Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Monday, crude oil lost 0.21% as mixed U.S. economic data weighed on investors’ sentiment. In this way, light crude tested the strength of its nearest support zone and closed the day slightly above it. Is this as positive sign as it seems at the first glance?

Yesterday, the National Association of Realtors reported that pending home sales jumped 6.1% in May from April, rising to its highest level since last September. May's figure marked the largest increase since August 2010, beating forecasts for a 1.5% reading.

However, as it turned out later, soft regional manufacturing data offset upbeat housing data as market research group Kingsbury International showed that its Chicago purchasing managers’ index slumped to a three-month low of 62.6 in June from a reading of 65.5 in May (while analysts had expected the index to decline to 63.0 this month).

These disappointing regional U.S. factory data fueled worries that Thursday's widely-watched jobs report may be weaker-than-expected, which could encourage monetary authorities to leave interest rates low for longer than once thought.

How did these fundamental factors affected the technical picture of crude oil? Let’s check (charts courtesy of http://stockcharts.com.)

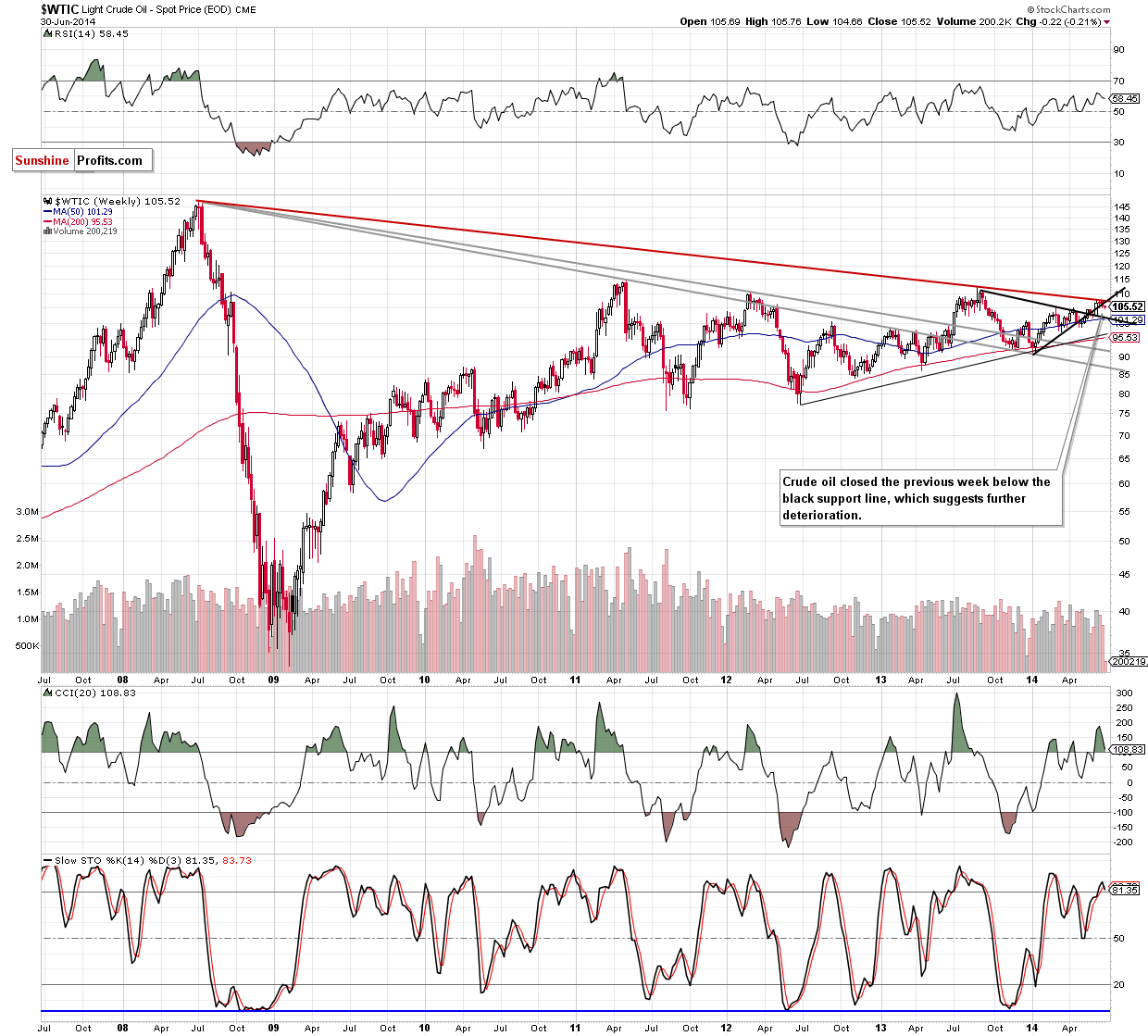

From this perspective, we see that crude oil still remains below the previously-broken medium-term black rising line, which suggests further deterioration. Therefore, what we wrote in our last Oil Trading Alert is up-to-date:

(…) If (…) oil bulls do not invalidate the breakdown, we’ll see a downward move to around $102, where the declining black medium-term support line and the 50-week moving average are.

Once we know the medium-term picture, let’s take a closer look at the daily chart.

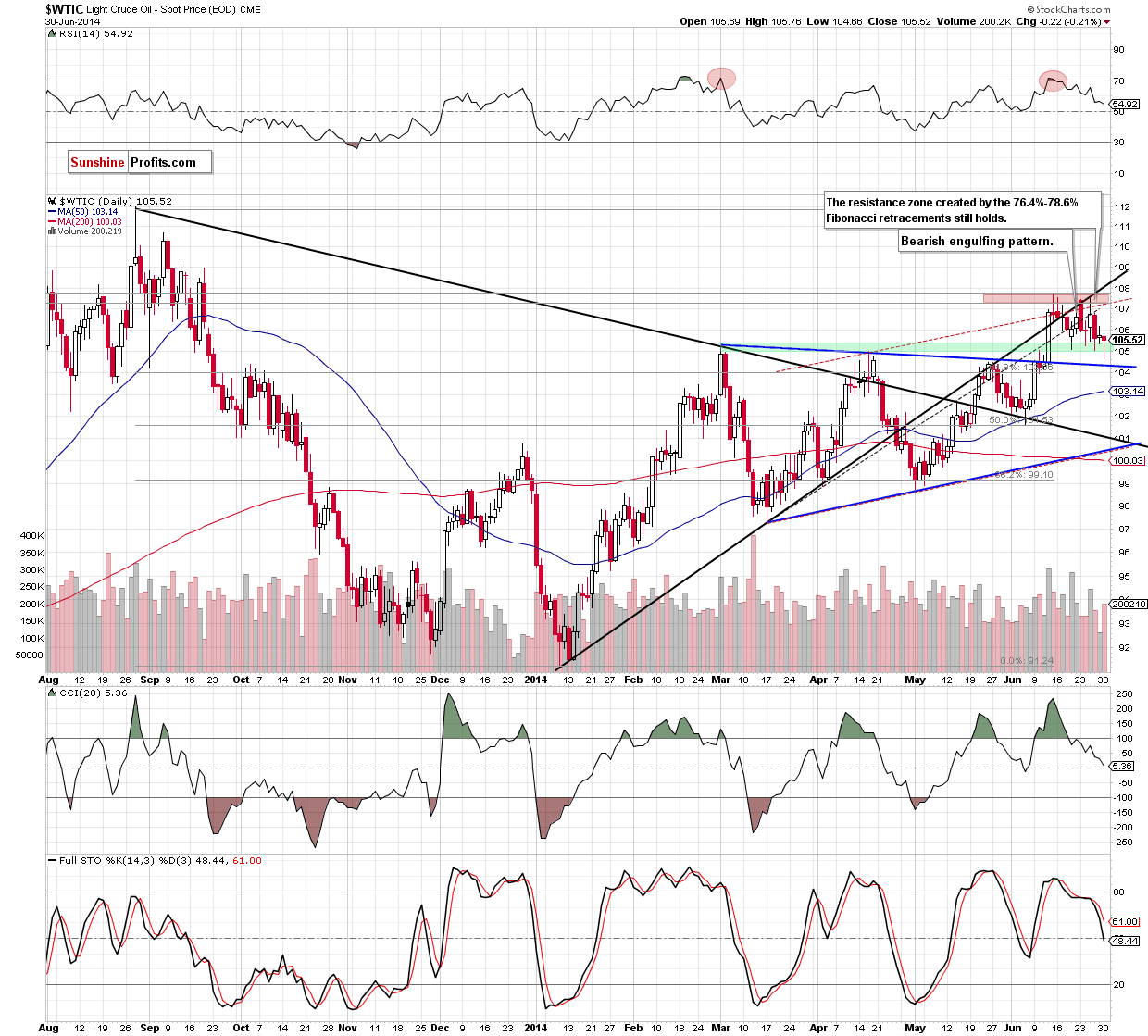

Looking at the above chart, we see that although crude oil extended losses and declined (very temporarily) below the green support zone, the commodity reversed and rebounded as the proximity to the blue support line encouraged oil bulls to act. As a result, light crude came back above its support zone and closed the day slightly above it. Therefore, it seems to us that our last commentary is still valid:

(…) crude oil is still trading in the narrow range between the resistance zone (created by the 76.4%-78.6% Fibonacci retracement levels and the medium-term black resistance line) and the green support zone (based on the March, April, June 10 highs and recent lows).

(…) If this support zone holds, we’ll see another corrective upswing to around $107.30-$107.68, where the resistance zone is. On the other hand, if oil bears do not give up and show their claws one again, we will see a breakdown in the nearest future and a correction to at least the previously-broken blue support line (currently around $104.40). Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish scenario.

Summing up, although crude oil extended losses and approached its downside target, the proximity to the blue support line encouraged oil bulls to act and the commodity rebounded, coming back to the narrow range between the above-mentioned support and resistance zone. Therefore, we think that the overall situation remains unchanged and as long as there is no breakdown or breakout below/above one of these key areas another sizable move is not likely to be seen. However, the current position of the indicators and the breakdown below the black support line on the weekly chart suggest that further deterioration and lower values of crude oil are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts