Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

On Thursday, crude oil gained 2.72% as the combination of solid U.S. data and talks that OPEC may consider trimming production supported the price. Because of these circumstances, light crude invalidated the breakdown below the support line and closed the day above another important line. Is it enough to spark the rally?

Yesterday, the Labor Department showed that the U.S. consumer price index was unchanged in the previous month, but stronger than expectations for a 0.1% drop. On a year-over-year basis consumer prices rose 1.7% in October, beating expectations for a 1.6% increase. Additionally, core inflation (without volatile food and energy components) rose by 0.2%, pushing the annual rate up to 1.8%. On top of that, a separate report showed that the initial jobless claims fell by 2,000 last week, to 291,000. Although analytics had expected a drop to 286,000, it was the tenth straight week when initial claims remained below 300,000.

Later in the day, the Federal Reserve Bank of Philadelphia showed that its manufacturing index improved to 40.8 this month from 20.7 in October, beating analysts’ expectations for a decline to 18.5. These bullish numbers in combination with Libya's OPEC governor commentary (as a reminder, Samir Kamal, told that OPEC could agree to take small steps to trim global supply) triggered further improvement, which resulted in a climb to an intraday high of $76.37. How did this rally affected the very short-term picture of crude oil? (charts courtesy of http://stockcharts.com).

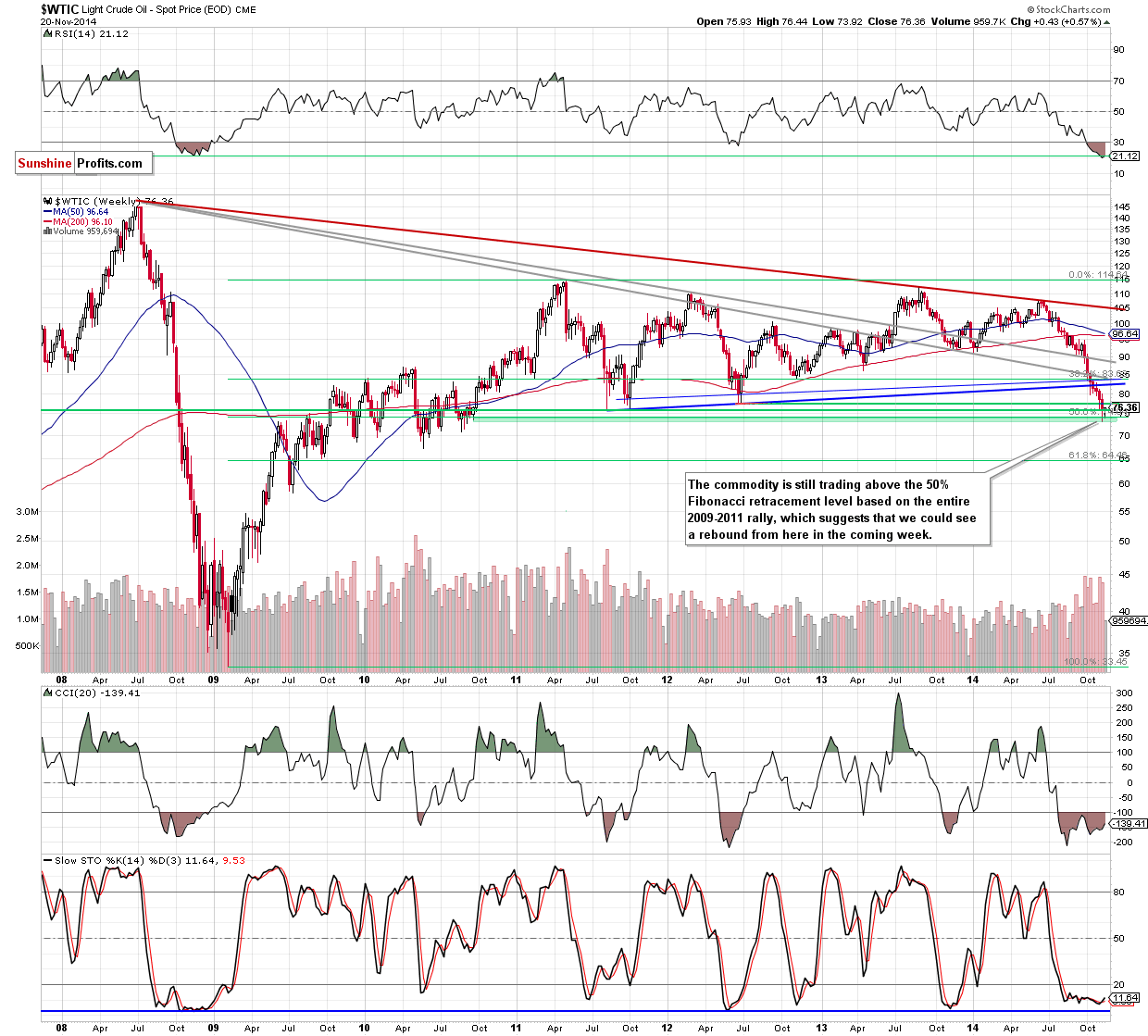

From the medium-term perspective, we see that the situation hasn’t changed much as crude oil is still trading above the key support created by the 50% Fibonacci retracement based on the entire 2009-2011 rally.

Will the very short-term picture give us any interesting clues about future moves?

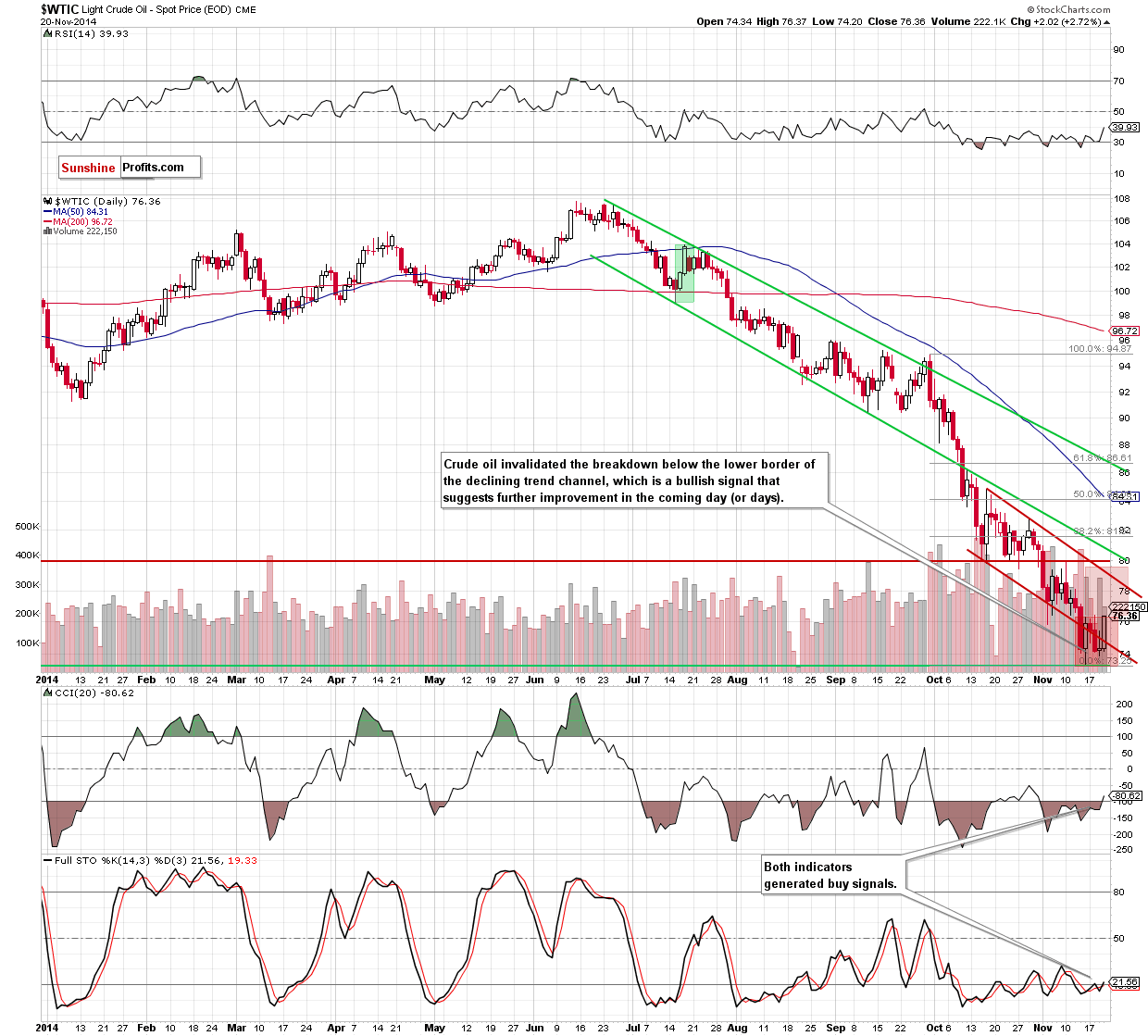

The first thing that catches the eye on the daily chart is an invalidation of the breakdown below the previously-broken lower border of the declining trend channel. Although we saw a similar price action in mid-Nov, this time oil bulls managed to push the commodity not only well above this support line, but also above the upper border of the consolidation (marked with red). These are strong bullish signals, which suggest further improvement in the coming days. How high could light crude go? Taking into account the breakout from consolidation, crude oil will likely climb to around $79.50, where the size of the upswing will correspond to the height of the formation. At this point, it’s worth noting that this target is in a solid resistance area where the upper line of the declining trend channel, the previous lows and the barrier of $80 are. Therefore, we think that further rally will be more likely, if we see a breakout above this zone. In this case, the next upside target for oil bulls would be around $81.68, where the 38.2% Fibonacci retracement based on the Sep 30-Nov 14 decline is. Before we summarize today’s alert, we would like to draw your attention to the fact that the CCI and Stochastic Oscillator generated buy signals, supporting the bullish case.

Summing up, we are convinced that keeping long positions (which are already profitable) is still justified from the risk/reward perspective as the breakdown below the lower border of the declining trend channel was invalidated. On top of that, crude oil broke above the upper line of the consolidation and the CCI and Stochastic Oscillator generated buy signals, which signifies to us that further rally is just around the corner.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts