Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Monday, crude oil gained 0.80% as geopolitical concerns over the situation in Iraq, Libya and Ukraine supported the price. Because of these circumstances, light crude bounced off the support zone, but will we see further rally?

Yesterday, the price of crude oil increased to an intraday high of $98.67 as disturbing events in Iraq, Libya and Ukraine over the weekend weighed. What happened? In Iraq, rebels from the Islamic State seized control of the Ain Zalah oilfield in the northern part of the country, while in Libya, eight fuel tanks caught fire amid heavy fighting near Tripoli’s international airport between rival militias. Meanwhile, in Ukraine, government forces seized two towns on the outskirts of Donetsk from pro-Russia separatists on Saturday. Is the technical picture also supportive for further improvement? Let’s check the charts and find out (charts courtesy of http://stockcharts.com).

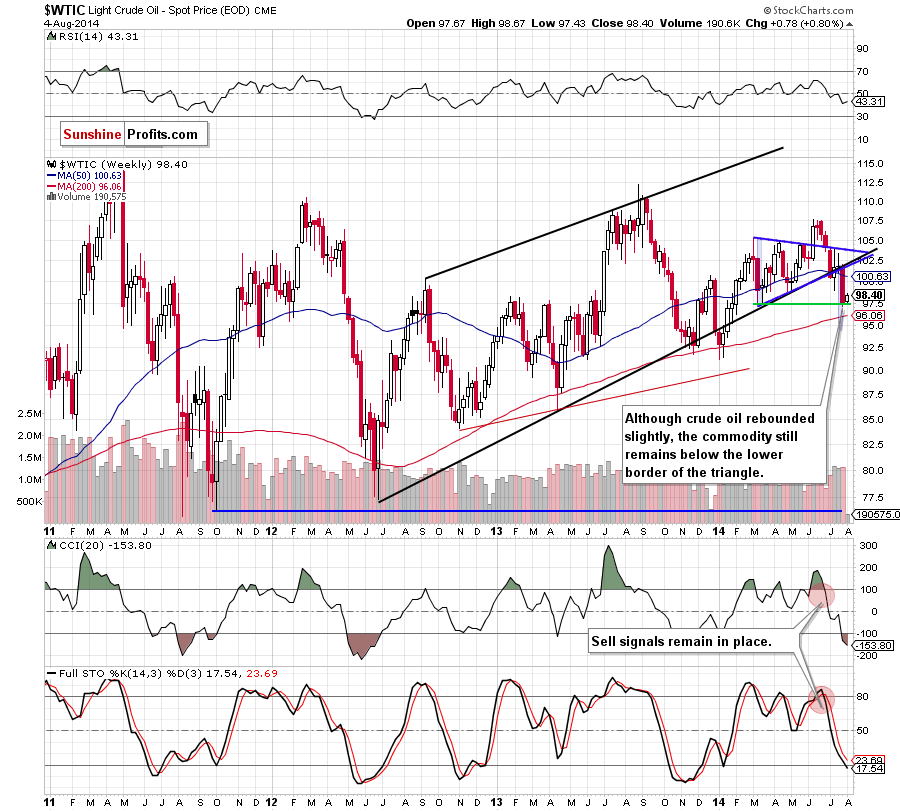

Looking at the weekly chart, we see that crude oil rebounded slightly, however, the size of the upswing is too small (even if we compare it with the previous corrective upswing) at the moment to say that the medium-term picture has improved. Therefore, we think that our last commentary is still up-to-date:

(…) What’s next? If this support level holds, we’ll see a rebound from here in the coming week. Nevertheless, we should keep in mind that sell signals remain in place, which suggests that even if we’ll see a short-term improvement, the commodity will likely test the strength of the 200-week moving average – similarly to what we saw several times in the past (for example in April, November 2013 and also at the beginning of the year).

Can we infer something more from the very short-term chart? Let’s check.

Quoting our last Oil Trading Alert:

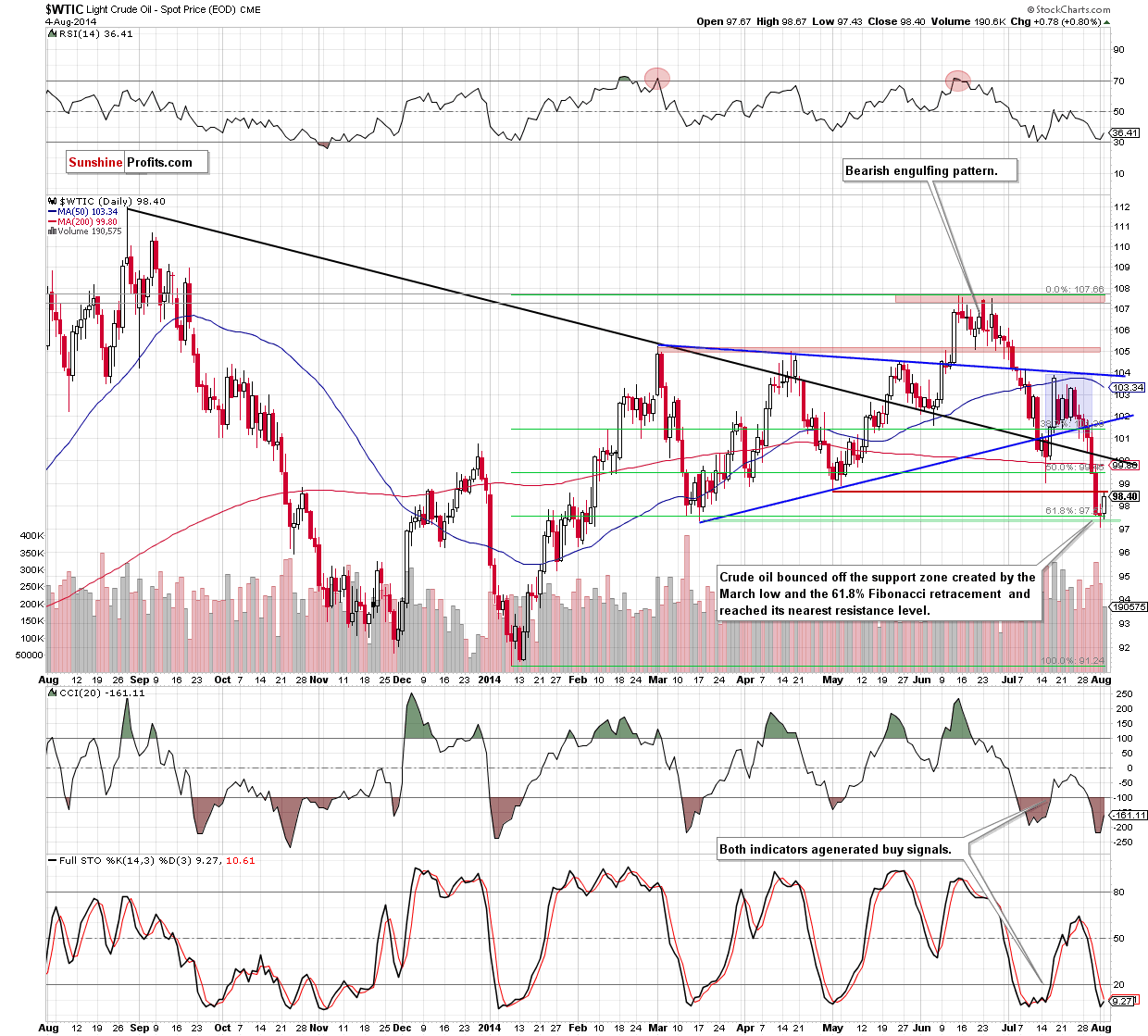

(…) the commodity reached the March low and the 61.8% Fibonacci retracement based on the entire Jan-June rally. (…) if this support area encourages oil bulls to push the buy button, we’ll see a corrective upswing to at least May low of $98.74.

(…) Please note that the CCI and Stochastic Oscillator are oversold, while the RSI approached the level of 30 once again. We saw similar readings of the indicators in mid-July. Back then, they preceded a bigger corrective upswing, therefore, if history repeats itself, we may see a rebound from here. Nevertheless, we should keep in mind that as long as there is no buy signals, another test of the strength of the support zone is likely.

As you see on the daily chart, the situation developed in line with our yesterday’s commentary and crude oil reached its initial upside target. On one hand, if light crude breaks above the resistance level created by the May low, we’ll see further improvement and the next target for oil bulls will be the previously-broken 200-day moving average (currently at $99.80). On the other hand, if the nearest resistance holds, the commodity will reverse and test the strength of the green support zone once again. In this case, it could turn out that yesterday’s upswing was nothing more than a verification of the breakdown below the May low, which would be a bearish signal that could trigger further declines. Please keep in mind that if crude oil drops below Friday’s low, the next downside target will be around $94.76-$95.21, where the strong support zone (created by the 76.4% and 78.6% Fibonacci retracements based on the entire 2014 rally and the Jan. 27 bottom) is.

Summing up, although crude oil rebounded, reaching its initial upside target, the overall situation hasn’t changed much as the size of the move is too small to say that the very short-term picture (not to mention the short-term or medium-term outlook) has improved. Therefore, just like yesterday, we think that as long as we won’t receive more clues about future moves (like a breakdown below the support zone or buy signals) opening any position is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts