Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Tuesday, crude oil gained 0.80% as ongoing worries that geopolitical tensions in Ukraine and Libya will disrupt global supply supported the price. Thank to these circumstances, light crude climbed to a four-week high and broke above one of the medium-term resistance lines. Does this show of strength mean that oil bears lost all their technical arguments?

As we have emphasized in our last Oil Trading Alert, ongoing tensions between Russia and Ukraine and also situation in Libya remain in focus, amid fears over a supply interruptions from these key markets. Ukraine will hold presidential elections on May 25, and concerns persist that Russia will meddle in the voting and escalate the crisis. U.S. and European officials have already warned that Russia would face additional sanctions if Moscow disrupts the upcoming elections. On top of that, concerns over Libya's oil output raised on news that French and Algerian oil companies are evacuating employees out of the country. As we mentioned earlier, these geopolitical concerns supported the price and pushed crude oil to its highest level since Apr.22.

Will the commodity climb much higher in the coming days? Let’s check the technical picture in the short term (charts courtesy of http://stockcharts.com).

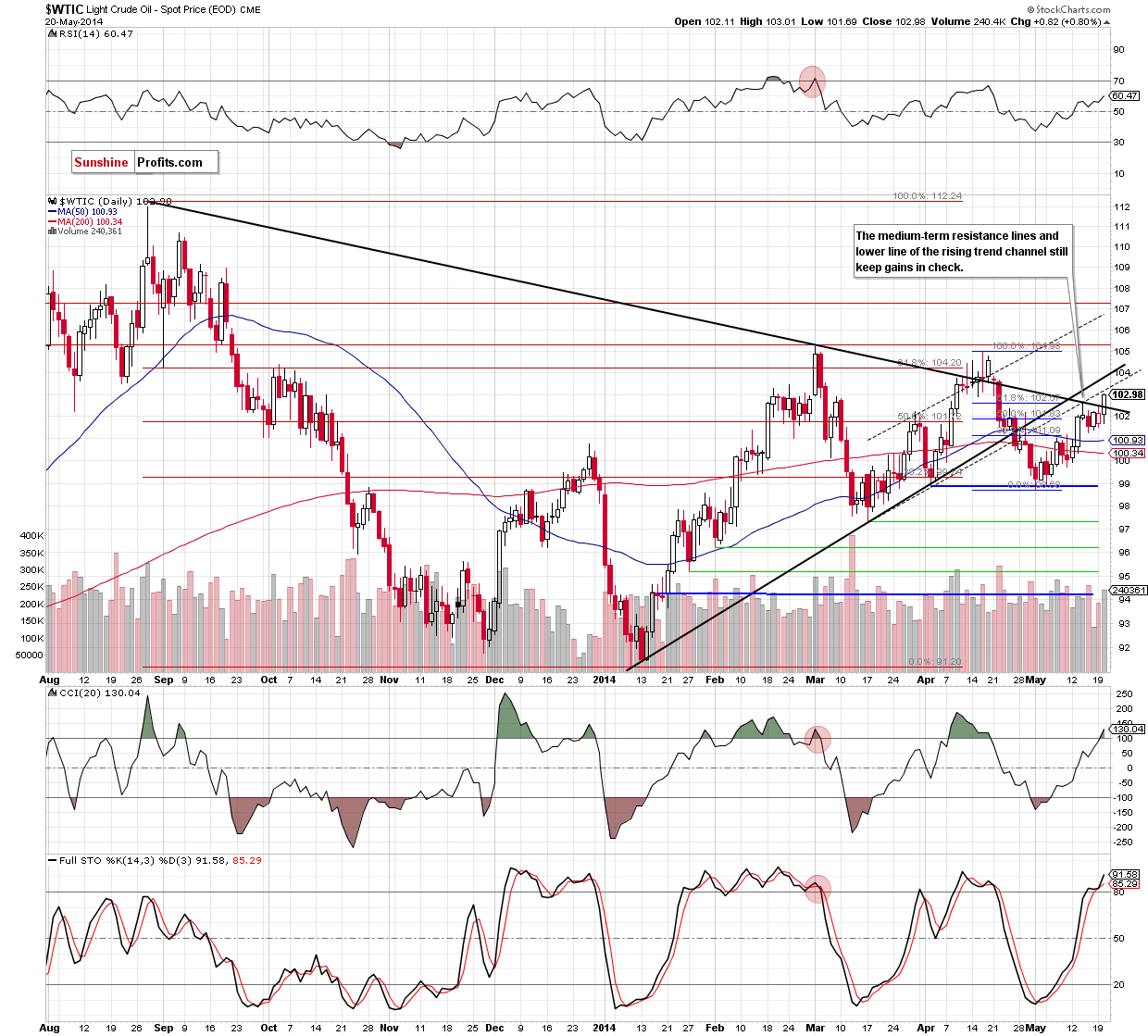

The medium-term situation hasn’t changed much as the commodity remains below the lower border of the triangle. Today, we’ll focus only on the very short-term changes.

As you see on the above chart, crude oil extended gains and broke above the medium-term declining resistance line (the upper line of the triangle) and the 61.8% Fibonacci retracement. Although this is a bullish sign, we remain skeptical because there was a similar breakout above this resistance line (and also above the upper line of the rising trend channel) in mid-April. As it turned out in the following days it was only a temporarily improvement and light crude reversed. Therefore, taking into account the fact that crude oil still remains below the black rising line (the lower border of the tringle) and the lower line of the rising trend channel (currently around $103.30), we believe that history will repeat itself and we’ll see lower price of light crude in the near future. In our opinion, even if the commodity moves higher, the medium-term rising resistance line (currently around $103.70) in combination with the 78.6% Fibonacci retracement based on th entire recent decline (at $103.65) will be strong enough to stop further improvement and trigger a pullback in the coming days.

Summing up, despite yesterday’s breakout (which is unconfirmed) above the medium-term declining resistance line, we remain bearish as crude oil still remains below the black rising resistance line and the lower line of the rising trend channel. As we have pointed out before, it seems quite likely that even if crude oil moves higher, the combination of the lower border of the tringle and the 78.6% Fibonacci retracement will be strong enough to stop further improvement and trigger a pullback in the near future.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Taking into account the fact that the medium-term resistance line is currently higher than at the beginning of the month (when short positions were opened), we decided to raise the stop-loss order to $104.30. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts