Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Monday, crude oil gained 1.70% as the combination of Friday's solid U.S. jobs report and upbeat Chinese export data weighted on the price. In reaction to these numbers, light crude rebounded sharply and reached the medium- and short-term resistance lines. Will they be strong enough to stop oil bulls’ charge?

On Friday, the U.S. Labor Department reported that the economy added 217,000 in May, missing slightly expectations for a 218,000 gain. The private sector added 216,000 jobs last month, beating expectations for a 210,000 increase. The report also showed that the U.S. unemployment rate remained unchanged at 6.3% last month, compared to expectations for a rise to 6.4%. As a result, crude oil moved higher and climbed above the previously-broken 38.2% Fibonacci retracement.

On top of that, the weekend's Chinese trade data supported the commodity on Monday. Data released on Sunday showed that China's crude imports fell 9% to 6.16 million barrels a day in May from April's record high of 6.8 million barrels a day, but were still 9% higher than a year earlier. Additionally, Chinese exports gathered momentum last month, rising at an annualized rate of 7% after a 0.9% increase in April. These better-than-expected numbers boosted the commodity, pushing light crude to its medium- and short-term resistance lines. Will we see a breakout in the nearest future? Let’s check technical picture of crude oil (charts courtesy of http://stockcharts.com).

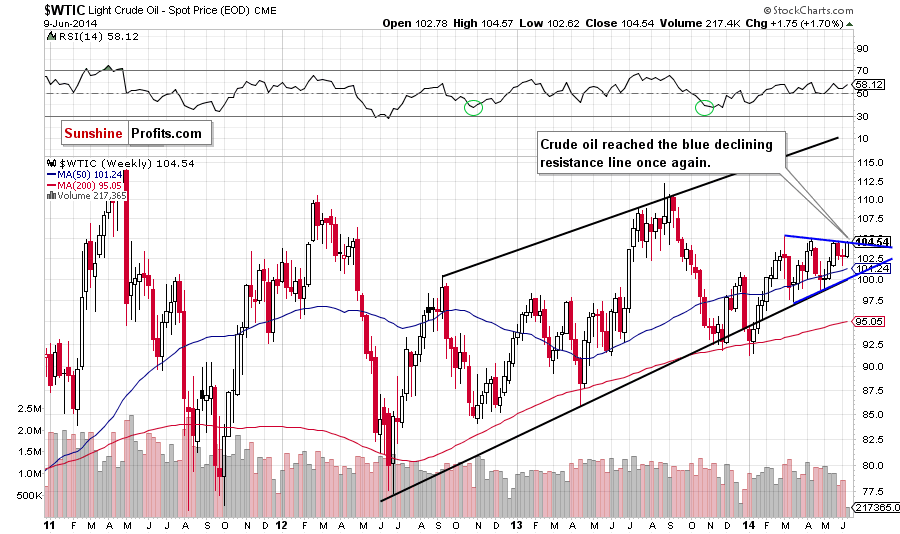

The situation in the medium term has improved slightly as crude oil rebounded sharply, reaching the blue resistance line based on the recent highs (the upper border of the triangle). Taking this fact into account, we think that if this line holds, we will see another pullback (similarly to what we noticed in the previous weeks) and the downside target will be the 50-week moving average (currently at $101.24 – slightly below last week’s low). However, if oil bulls do not give up and push the price above the resistance line, we will likely see further improvement and an increase to a 2014 high.

Once we know the above, let’s check on the very short-term picture.

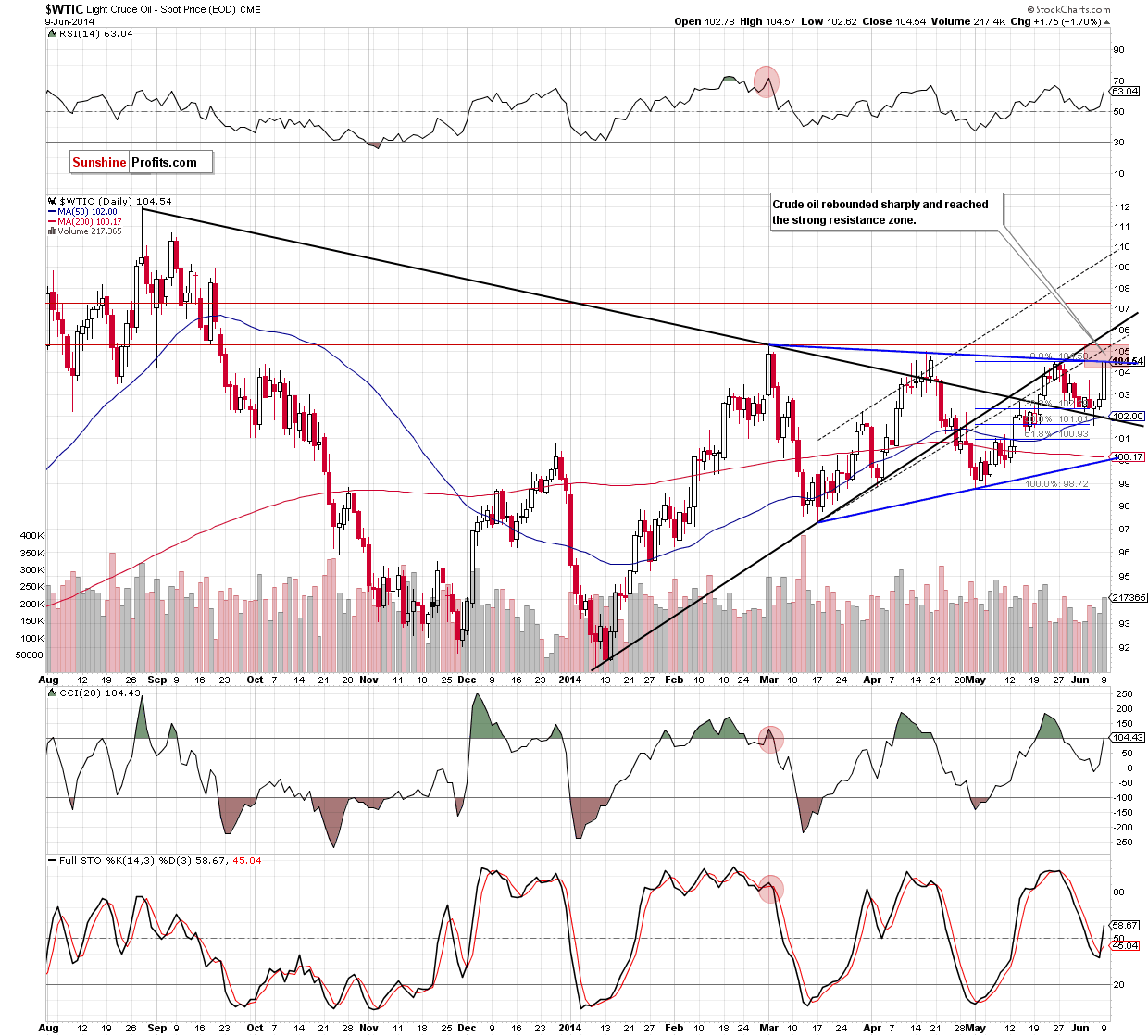

Looking at the above chart, we see that crude oil extended gains and rebounded sharply after a drop to the support zone created by the key support line, the 50% Fibonacci retracement and the 50-day moving average. With this upswing, light crude reached the blue declining resistance line (the upper line of the medium-term triangle), which sucesfully stopped further improvement at the end of the previous month. Therefore, if history repeats itself, we may see another pullback from here and the initial downside target will be the above-mentioned support zone (around $102). Please note that this scenario is currently reinforced by the potential double top formation as crude oil reached the May 27 high. On the other hand, even if oil bulls manage to push the price higher, it seems to us that the resistance zone (marked with red) created by the lower border of the rising trend channel, the medium-term rising black line and the April and March highs will be strong enough to stop futher improvement.

Summing up, although crude oil rebounded sharply after a drop to the support zone, the commodity still remains below the key resistance line and the resistance zone (marked with red). Taking these facts into account, we think that history repeats itself and we’ll see a pullback from here and lower values of crude oil in the coming day (or days).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts