Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Wednesday, crude oil moved higher supported by a drop in crude oil inventories. Despite this improvement, the commodity reversed and decline as gasoline and diesel supplies weighted on the price. Thanks to these circumstances, light crude climbed above its important resistance, but then reversed for the second day in a row. Third time lucky?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories decreased by 2.6 million barrels in the week ended June 6, beating expectations for a decline of 1.9 million barrels. Additionally, the report also showed other seemingly bullish numbers as another supply drawdown in Cushing, Okla., and imports well below year-ago levels. Despite these positive numbers, which pushed the price to an intraday high of $104.81, the commodity reversed as stocks of refined gasoline increased by 1.7 million barrels (far more than forecasts for a gain of 0.9 million barrels) and demand fell for the second week in a row. On top of that, data on distillates such as heating oil and diesel told a similar story, with supplies rising and demand down. In reaction to this news, light crude moved lower, finishing the day below the key resistance line. Will it drop any further from here? Let’s examine technical factors (charts courtesy of http://stockcharts.com).

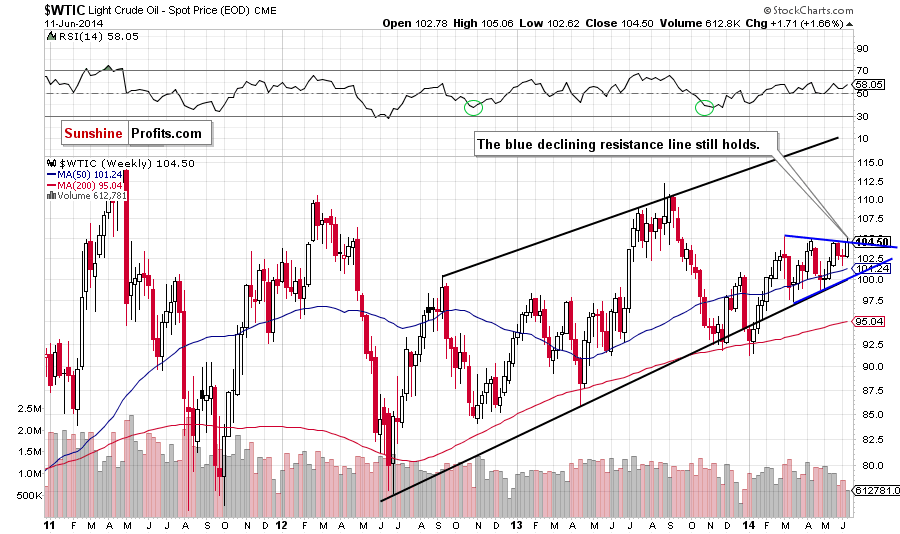

Although crude oil moved little higher (from this perspective, it’s barely visible), the commodity still remains slightly below the blue resistance line based on the recent highs (the upper border of the triangle). Therefore, our last commentary is up-to-date:

(…) an invalidation of a breakout above the blue resistance line based on the recent highs (…) is a bearish signal that suggests further deterioration. If this is the case, we will see another pullback (similarly to what we noticed in the previous weeks) and the downside target will be the 50-week moving average (currently at $101.24 – slightly below last week’s low).

Having discussed the medium-term outlook, let’s focus on the very short-term picture.

Quoting our previous Oil Trading Alert:

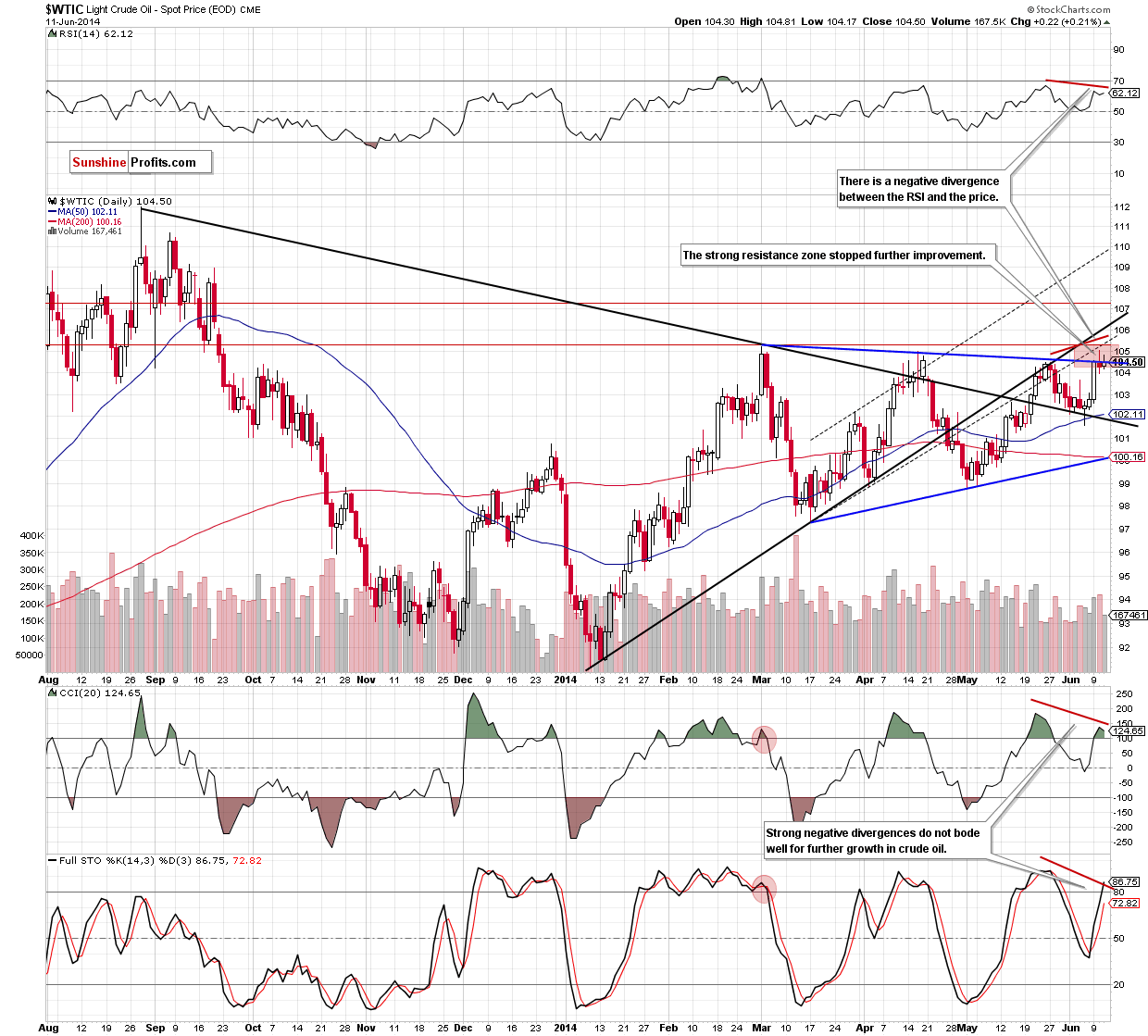

(...) even if crude oil moves higher, we believe that the resistance zone (marked with red) will stop further improvement.

Yesterday, we noticed such price action as crude oil broke above the blue declining resistance line (the upper line of the medium-term triangle) and then reversed, closing the day below it (similarly to what we noticed on Tuesday). This is a bearish signal – especially when we factor in negative divergences between the RSI, CCI, Stochastic Oscillator and the price of crude oil. Nevertheless, we should keep in mind that as long as light crude remains around the blue declining resistance line another attempt to break above this key resistance line can’t be ruled out. If we see such price action, the next upside target will be the March high of $105.22 or even the lower border of the rising trend channel (currently around $105.50). However, if the upper line of the medium-term triangle withstand the buying pressure, it seems to us that the initial downside target will be around $102.65, where the 38.2% Fibonacci retracement (based on the entire May-June rally) meets the Monday low.

Summing up, although crude oil moved little higher, the overall situation in the very short term hasn’t changed as the commodity still remains below the key resistance line. As we have pointed out before, even if light crude moves higher from here, the resistance zone created by the March high and the lower border of the rising trend channel will be strong enough to stop further improvement. Additionally, taking into account negative divergences between light crude and the indicators, is seems that correction is just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts