Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 2.21% as mostly upbeat U.S. economic data and tension fears between Ukraine and Russia supported the price. As a result, light crude shot up and hit a one-week high, reaching an important resistance zone. Will it stop the rally?

Yesterday, the U.S. Commerce Department showed that the number of building permits issued last month fell by 4.2% , while analysts expected building permits to rise by 4.2%. The report also showed that U.S. housing starts dropped by 9.3% in June, missing expectations for an increase of 0.9% to 1.018 million units. Despite these disappointing numbers, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending July 12 declined by 3,000, while analysts had expected jobless claims to rise by 5,000. Additionally, the Federal Reserve Bank of Philadelphia said that its manufacturing index improved to a reading of 23.9 this month from June’s reading of 17.8, beating analysts’ expectations. These upbeat U.S. economic data underlined optimism over the health of the economy and pushed the price of crude oil higher.

On top of that, later in the day, light crude extended gains after news that a Malaysian Airlines plane was shot down near the Russia-Ukraine border, which fueled fears that the crisis between countries will escalate and disrupt the global flow of crude oil. As a result, the commodity shot up and closed the day well above $103 per barrel. How much more room to rally does crude oil have? Let’s examine the charts below and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

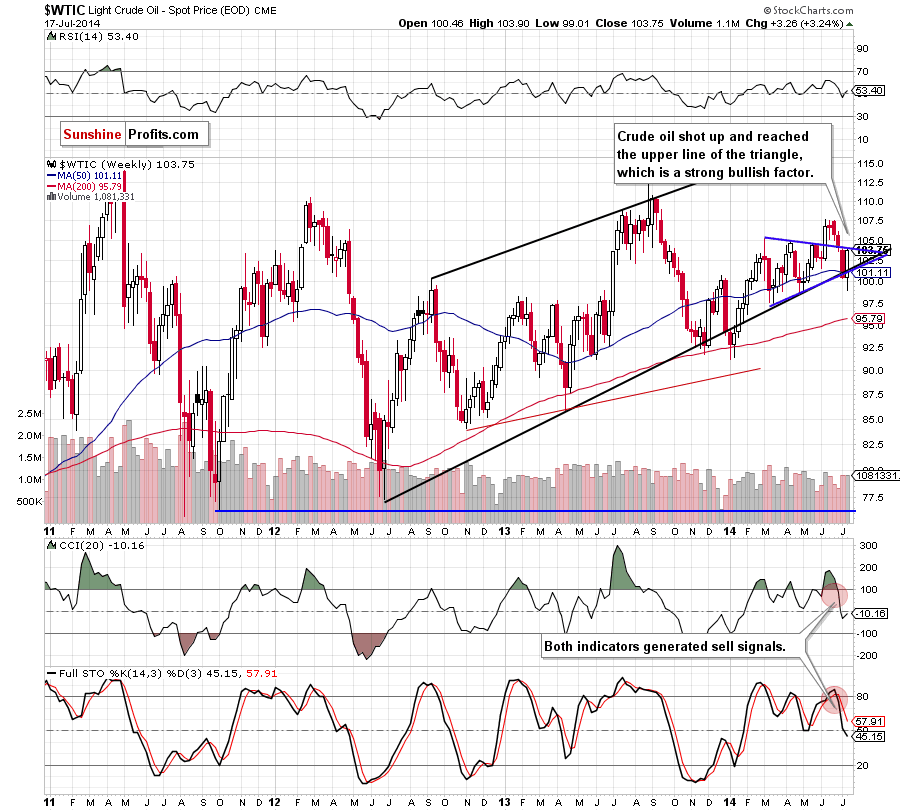

(…) crude oil reversed and invalidated the breakdown below the lower border of the blue triangle (…) the commodity also climbed above the previously-broken 50-week moving average and reached the June low of $101.60, which is the last resistance level before further improvement. Therefore, (…) if it is broken, crude oil will extend the rally.

On the above chart, we see that the medium-term outlook has improved as crude oil extended gains and reached the upper line of the blue triangle. As a result, there is a threat of returning to the support zone created by the 50-week moving average and the lower border of the formation (especially when we factor in sell signals, which are still in play). Nevertheless, an invalidation of earlier breakdown is a strong positive signal and if oil bulls manage to push the commodity above its major resistance, we’ll see further improvement. Where light crude head next? Let’s look for answer on the daily chart.

Quoting our Oil Trading Alert posted on July 16:

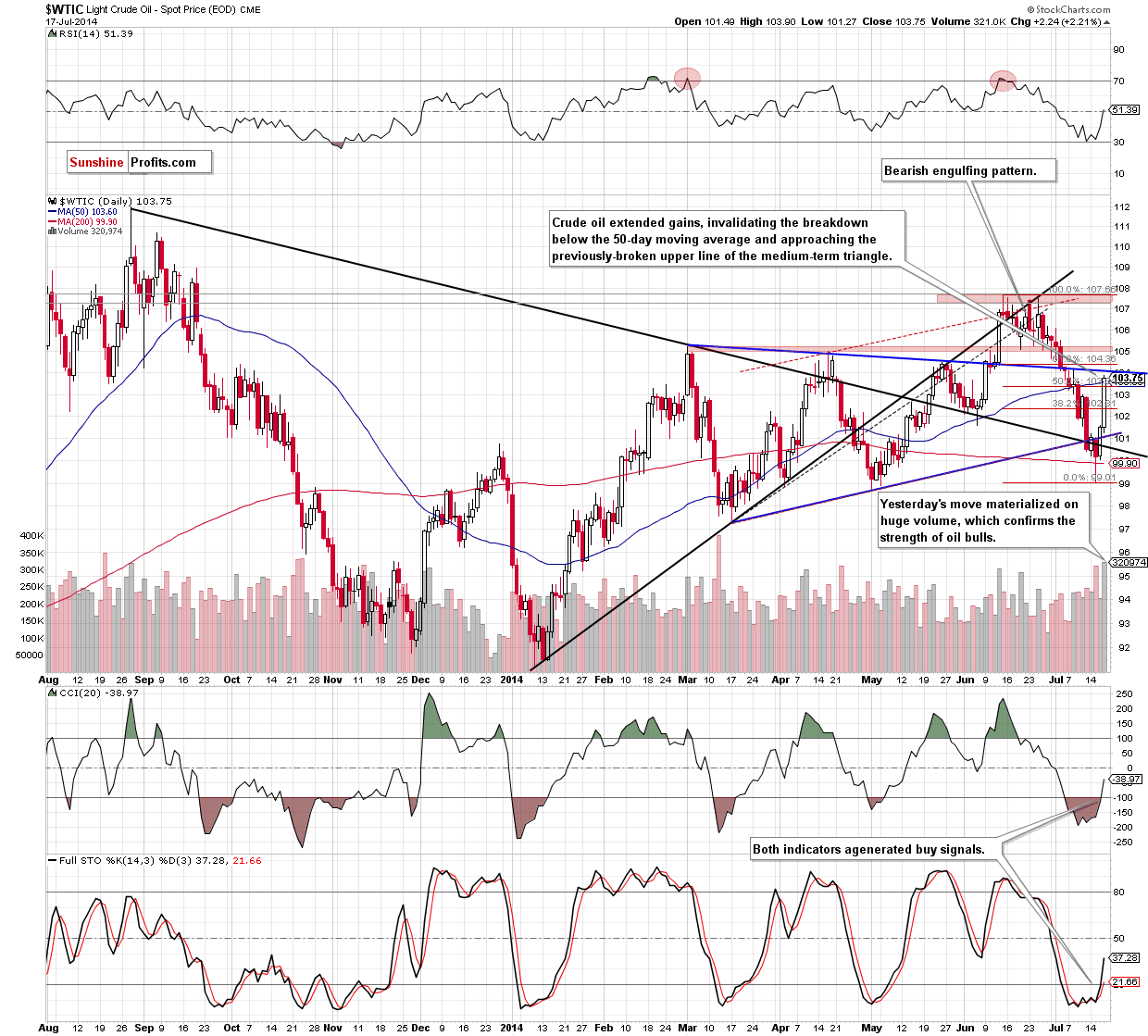

(…) if crude oil climbs above both resistance lines, we’ll see a corrective upswing to at least $102.30, where the 38.2% Fibonacci retracement (based on the entire recent decline) is.

Looking at the daily chart, we clearly see that oil bulls took their chance and not only realized the above-mentioned scenario, but also successfully pushed crude oil above the next Fibonacci retracement and the previously-broken 50-day moving average, invalidating earlier breakdown below these levels. With this upswing, the commodity approached its major resistance – the upper line of the blue triangle (please note that slightly above it is also the 61.8% Fibonacci retracement level, which usually is the last stop before further improvment). Therefore, this is the point where we should consider two scenarios.

On one hand, if the proximity to the resistance zone encourages oil bears to act, the commodity will correct the rally. In this case, the initil downside target will be around $102, where the 38.2% Fibonacci retracement based on the recent increases is. On the other hand, if crude oil breaks above this important area, we’ll see further improvement – to at least the next resistance zone (around $105). Which scenario is more likely at the moment?

In our opinion, oil bulls have more arguments on their side: an invalidation of the breakdown below very important support/resistance lines and moving averages, an increase above the 50% Fibonacci retracement and buy signals generated by the indicators. Another positive sign is the fact that yesterday’s upward move materialized on huge volume, which confirms the strength of oil bulls. We are not opening long positions here despite the huge-volume rally, as it could be the case that it was just an event-driven one-time rally, not a sign of oil market's true strength. On the other hand, the invalidation of the previosu breakdown is an important development, so we are not opening short positions either. We are keeping our eyes open for confirmation of either bullish or bearish scenario.

Summing up, the situation in the medium- and short-term has improved as crude oil shot up, extending rally and reaching the resistance zone. As we have pointed out before, although this is the place from which crude oil could go both north and south, we think that oil bulls have more arguments on their side and the next move will be to the upside, even if we see a pullback later in the day.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Taking into account this week's rally, we believe that our decision to take the profits off the table and close the short position on July 11 was correct. As we mentioned earlier, no positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts