On Tuesday, crude oil gained 0.37% as concerns over oil flows from Iraq and Libya pushed the price higher. Additionally, light crude was supported by better-than-expected trade data out of the U.S. In this way, crude oil rose for the first time in six sessions and closed the day slightly below $94 per barrel.

As we wrote in our previous Oil Trading Alerts, the price of light crude has fallen in recent sessions on expectations for Libyan production to approach normal levels and add to global supply. Meanwhile, yesterday, the country's armed forces warned they would not allow any oil tanker to load at ports seized by protesters. The Libyan Navy had blocked a Maltese-flagged vessel from trying to reach a dock and opened fire as it approached the port of Es Sider. This news, fueled concerns over oil flows from Libya and pushed the price higher.

Additionally, oil investors have worried about violence in Iraq as a missile strike reportedly killed 25 militants in the city of Ramadi. Iraqi forces mounted attacks against al Qaeda-linked militants there and in Fallujah after the insurgents made their first push into major cities of the country since the conflicts that followed the U.S.-led invasion in 2003.

At this point, it’s worth noting that Iraq exported 2.4 million barrels of crude in 2012 according to the Energy Information Administration, and the main concern in this case is that the fighting could disrupt the country's crude exports.

Yesterday, the Commerce Department reported that the U.S. trade deficit narrowed to $34.25 billion in November from a revised deficit of $39.33 billion in the previous month (while economists had expected the U.S. trade deficit to widen to $40 billion). These better-than-expected trade data also supported the price of crude oil by fueling hopes for the U.S. economy to gain steam and demand more oil and energy.

Today, traders have been awaiting data from the Energy Information Administration, which are expected to show a sixth straight weekly decline in U.S. crude inventories. Please note that over the past five weeks, crude stocks have dropped by 7.9%, or 30.8 million barrels to the lowest level since Sept. 20.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

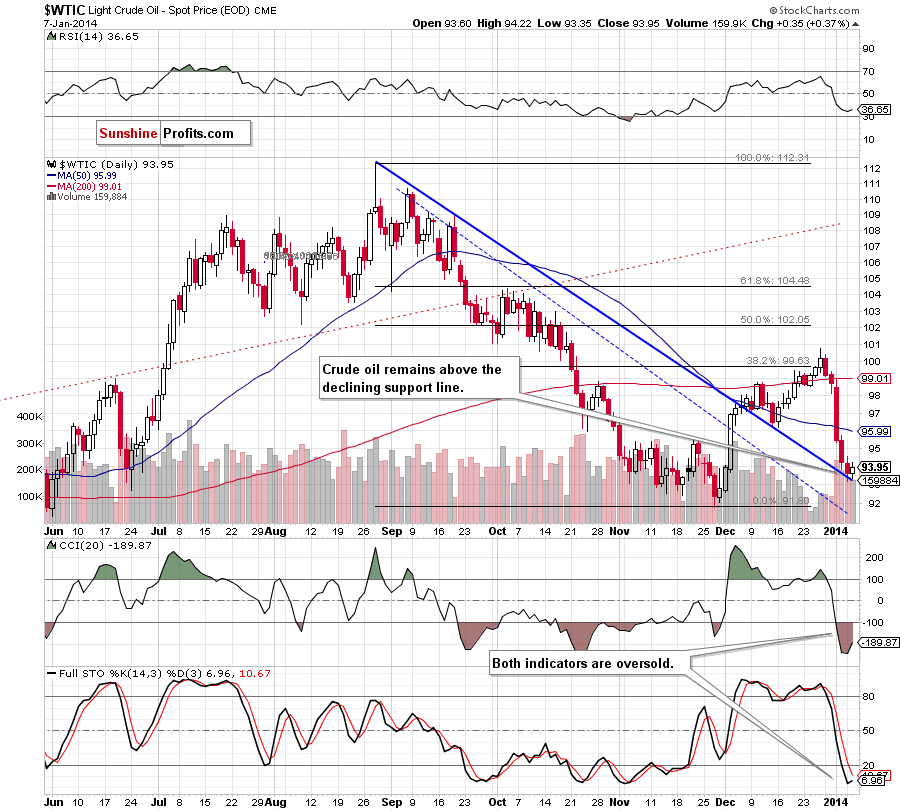

(...) crude oil reached its strong short-term declining support line(based on the August and September highs and marked with blue), which successfully stopped further deterioration in December. If history repeats itself once again, we will likely see an upward correction in the coming day (or days) (…) the recent candlesticks have materialized on decreasing volume, which suggests that the strength of the sellers has waned. Please note that the RSI dropped to its lowest level since mid-November and both other indicators are oversold, which support the bullish case.

On the above chart, we see that crude oil rebounded slightly yesterday. After the market open, sellers re-tested the strength of the short-term declining support line, but they didn’t manage to push the price below it. This show of weakness encouraged oil bulls to trigger an upswing, which took crude oil to its daily high of $94.22. Nevertheless, yesterday’s increase is still small and didn’t change the very short-term outlook, which remains bearish.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

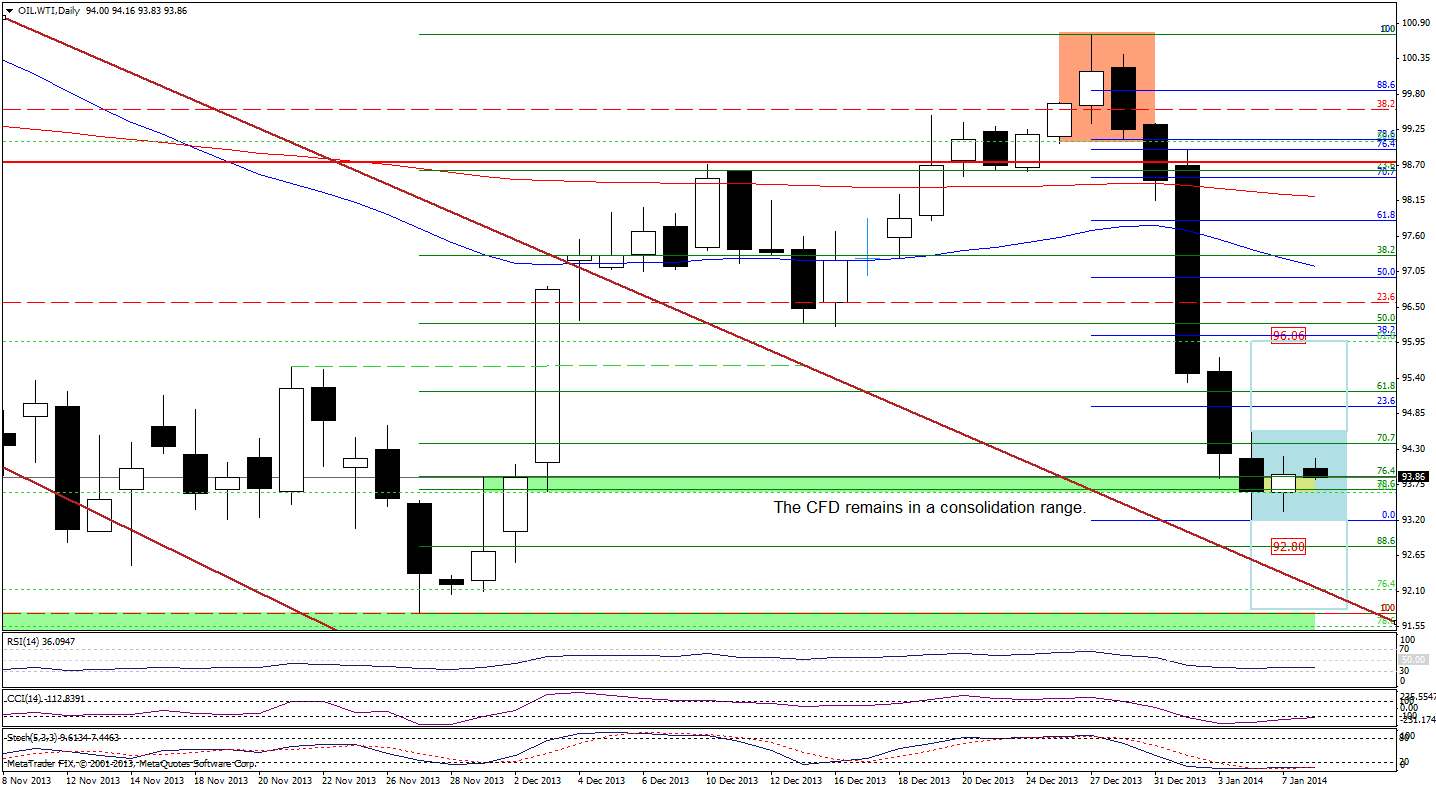

Looking at the above chart, we see that the situation hasn’t changed much. Yesterday, WTI Crude Oil slipped to slightly above Monday’s low, but rebounded in the following hours. Despite this increase, the CFD remains in a consolidation. Therefore, we should consider two scenarios. If oil bulls push WTI Crude Oil above Monday’s high, we will likely see an upswing to around $96. On the other hand, if they fail, we could see further deterioration and the downside target will be around the November low.

When we take a closer look at the position of the indicators, we see that the RSI still remains slightly above the level of 30 and both other indicators are oversold, but they haven’t generated buy signals yet. Therefore, we could see another re-test of Monday’s low. If it holds, we will likely see further improvement (to the 38.2% Fibonacci retracement based on the recent decline). However, if oil bulls fail, we could see a downswing to the next Fibonacci retracement around $92.80 or even to the November low.

Once we know the above, let’s take a look at the NYSE Arca Oil Index (XOI) chart.

In our previous Oil Trading Alert, we wrote the following:

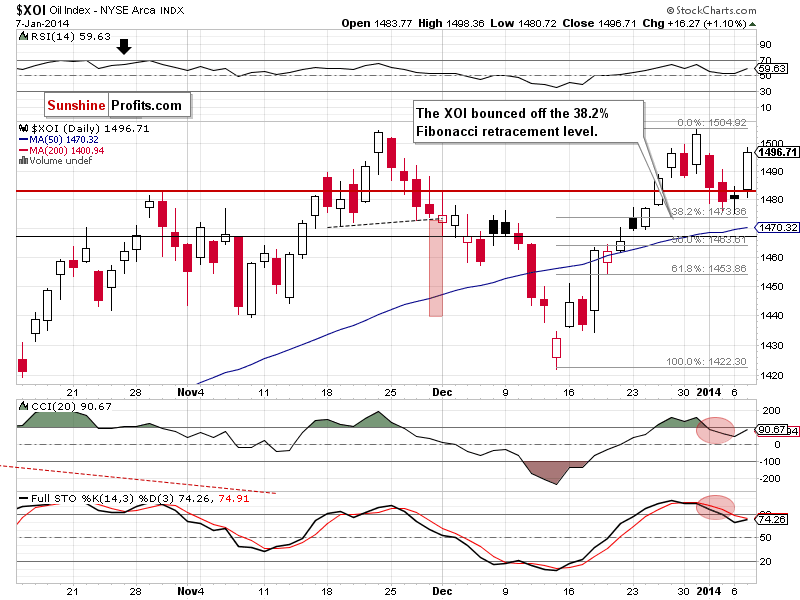

(…) the XOI extended its decline on Friday and almost reached the 38.2% Fibonacci retracement level based on the recent rally. Therefore, if this support encourages buyers to push the buy button, we will likely see a corrective move up. On the other hand, if they fail, we will likely see further declines and the next target for the sellers will be the support zone created by the 50-day moving average and the 50% Fibonacci retracement level (between 1,463 and 1,468).

On the above chart, we see that the oil stock index bounced off the 38.2% Fibonacci retracement level and gained 1.1% yesterday. With this upswing, the XOI approached the psychological barrier of 1,500 and erased most of the recent correction. Additionally, we can notice a morning star and yesterday’s (third) long white candlestick provides a bullish confirmation of the reversal. Therefore, another upswing should not surprise us.

Summing up, crude oil rebounded slightly and still remains above the short-term declining support line, which successfully stopped declines in December. Although yesterday’s increase was quite small it seems that another upswing is likely to be seen in the near future. We are waiting to see a confirmation that the bottom is in, before suggesting going long, or an invalidation of the support lines (the medium- and short-term one) before we consider going short.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): We do not suggest opening any positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Oil Investment Updates

Oil Trading Alerts