Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 0.42% after weaker-than-expected U.S. jobless claims and forecasts for warmer weather in early March pushed the price lower. In this way, light crude erased some of Wednesday gains and closed the day slightly above $102 per barrel.

Yesterday, the Commerce Department showed that durable goods orders fell less than expected in January. Additionally, core durable goods orders (without transportation items) rose 1.1% in January, well above forecasts for a 0.3% decline (it was also the largest increase since May). Although these positive numbers gave crude oil some support, the number of new unemployment claims sent the price of light crude lower. The Labor Department said in its report that initial claims for jobless benefits rose by 14,000 to 348,000 from the previous week’s total of 334,000 (while analysts had expected an increase of just 1,000), which raised fears that the U.S. economy will consume less fuel and energy.

Additionally, updated weather forecasts showed that warmer temperatures may return in the first and second week of March (such circumstances should curb demand for heating oil), which had a negative impact on light crude and sent the price lower as well.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

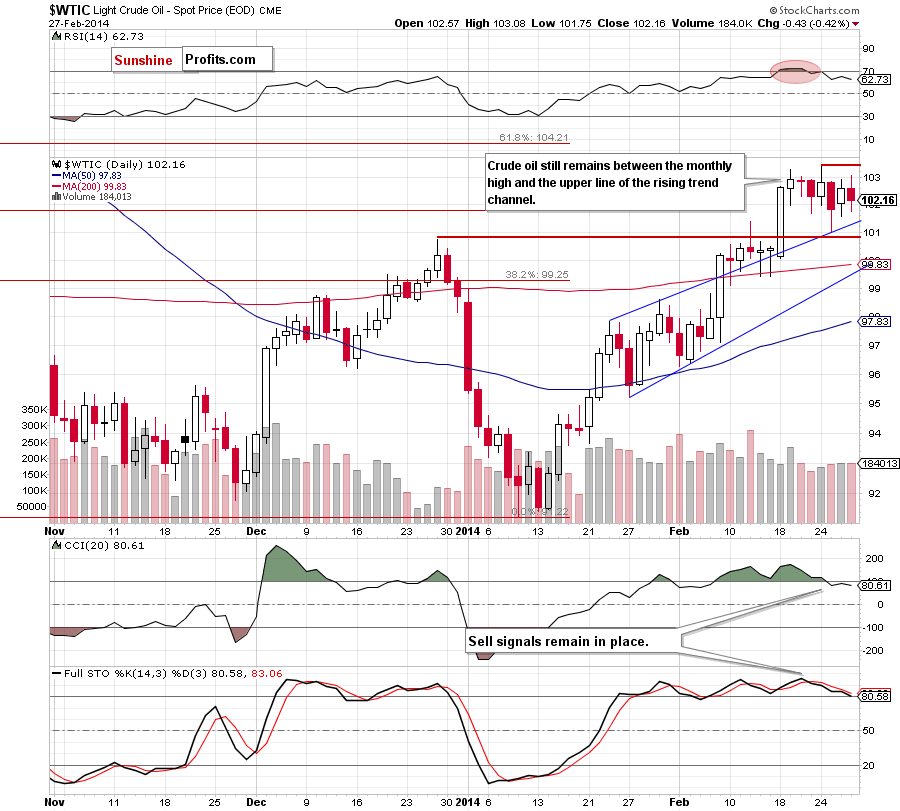

As you see on the above chart, the situation hasn’t changed much as crude oil still remains in a narrow range (between the monthly high and the upper line of the rising trend channel). Therefore, what we wrote in our previous Oil Trading Alert remains up-to-date.

(…) the February high is reinforced by the 127.2% Fibonacci extension level based on the Dec.-Jan. decline (around $103.34), which serves as the nearest resistance level. The major short-term support is the upper line of the rising trend channel (and a support level created by the December high, slightly below this line). All sell signals generated by the indicators remain in place, supporting the bearish case. Connecting the dots, the very short-term situation is unclear and it is difficult to predict which way the next move will be (…) it seems that as long as there is no breakout above the monthly high (or a breakdown below the upper line of the rising trend channel) a bigger upswing (or downswing) is not likely to be seen.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

Looking at the above chart, we see that the situation hasn’t changed much as WTI Crude Oil still remains in a consolidation between the upper border of the rising trend channel/rising wedge and the February high. Similarly to what we wrote in the case of crude oil, it seems that as long as there is no breakout above the monthly high (or a breakdown below the major short-term support line) a bigger upswing (or downswing) is not likely to be seen.

On one hand, if oil bulls do not give up and successfully push the CFD above the 127.2% Fibonacci extension, we may see an upswing to a resistance zone created by the Oct. high and the 61.8% Fibonacci retracement based on the entire Aug.-Jan. decline. On the other hand, if they fail and the CFD drops below the upper border of the rising trend channel/rising wedge, the next downside target for oil bears will likely be around $100.46, which corresponds to the lower border of the rising trend channel/rising wedge at the moment. This bearish scenario is still reinforced by the position of the indicators as sell signals generated remain in place, favoring sellers.

Very short-term outlook: mixed

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, the situation is too unclear to go short or long at the moment. So, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts