Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 0.81% as upbeat jobless claims data supported the price. Thanks to these bullish numbers, light crude reversed and closed the day above the previously-broken support zone. Will this event trigger further improvement?

Yesterday, the Labor Department said in its report that initial claims for jobless benefits in the week ending Aug. 2 fell by 14,000 to 289,000 from the previous week’s total of 303,000, beating analysts’ expectations for a 2,000 increase. As we mentioned earlier, thanks to these bullish numbers, the commodity reversed and came back above the previously-broken support zone. Will it climb higher in the coming days? (charts courtesy of http://stockcharts.com).

In our previous Oil Trading Alert, we discussed the long-term picture, which gave us interesting clues:

(…) Crude oil is very, very close to 2 strong support levels: the rising, long-term support line and the 200-week moving average. It seems that each of them could stop the most recent decline, or at least cause it to pause. Their combination, naturally, is even stronger. Consequently, the crude oil price is more likely to move at least temporarily higher shortly, even if the move doesn’t take the commodity much higher.

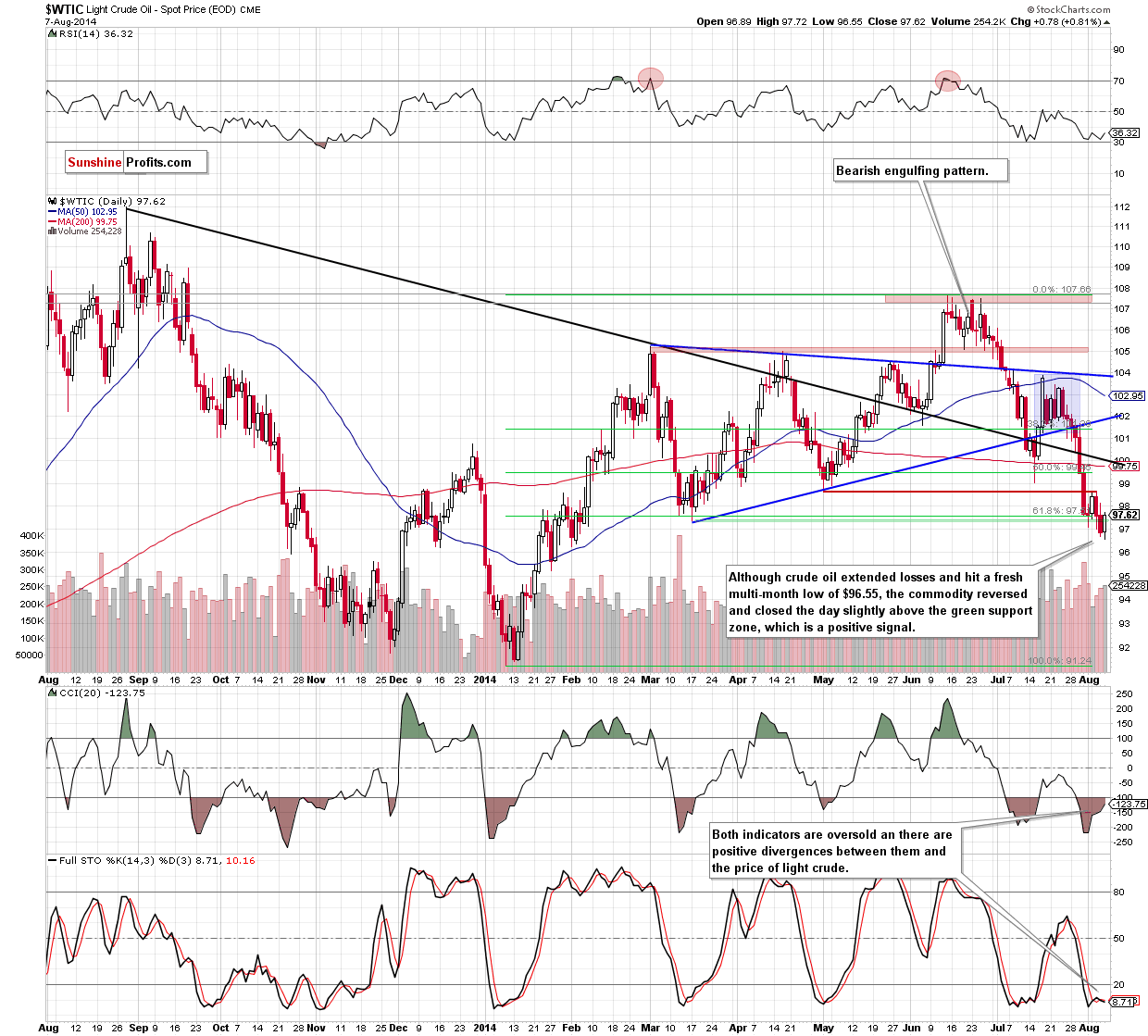

Did the proximity to this important support zone encourage oil bulls to act? Let’s examine the daily chart and find out.

From this perspective, we clearly see that although the commodity extended losses and hit a fresh multi-month low of $96.55, crude oil reversed and erased most of Wednesday’s losses. With this upswing light crude came back above the previously-broken green support zone, which means that the breakdown below the March low and the 61.8% Fibonacci retracement was invalidated. This is a strong bullish signal, which will likely trigger further improvement in the coming days – especially if the CCI and Stochastic Oscillator generate buy signal (it’s also worth noting that there is a positive divergence between the RSI and the price, which supports the bullish case). If crude oil moves higher from here, the first upside target will be the May low, which stopped further improvement at the beginning of the week. If it holds, we’ll see a test of the strength of the recent lows, however, if it is broken, we may see an increase to the 200-day moving average, which is slightly below the psychological barrier of $100 and the 38.2% Fibonacci retracement (based on the entire June-Aug decline) at the moment

Summing up, the most important event of yesterday’s session was an invalidation of the breakdown below the March low and the 61.8% Fibonacci retracement. Although this is a strong bullish signal, we think that the size of the upswing is still too small to say that the very short-term outlook improved. Therefore, we continue to think that it’s worth to stay on the sidelines waiting for another profitable buying or selling opportunity as long as we won’t receive more valuable clues about future price moves.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts