Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Friday, crude oil gained 0.59% as the U.S. dollar weakened against the euro after the release of positive euro zone economic reports and disappointing data from the Commerce Department. In this way, light crude erased Thursday losses and closed the day above $102 per barrel once again.

The U.S. dollar declined sharply against the euro on Friday after data showed that the annual rate of consumer inflation in the euro zone rose more than expected (to 0.8% in February), weakening speculation the European Central Bank will add to stimulus at its upcoming policy meeting. Later in the day, the greenback extended losses against the common currency and dropped to its lowest level since the beginning of the year after preliminary data showed that the U.S. gross domestic product rose 2.4% in the fourth quarter, missing expectations for a 2.5% growth.

These lower-than-expected numbers have helped push the price of light crude higher by weakening the dollar, making crude oil cheaper for buyers using foreign currencies. In this way, light crude climbed 0.45% in the previous week and this was the seventh consecutive weekly gain. It’s also worth noting that crude oil ended February with an increase of 5.44%.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

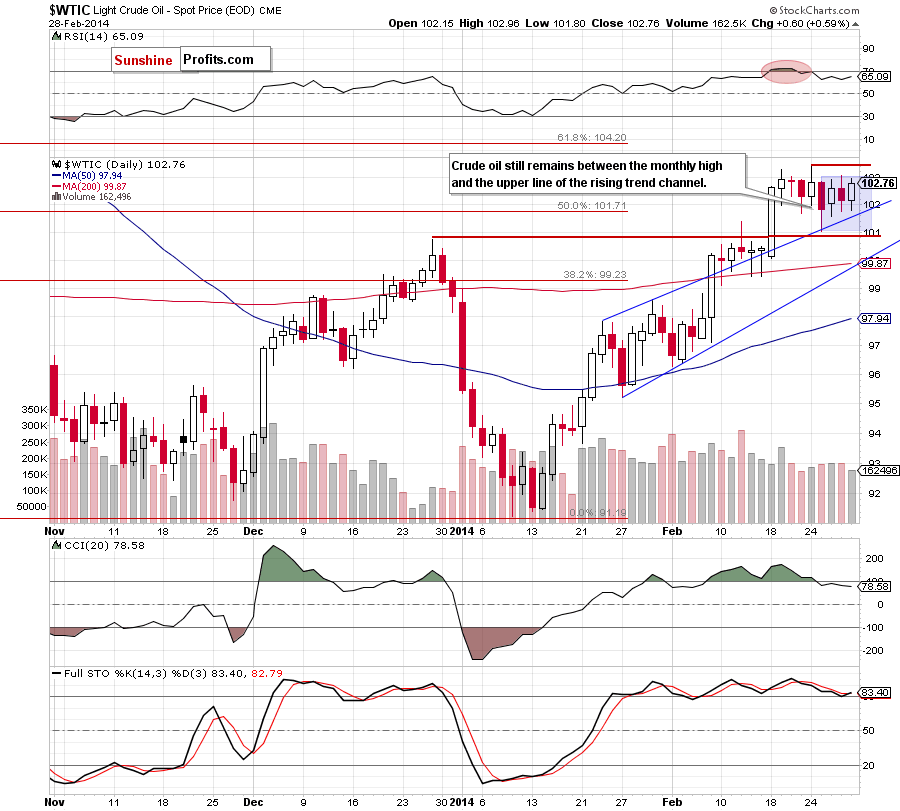

As you see on the above chart, although crude oil moved higher on Friday, it still remains in a narrow range (between the monthly high and the upper line of the rising trend channel) and the overall situation hasn’t changed much. Looking at the chart from this perspective, what we wrote in our previous Oil Trading Alert remains up-to-date.

(…) the February high is reinforced by the 127.2% Fibonacci extension level based on the Dec.-Jan. decline (around $103.34), which serves as the nearest resistance level. The major short-term support is the upper line of the rising trend channel (and a support level created by the December high, slightly below this line). (…) Connecting the dots, the very short-term situation is unclear and it is difficult to predict which way the next move will be (…) it seems that as long as there is no breakout above the monthly high (or a breakdown below the upper line of the rising trend channel) a bigger upswing (or downswing) is not likely to be seen.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

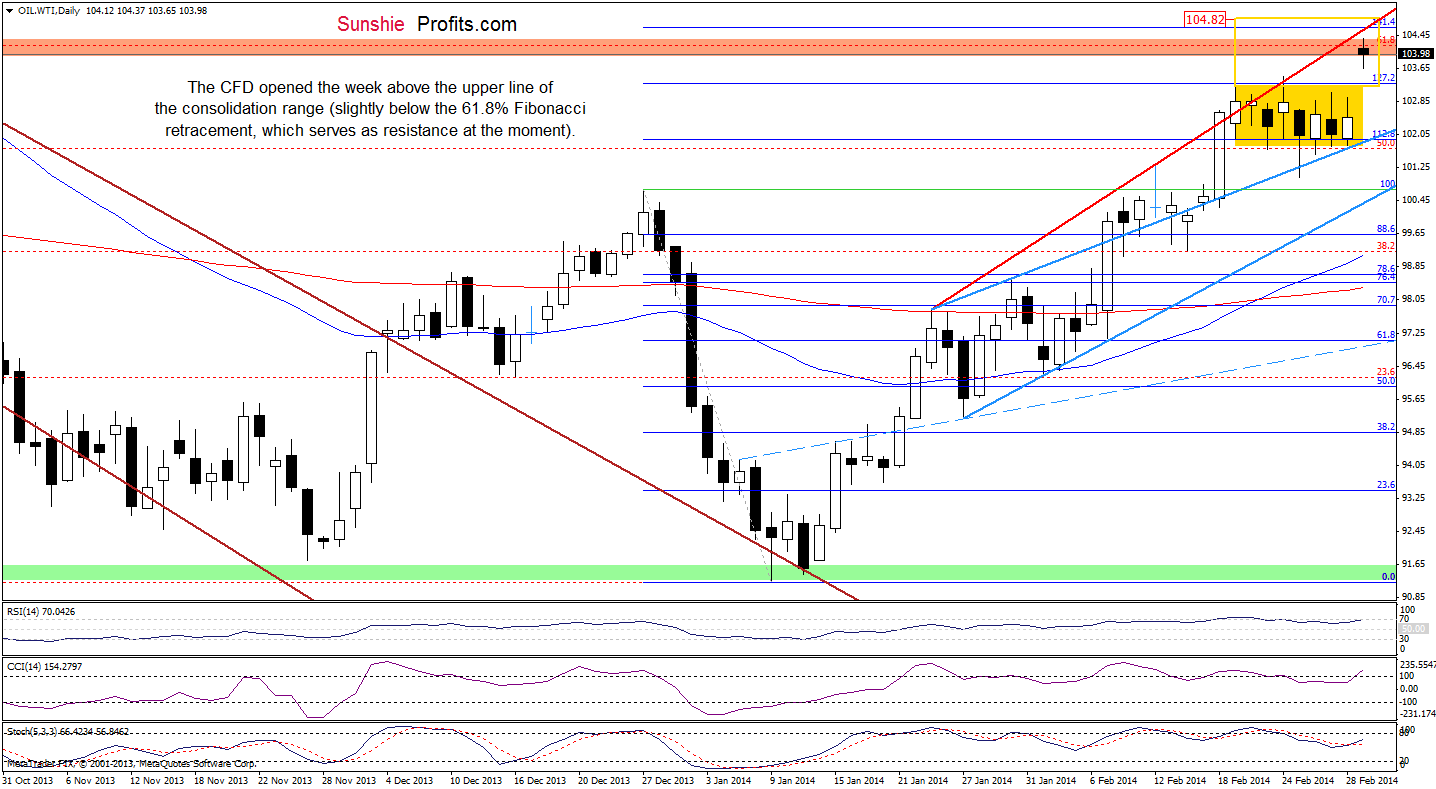

Looking at the above chart, we see that the situation has improved as WTI Crude Oil opened the week above the upper border of a consolidation range. According to theory, such price action should trigger a pro growth scenario, which assumes an increase to around $104.82. Although oil bulls didn’t reach this level so far, the CFD hit a fresh 2014 high of $104.37 and approached the price target. Thanks to these circumstances, WTI Crude Oil reached the 61.8% Fibonacci retracement based on the entire Aug.-Jan. decline earlier today. Additionally, it also climbed to the very short-term rising line (marked with red) based on the Jan.23 and Feb.12 high, which together with the 141.4% Fibonacci extension serves as the nearest resistance. If this area encourages oil bears to act, we will likely see a comeback to the consolidation range. However, if it is broken, the CFD may increase to around $105.44 (where the next Fibonacci extension is) or even slightly above $106.04 (the 70.7% Fibonacci retracement based on the entire Aug.-Jan. decline). Please note that the current position of the indicators support the bullish case (although the RSI and CCI are overbought, the Stochastic Oscillator generated a buy signal).

Summing up, the very short-term outlook for crude oil is still unclear as light crude remains between the February high and the upper line of the rising trend channel. As mentioned earlier, as long as there is no breakout /breakdown above/below one of these important lines a bigger upswing (or downswing) is not likely to be seen. However, taking into account the current situation in the CFD, another attempt to move higher should not surprise us. Please note that if crude oil climbs once again, the upside target for the buyers will likely be the 61.8% Fibonacci retracement level (around $104.20).

Very short-term outlook: mixed

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, the situation is too unclear to go short or long at the moment. So, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts