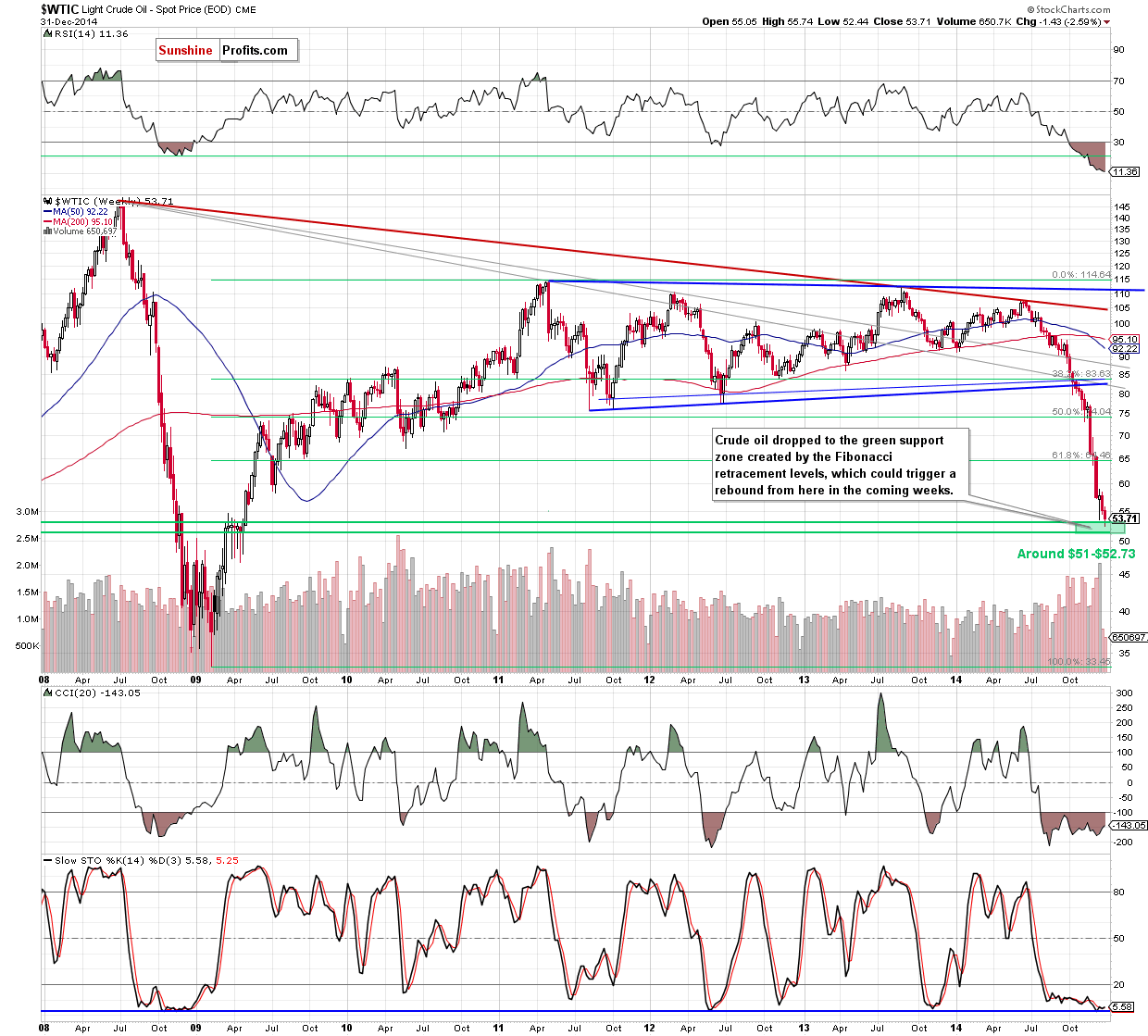

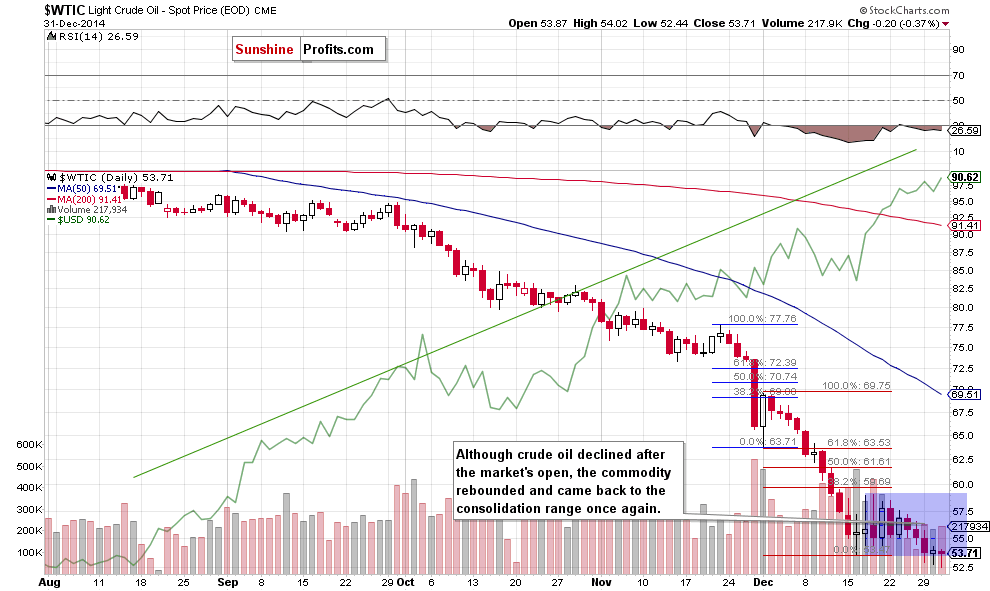

On Wednesday, China's factory data showed that the final reading of the HSBC Manufacturing Purchasing Managers' Index dropped to 49.6 in December, from 50 in November. These disappointing numbers underlined weaker growth that has slowed the rise in oil demand and weighed on prices. As a result, light crude moved lower after the market’s open, hitting a fresh 2014 low of $52.44. Later in the day, the commodity rebounded after the U.S. Energy Information Administration showed that U.S. oil supplies fell by more than expected last week as refiners bought more crude. However, light crude quickly reversed gains because the storage data also showed that supplies of petroleum products rose more than expected and crude stockpiles in Cushing, Okla. rose by 2 million barrels to a 10-month high. In these environment, crude oil closed the day at its lowest level since May 2008. Will we see new lows in the coming month? (charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on Wednesday, we wrote the following:

(…) the American Petroleum Institute showed that (…) stockpiles at the Cushing, Oklahoma rose by 1.8 million barrels. If today’s the EIA’s report confirm these numbers, we’ll see another test of the support zone created by the 76.4% and 78.6% Fibonacci retracement levels (around $51-$52.73).

As you see on the charts, the situation developed in line with the above-mentioned scenario and crude oil moved lower after the market’s open, hitting a fresh 2014 low. Despite this drop, the commodity rebounded later in the day, coming back to the consolidation – similarly to what we saw on Tuesday. Taking this fact into account, we believe that our last commentary is up-to-date:

(…) As you see on the weekly chart, the green support zone withstood the selling pressure, triggering a small rebound, which took the commodity above $54 (…). In this way, light crude invalidated the breakdown below the previous lows and came back to the consolidation range, which is a positive signal. Despite this move, it’s hard to say that the situation in the very short term (not to mention the short- or medium-term perspective) has improved as yesterday’s upswing is barely visible on the weekly chart. In our opinion, the situation will improve, if we see an increase above the upper line of the consolidation and a confirmed breakout above the 38.2% Fibonacci retracement at $59.14. Until this time, another downswing and test of the above-mentioned support zone is more likely than not.

Summing up, although crude oil bounced off the support zone, Wednesday’s move didn’t change the very short-term outlook, which remains mixed. Taking this fact into account, we think that as long as there is no breakout above the 38.2% Fibonacci retracement (based on the recent declines) or breakdown under the 76.4% and 78.6% Fibonacci retracement levels opening any positions is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts