Trading position (short-term; our opinion): No positions.

On Thursday, crude oil gained 1.90% on news that Saudi Arabia cut its supply to the market in September. Thanks to these circumstances, light crude bounced off the key level of $80 and erased almost 60% of Wednesday’s losses. Is it the first sign that investors‘ sentiment is improving?

Yesterday, the price of lighr crude moved higher supported by news that Saudi Arabia cut crude oil production by about 328,000 barrels in September to a total of 9.36 million barrels a day.

Additionally, positive economic data from China, Europe and U.S also supported the commodity. A preliminary report on Chinese manufacturing activity from HSBC inched up to 50.4 in October from 50.2 in September. Meanwhile in Europe, data firm Markit showed that its PMI for the eurozone rose to 52.2 in October from 52 in September. Later in the day, the Department of Labor showed that the four-week average of the initial jobless claims fell to the lowest level since May 2000, which suggested that lower unemployment could lead to stronger demand for petroleum products, especially gasoline, as more people drive to work. Thanks to these bullish numbers, crude oil closed the day slightly below $82. Will yesterday’s rally trigger further improvement? (charts courtesy of http://stockcharts.com).

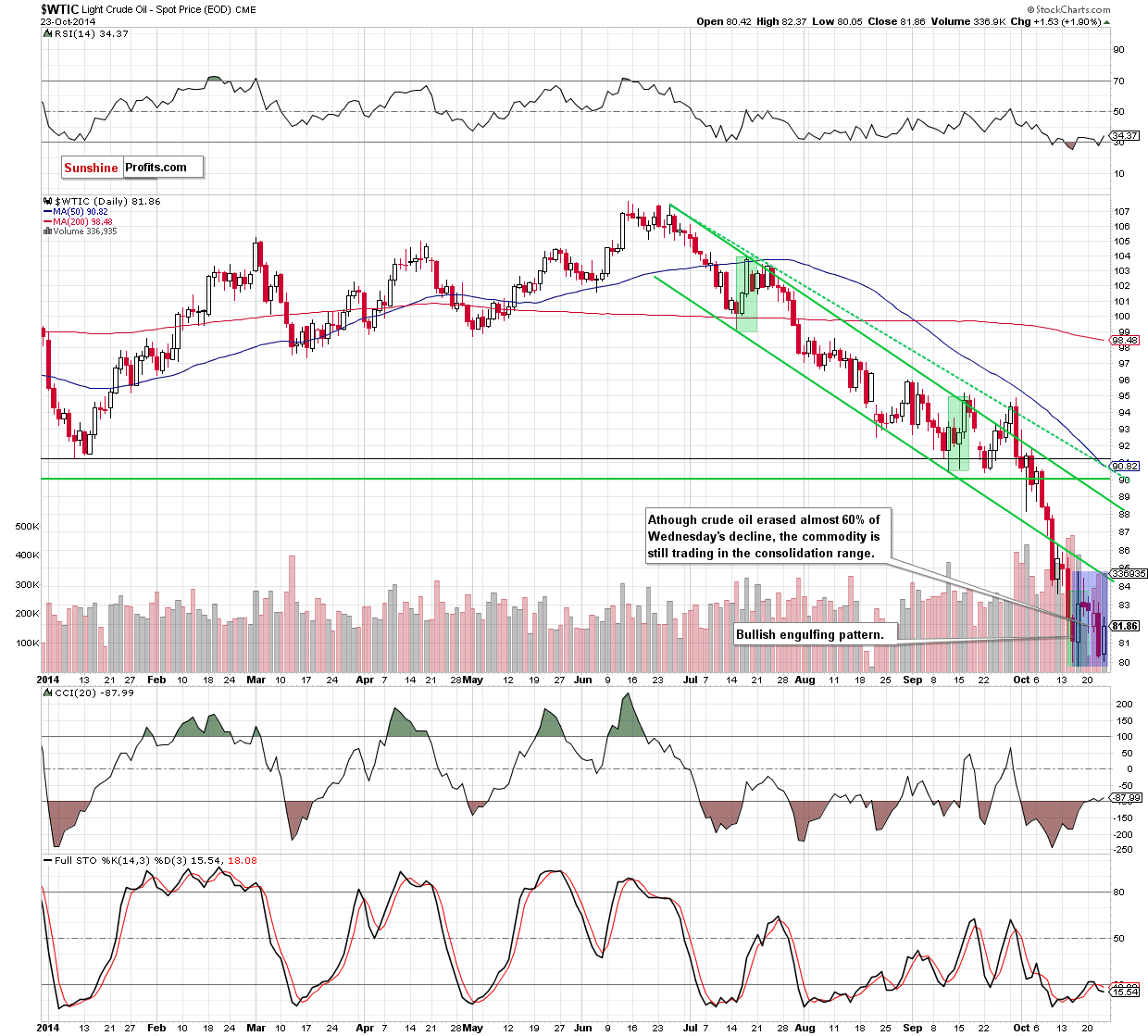

Looking at the daily chart, we see that although crude oil hit an intraday low of $80.05, the key level of $80 withstood the selling pressure and the commodity rebounded sharply in the following hours. With this upswing, light crude erased almost 60% of Wednesday’s decline, but despite this improvement, the commodity is still trading in the consolidation between Oct 16 high and low (marked with blue). Therefore, what we wrote yesterday is up-to-date:

(…) light crude approached the recent low, which could encourage oil bulls to act and result in a post-double bottom rally. If this is the case, crude oil will rebound from here in the coming days and the initial upside target would be around $84.45, where the lower border of the declining trend channel and the lower long-term grey resistance line are. Additionally, slightly above these lines is also the upper border of the current consolidation (at $84.83). Therefore, a breakout above such solid resistance zone would be a strong bullish signal that should trigger further improvement and an increase to at least $88.50-$89, where the next resistance zone (created by the upper line of the declining trend channel and the first long-term grey declining line) is. Nevertheless, if oil bulls fail, and the commodity breaks below $79.78, they will find the next support around $77.28, where the Jun 2012 low is.

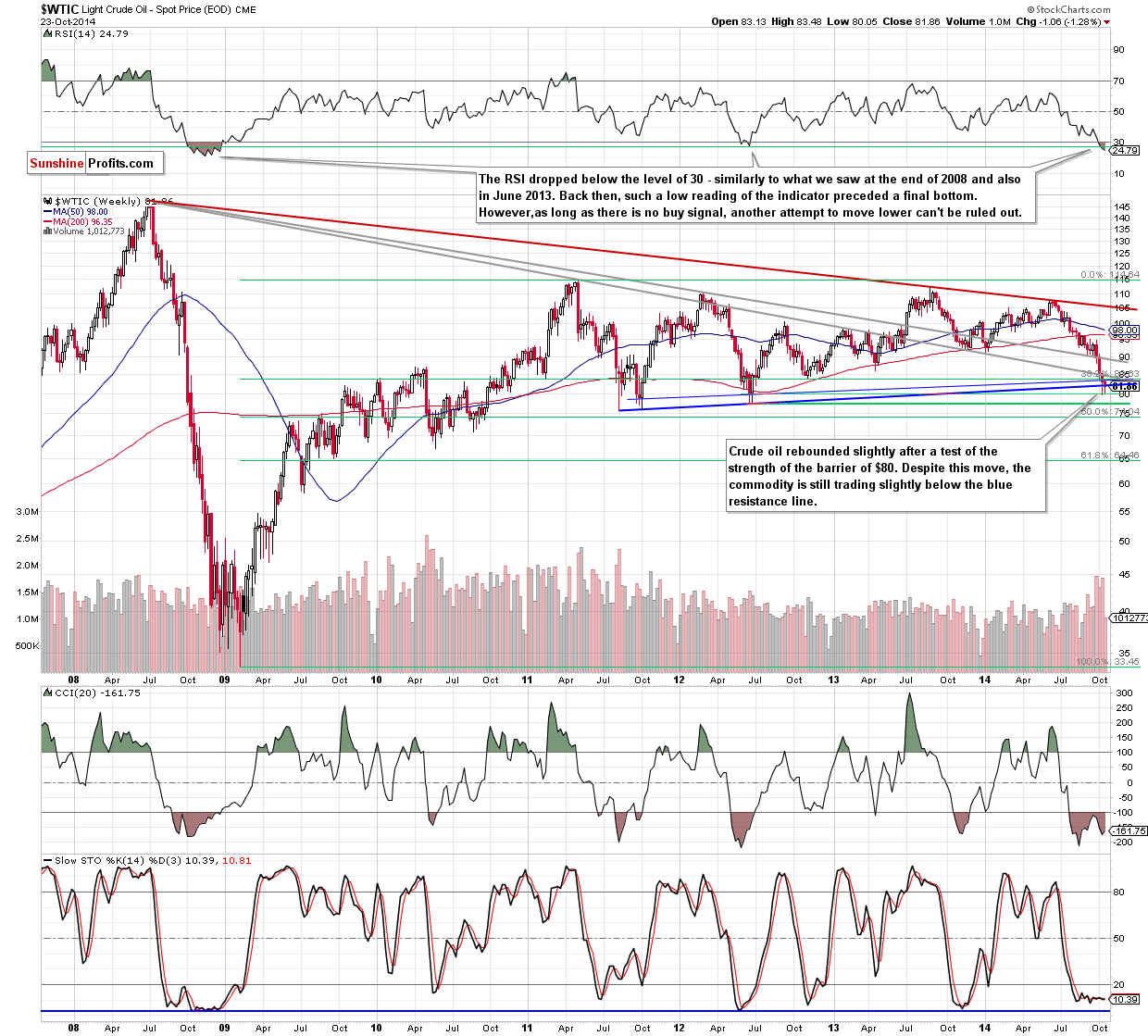

What impact did yesterday’s rally have on the medium-term picture?

From this perspective, we see that although crude oil rebounded, the commodity reached only the previously-broken blue rising support line. Taking into account the fact that yesterday’s session closed slightly below the resistance, it seems that another pullback from here can’t be ruled out. However, as long as the barrier of $80 is in play another sizable downward move is not likely to be seen. On the other hand, as long as there is no breakout above the blue resistance line, further improvement is questionable.

Summing up, crude oil bounced off a multi-month low and the barrier of $80, which resulted in an increase to the medium-term resistance. As we have pointed out before, as long as there is no breakout above this line, further improvement is questionable. In our opinion, a sizable upward move will be more likely if light crude comes back above $84.45, breaking the above-mentioned solid resistance zone. Until this time, we think that staying on the sidelines is the best choice.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts