Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 3.38% as a stronger greenback weighed on the price once again. As a result, light crude hit a fresh multi-year low of $58.96 and closed the day below $60 for the first time mid-Jul 2009. How low could the commodity go?

Yesterday, the U.S. Department of Labor reported that the initial jobless claims in the week ending December 6 dropped by 3,000 to 294,000, beating forecast. Additionally, the U.S. Commerce Department showed that retail sales increased by 0.7% last month, beating expectations for a gain of 0.4%, while core retail sales (without automobile sales), increased by 0.5% in November, surpassing forecasts for a 0.1% gain. These bullish numbers supported the greenback, fueling expectations that the Federal Reserve will hike interest rates earlier in 2015 than once anticipated. As is well known, a stronger U.S. currency makes crude oil more expensive among investors holding other currencies, which resulted in a fresh multi-year low of $58.96 per barrel. Will we see a final bottom later this month? (charts courtesy of http://stockcharts.com).

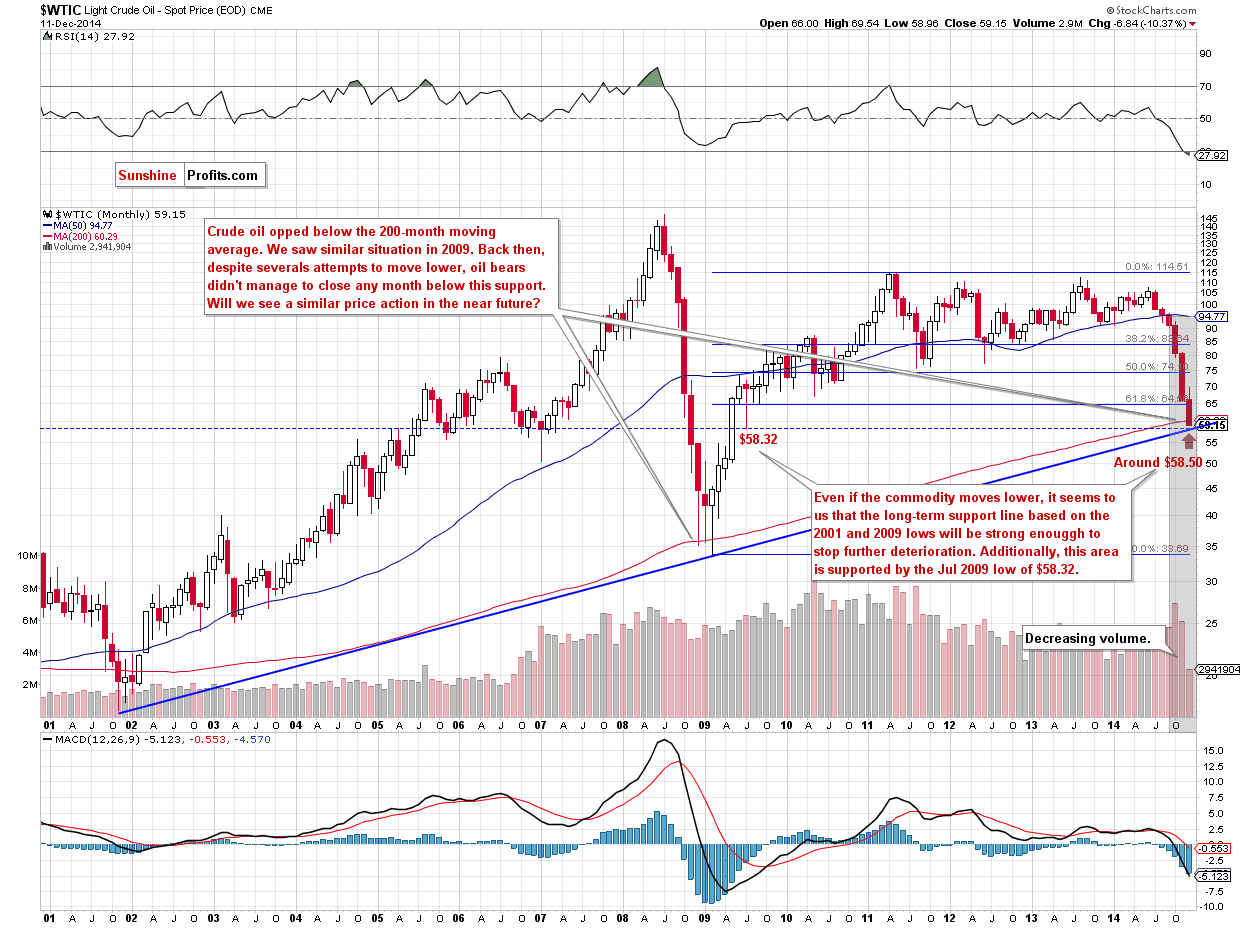

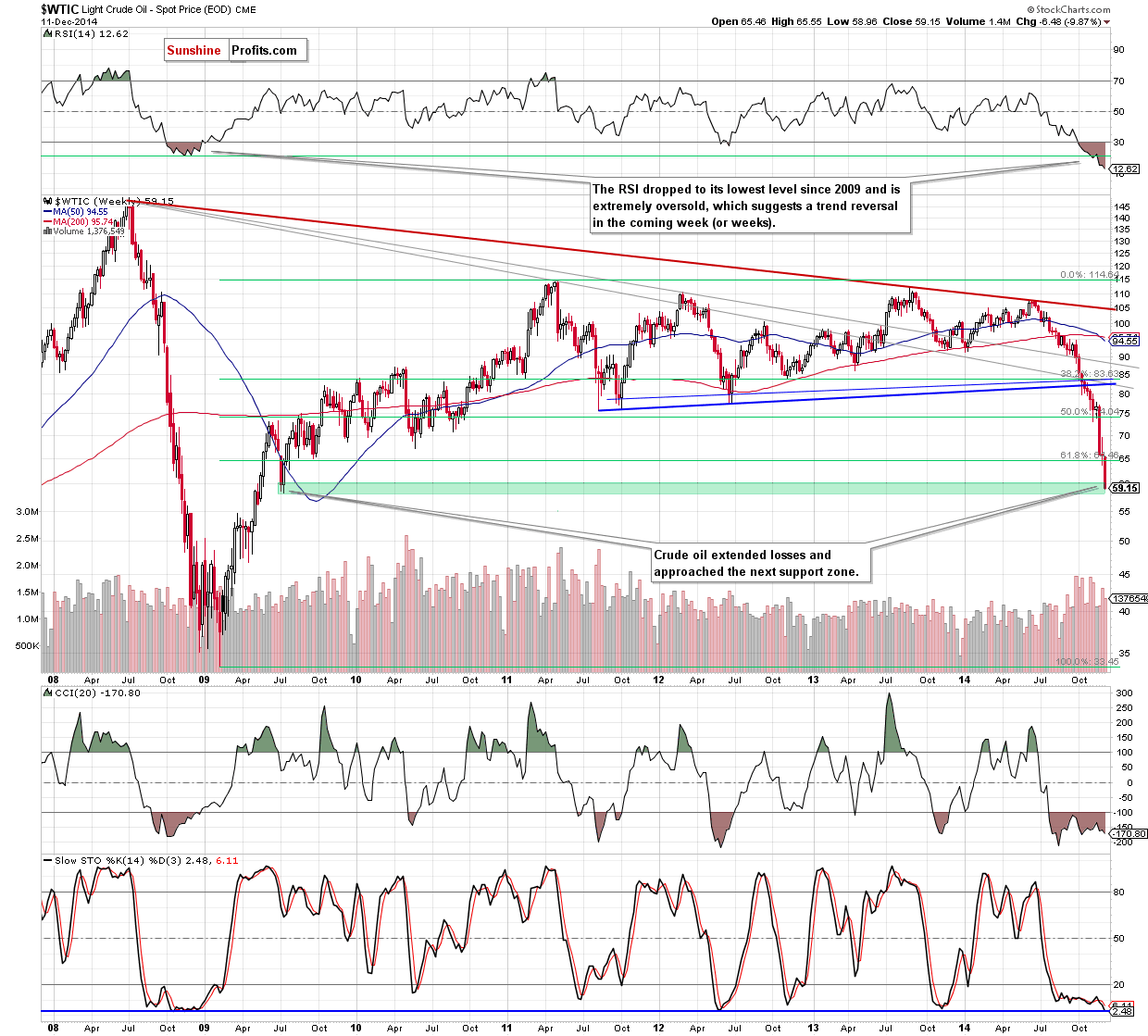

Looking at the above charts, we see that crude oil extended losses and broke below the level of $60 and the 200-monh moving average. Although this is a bearish signal, we should keep in mind that the commodity reached the next solid support zone (around $58.32-$60) created by the Jul 2009 lows in terms of intraday and weekly closing prices. As you see on the monthly chart, in this area is also the long-term blue support line (based on the 2002 and 2009 lows), which could (at least) pause further deterioration in the coming days.

Before we summarize today’s alert, it’s worth noting that although we saw several attempts to close the month below the 200-month moving average in 2009, oil bears failed, which resulted in a significant rebound in the following months. Taking this fact into account and combining it with the above-mentioned support zone and decreasing volume (at least in the previous months), we think that even if crude oil moves little lower in the coming day (or days), the space for further declines seems limited and a trend reversal is just around the corner.

Summing up, crude oil extended losses, hitting a fresh multi-year low and closed the day below $60. This provides us with bearish implications and suggests that we’ll likely see another attempt to move lower later in the day. Nevertheless, we should keep in mind that the space for further declines seems limited as crude oil reached the next solid support zone. Therefore, if this area withstands the selling pressure in the coming days and we see any strength in the market, we’ll consider opening long position.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts