Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

On Thursday, crude oil lost 0.46% as a stronger greenback and ongoing worries that global supply is plentiful weighed on the price. In this environment, light crude dropped below $93 once again, invalidating earlier breakout. Will this event trigger further deterioration?

Yesterday, the U.S. Department of Labor reported that the initial jobless claims in the week ending September 19 increased by 12,000, while analysts expected a 19,000 rise. Separately, official data showed that although U.S. durable goods orders dropped by 18.2% in August, missing expectations for a 18.0% decline, core durable goods orders (without volatile transportation items) rose 0.7% last month, in line with expectations. These solid numbers in combination with Wednesday’s better-than-expected U.S. new home sales data brought further support to the greenback, which resulted in a fresh annual high in the USD Index (as a reminder, the index tracks the performance of the U.S. dollar versus a basket of six other major currencies). A stronger greenback made oil less attractive in dollar-denominated exchanges, especially among investors holding other currencies. Additionally, ongoing concerns over signs of an abundance of light crude affected negatively the price of the commodity and pushed it below its key-resistance line once again. Will we see further deterioration?(charts courtesy of http://stockcharts.com).

Quoting our last commentary:

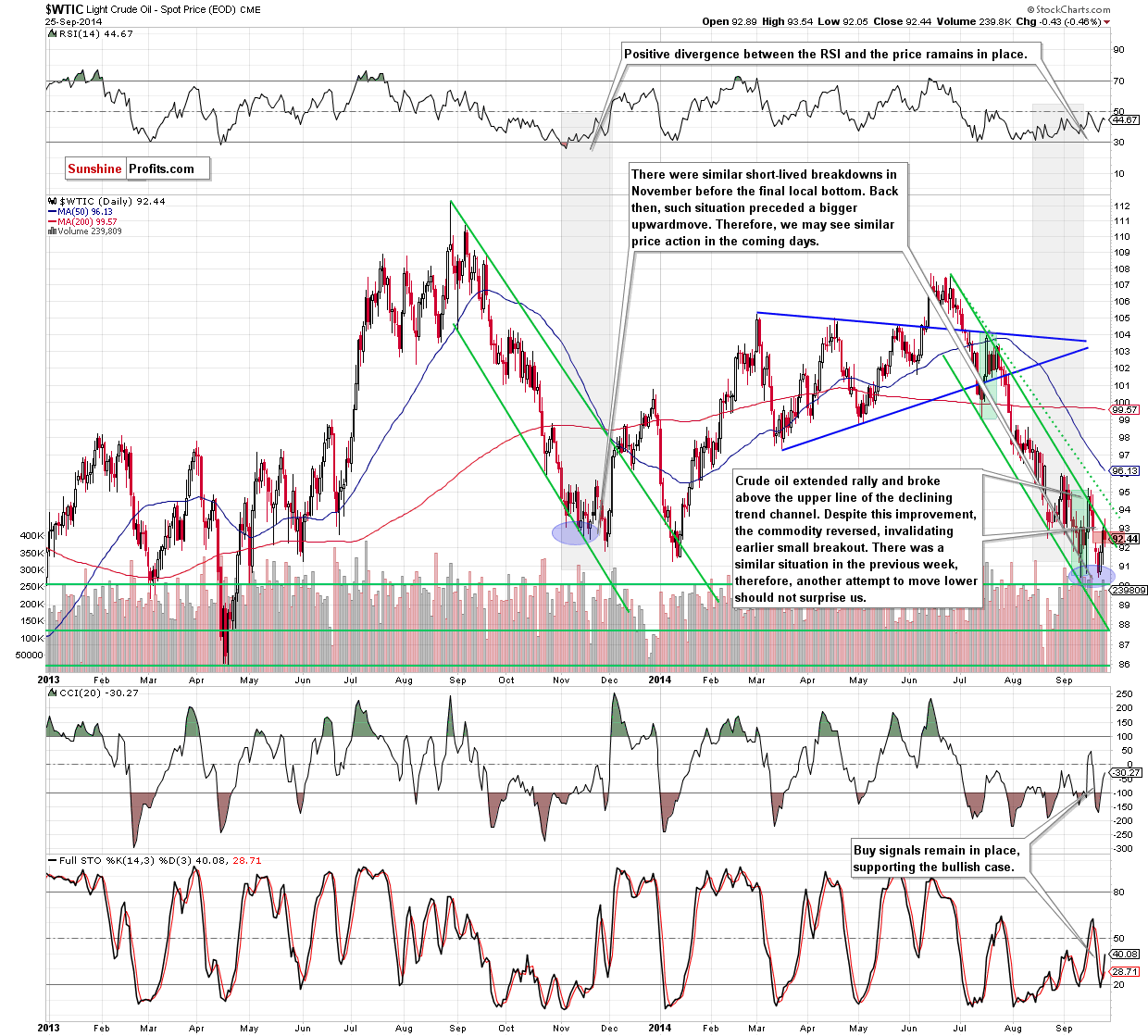

(…) yesterday’s upswing took light crude to the upper line of the declining trend channel, which serves as the key resistance line. Therefore, a shallow and short-lived pullback from here should not surprise us.

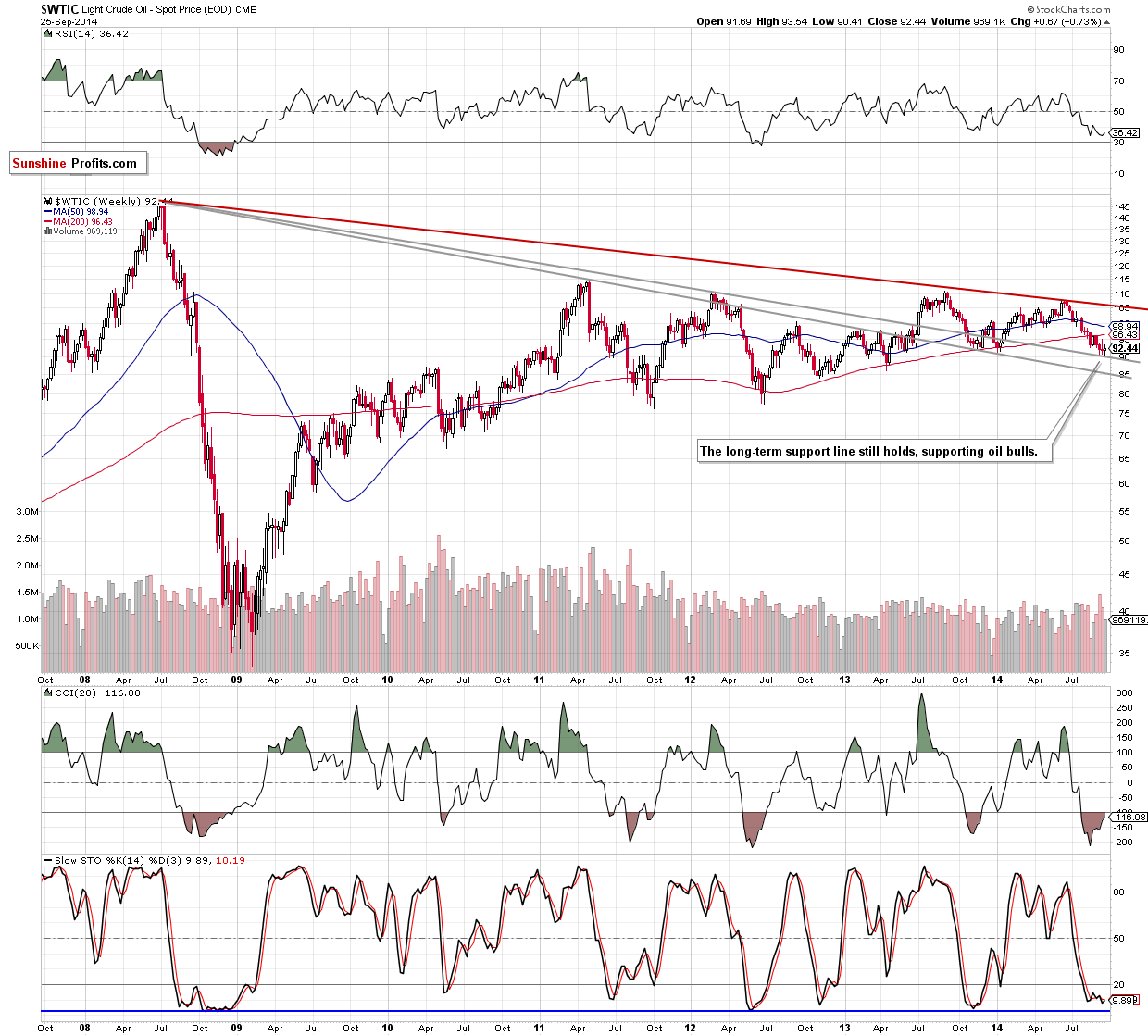

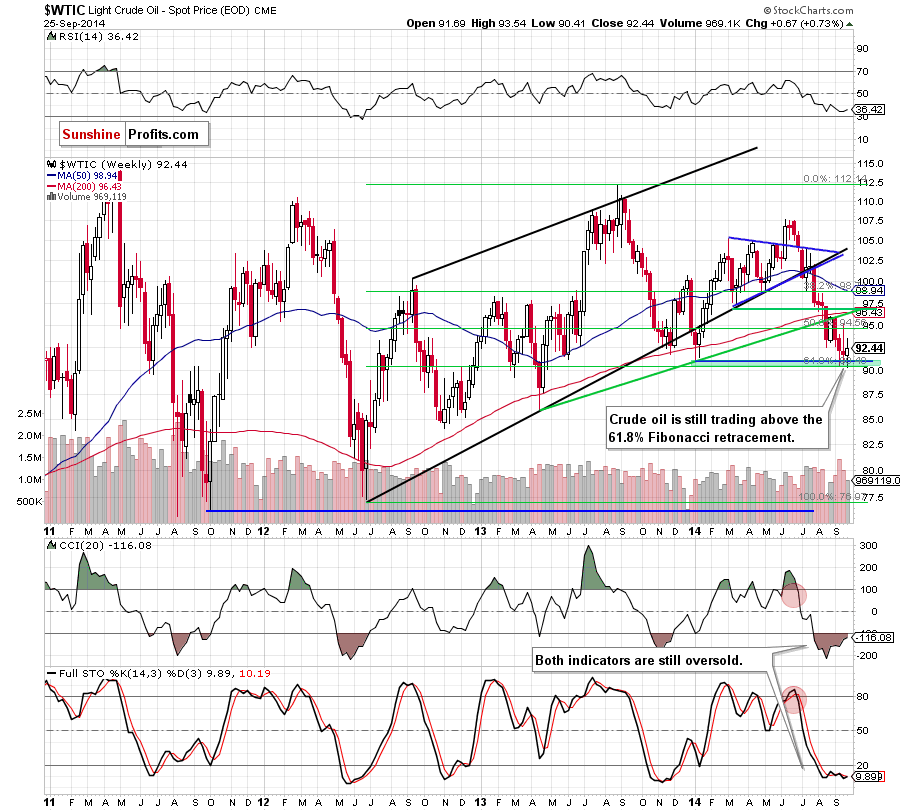

As you see on the daily chart, crude oil pulled back as we expected. Although oil bulls tried to break above the upper line of the declining trend channel, they failed, which resulted in a comeback below this key resistance line and an invalidation of earlier small breakout. As you know from our previous Oil Trading Alerts, this is a bearish signal, which usually triggers further deterioration. Therefore, another try to move lower should not surprise us – especially when we take into account a similar situation from the previous week. Nevertheless, we should keep in mind that buy signals generated by the indicators remain in place and even if the commodity extends losses from here, the space for further declines is limited as the strong support zone created by the long-term declining support line and the 61.8% Fibonacci retracement still holds. Taking this fact into account, we are still convinced that as long as there is no breakdown below these levels, another sizable downward move is not likely to be seen.

Summing up, although the very short-term situation has deteriorated slightly as crude oil invalidated an intraday breakout above the upper line of the declining trend channel, the medium-term picture still supports oil bulls and further improvement. Therefore, we believe that keeping long positions is justified from the risk/reward perspective. In our opinion, even if the commodity extends losses from here, the space for further declines is limited and a bigger upward move is just around the corner.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts