Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

Although light crude moved higher after the market’s open supported by ongoing concerns over the situation in Iraq, the commodity reversed and lost 0.18% as the International Monetary Fund cut its forecast for U.S. economic growth this year. In this way, crude oil reached the previously-broken medium-term support/resistance line. Will we see an invalidation of the breakout in the coming days?

On Monday, market participants continued to monitor developments in Iraq, where the conflict escalated. Yesterday, radical Sunni Islamic insurgents continued to march towards Baghdad after seizing control of key northern Iraqi cities, which spooked investors, underlining concerns over a disruption to supplies from the country. Although Iraq's oil-producing regions are in the south of the country, far from current fighting, investors are worried that the whole country could collapse into chaos. Thanks to these circumstances, the price of crude oil moved higher, hitting an intraday high of $107.54.

Despite this rally, the commodity reversed and gave up some gains after the International Monetary Fund cut its forecast for U.S. economic growth this year due to an unusually harsh winter along with a “still-struggling housing market”. The IMF said it now expects the U.S. economy to expand 2% in 2014, down from its forecast of 2.8% in April.

How did these circumstances influence the technical picture? Let’s check (charts courtesy of http://stockcharts.com).

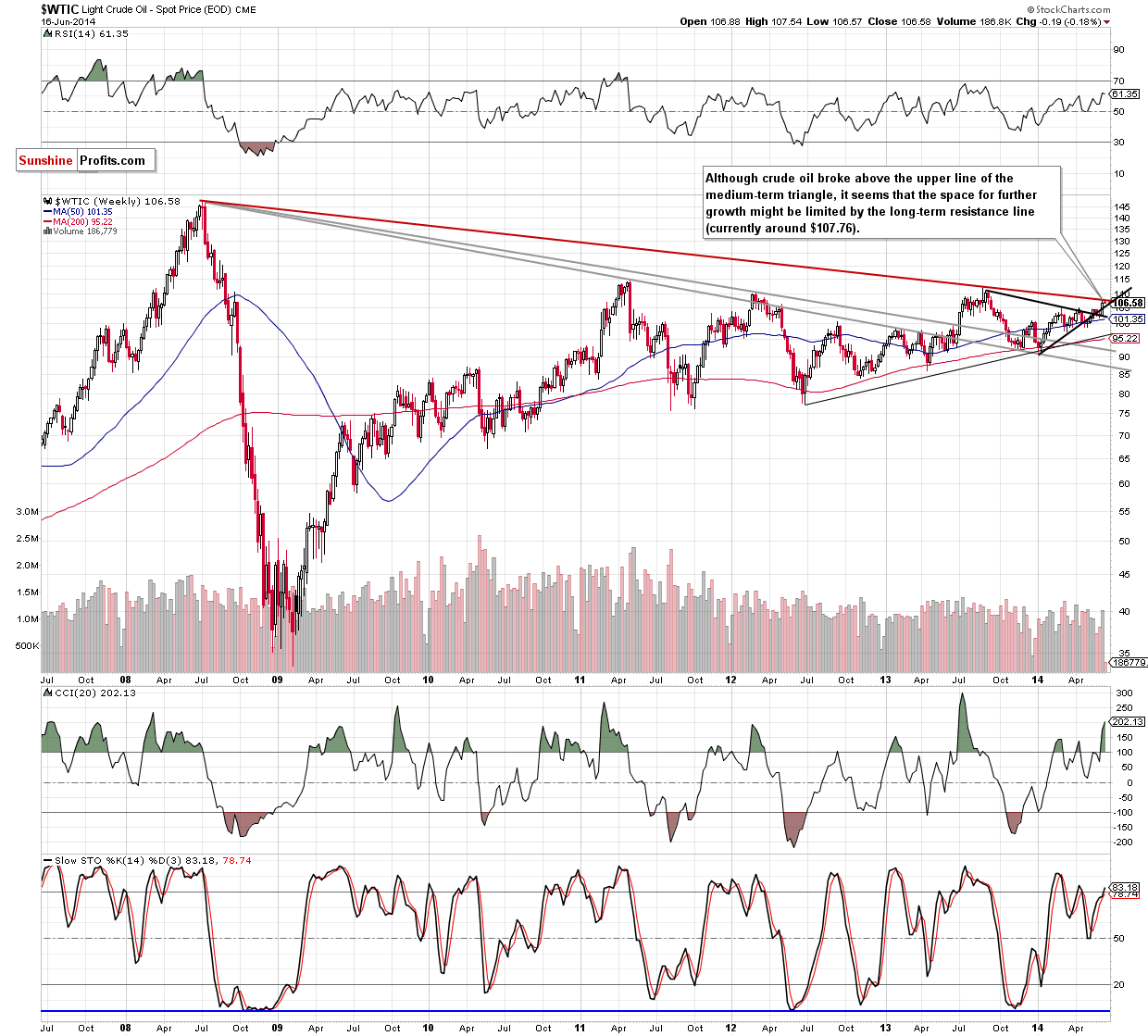

Looking at the weekly chart, we see that the proximity to the long-term declining line encouraged oil investors to push the sell button, which triggered a small (but visible from this perspective) downswing. Taking this fact into account, and combining it with the position of the indicators (the CCI and Stochastic Oscillator are overbought), it seems to us that further deterioration is likely – especially if crude oil breaks below the medium-term support line. Which one? Let’s zoom in our picture and take a closer look at the daily chart.

In our previous Oil Trading Alert, we wrote the following:

(…) the space for further growth might be limited in the near future. In our opinion, oil bulls could have a tough time breaking through the next resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels (around $107.30-$107.75). The reason for such assumption is not only the fact that this is a strong resistance zone, which usually pauses (or even stops) further improvement, but also the conclusion which emerges from the long-term chart.

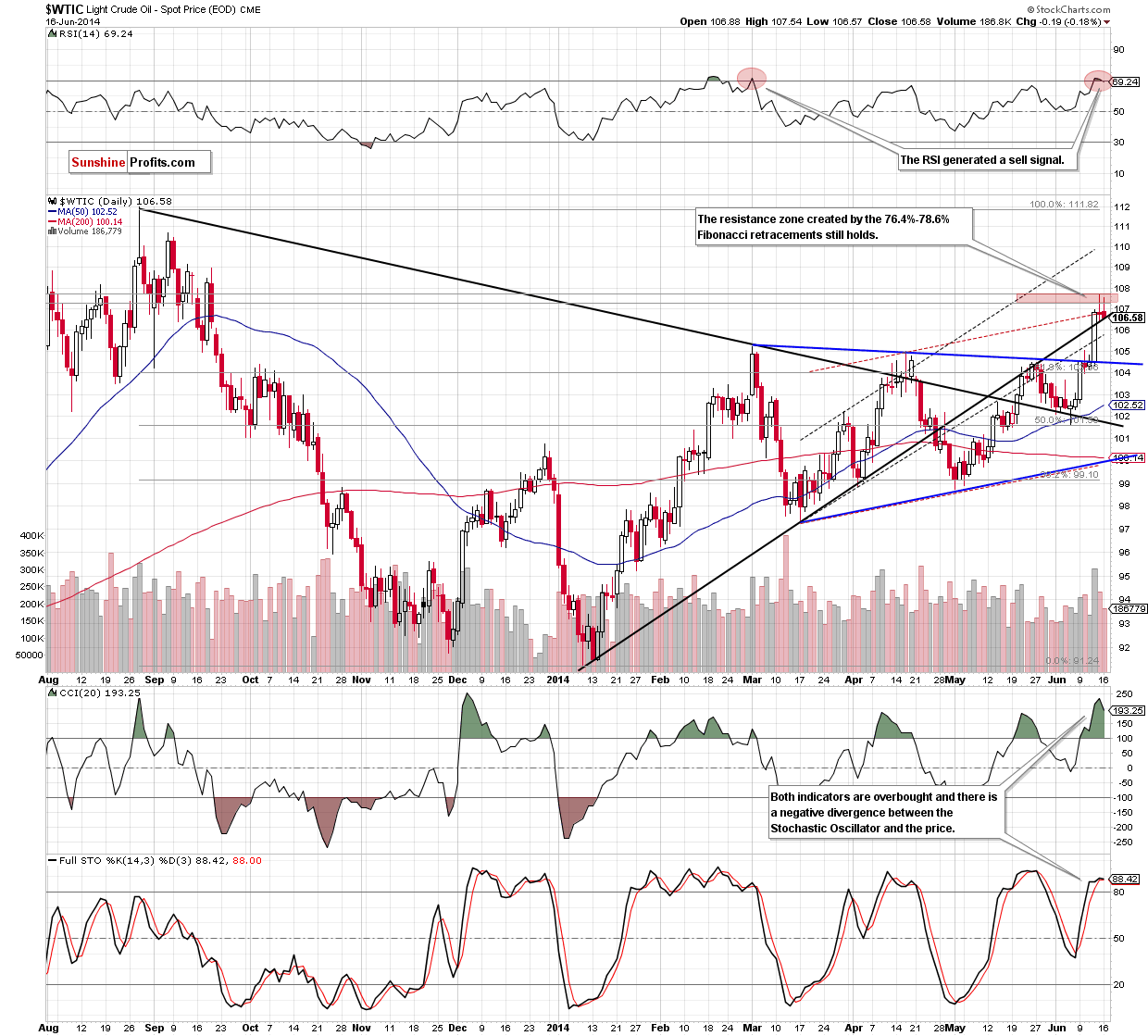

(…) the RSI reached its highest level since the beginning of March, breaking above the level of 70, while the CCI and Stochastic Oscillator are overbought (additionally, there is a negative divergence between the latter and the price), indicating that correction is just around the corner. If this is the case, the initial downside target for oil bears will be the previously-broken medium-term black rising line (currently around $106.60), which stopped further deterioration on Friday.

Looking at the above chart, we see that oil bears realized the above-mentioned scenario yesterday, pushing crude oil to its initial downside target. We think that if this line holds, we may see another attempt to break above the resistance zone. However, if it is broken, the current correction will accelerate and the commodity will find support around $104.55, where the upper line of the medium-term triangle (marked with blue) is.

Summing up, although crude oil moved higher, the strong resistance zone created by the long-term declining line and two important Fibonacci retracement levels successfully stopped further improvement for the second time in a row. In this technical environment, it is doubtful to us that oil prices will rise any further and we think that lower values of crude oil and correction are ahead us.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, short positions in the crude oil market with $109.20 as a stop-loss order are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts