Trading position (short-term): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95.

On Thursday, crude oil gained 0.17% after stronger-than-expected data on U.S. retail sales and initial jobless claims data. In this way, light crude rose for the first time in four days and closed the day above $98 per barrel once again.

Yesterday, the Commerce Department reported that U.S. retail sales rose 0.3% in February after two months of declines (above expectations for an increase of 0.2%), while core retail sales (without automobile sales) also rose 0.3% last month (beating expectations for a 0.2% rise). On top of that, the Department of Labor showed in its report that initial claims for jobless benefits decreased by 9,000 (while analysts had expected an increase of 6,000) to a three month low of 315,000 last week.

Although these positive numbers supported crude oil, gains were limited by soft data from China. Chinese industrial production rose 8.6% in the first two months of 2014, missing market expectations for a 9.5% increase, while Chinese retail sales rose by 11.8%, also below expectations for a 13.5% gain.

Worries over an economic slowdown in China have pressured industrial commodity prices earlier this week, however, the impact on oil has been limited by tensions in Ukraine and Libya.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

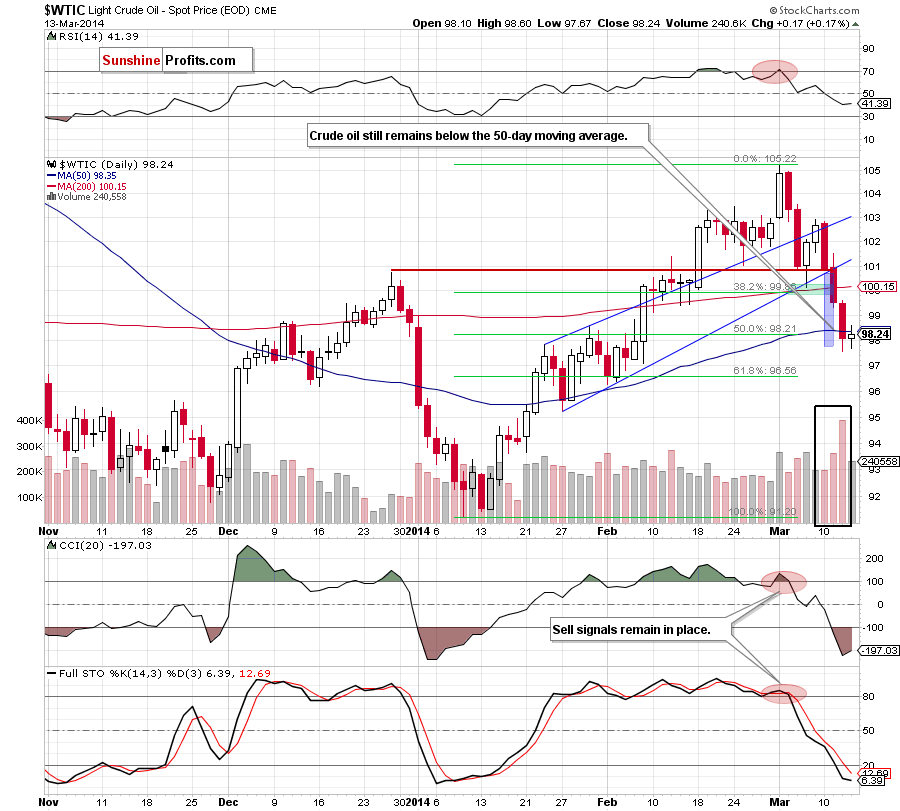

Looking at the above chart, we see that the situation hasn’t changed much. Although crude oil moved higher yesterday, this upswing was too small to change the very short-term outlook. Additionally, it materialized on relative small volume, which shows the weakness of the buyers at the moment. As you see on the above chart, crude oil remains below the 50-day moving average (which serves as the nearest resistance) and sell signals generated by the indicators are still in play, supporting oil bears. Please note that the nearest support (and the downside target for oil bears) is the 61.8% Fibonacci retracement around $96.50.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

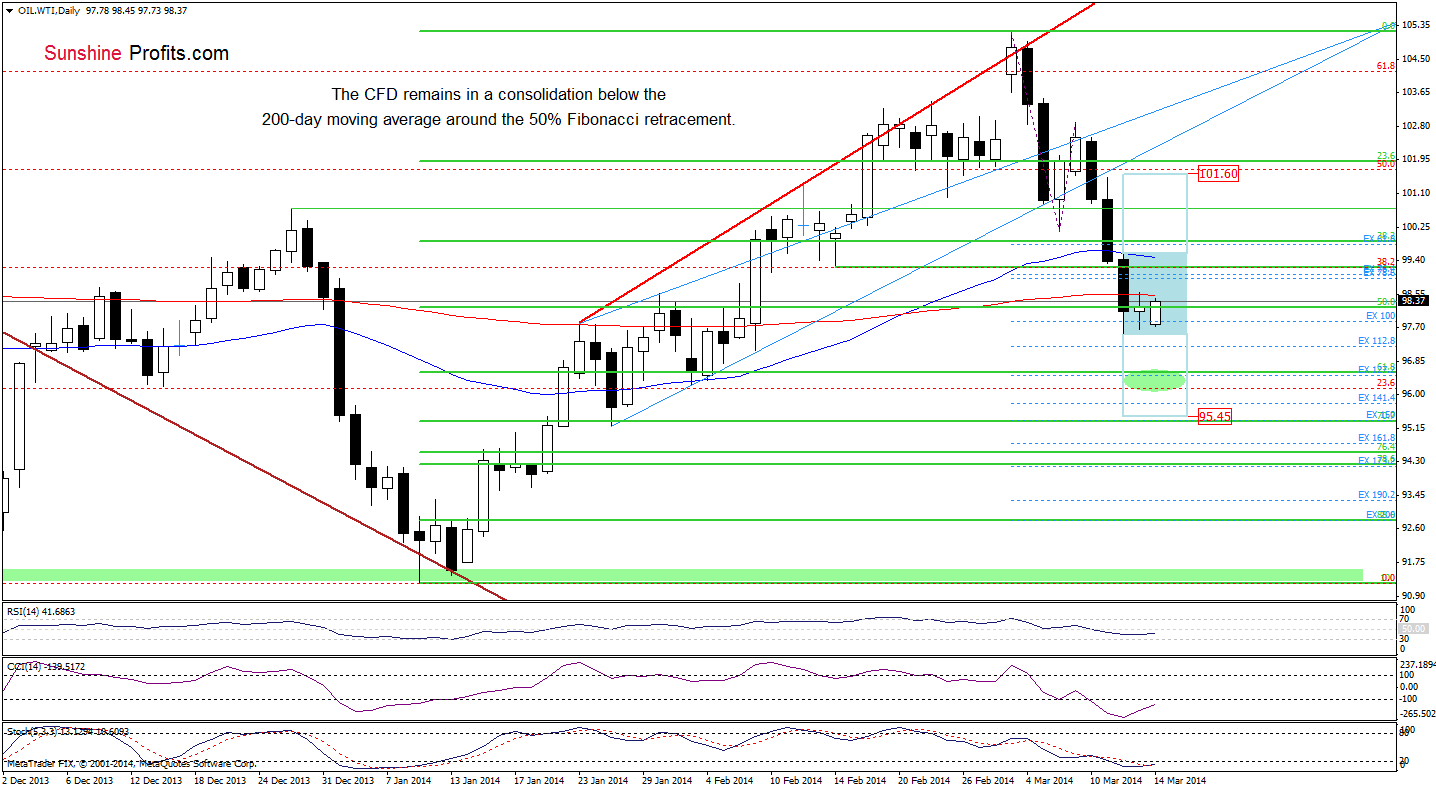

On the above chart, we see a situation (just like in the case of crude oil) hasn’t changed much. Although the CFD moved little higher yesterday (and also earlier today), it still remains in a consolidation below the 200-day moving average around the 50% Fibonacci retracement. From this perspective, it seems that as long as this resistance is in play, a bigger corrective upswing is not likely to be seen and another attempt to move lower should not surprise us. Nevertheless, taking into account the fact that the CFD remains in a consolidation, we should consider two scenarios. On one hand, if oil bulls break above the nearest resistance and push the price above Wednesday high (which is currently reinforced by the 50-day moving average), we may see an upward move to around $101.60. On the other hand, if they fail and the CFD drops below Wednesday low, we may see a downward move not only to the first downside target (the 61.8% Fibonacci retracement around $96.55), but even to around $95.45, where the 70.7% Fibonacci retracement and the Jan.27 low are. Looking at the position of the indicators, we see that they are still overbought, but there are no buy signals at the moment.

Summing up, although crude oil moved higher yesterday, the very short-term outlook remains bearish and the overall situation hasn’t changed much. The current situation in WTI Crude Oil suggests that we may see another attempt to move higher after the market open, but as long as light crude remains below the 200-day moving average another downswing can’t be ruled out (especially when we take into account the size of the volume that we saw in recent days and the position of the indicators).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): xxx

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts