Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil lost 3.98% as the combination of as lackluster readings from Asia and a price cut by Iraq fueled worries about a global supply glut. Thanks to this circumstances, light crude hit a fresh multi-year low, breaking below solid support zone. How low could the commodity go?

Yesterday, official data showed that China's imports shrank unexpectedly in November, falling 6.7% and missing expectations for a 3.9% increase. Additionally, Chinese export growth slowed and increased by 4.7%, disappointing forecast of a 8.2% rise. These weaker-than-expected numbers fueled worries that the world's second-largest economy could be facing a sharp slowdown.

On top of that, also yesterday, Iraq cut the January price of its crude-oil for Asian and American buyers, but raised them for European customers, in line with similar moves by Saudi Arabia. As a result, light crude moved sharply lower for the fifth time in a row and hit a fresh multi-year low of $62.78. How low could the commodity go? (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

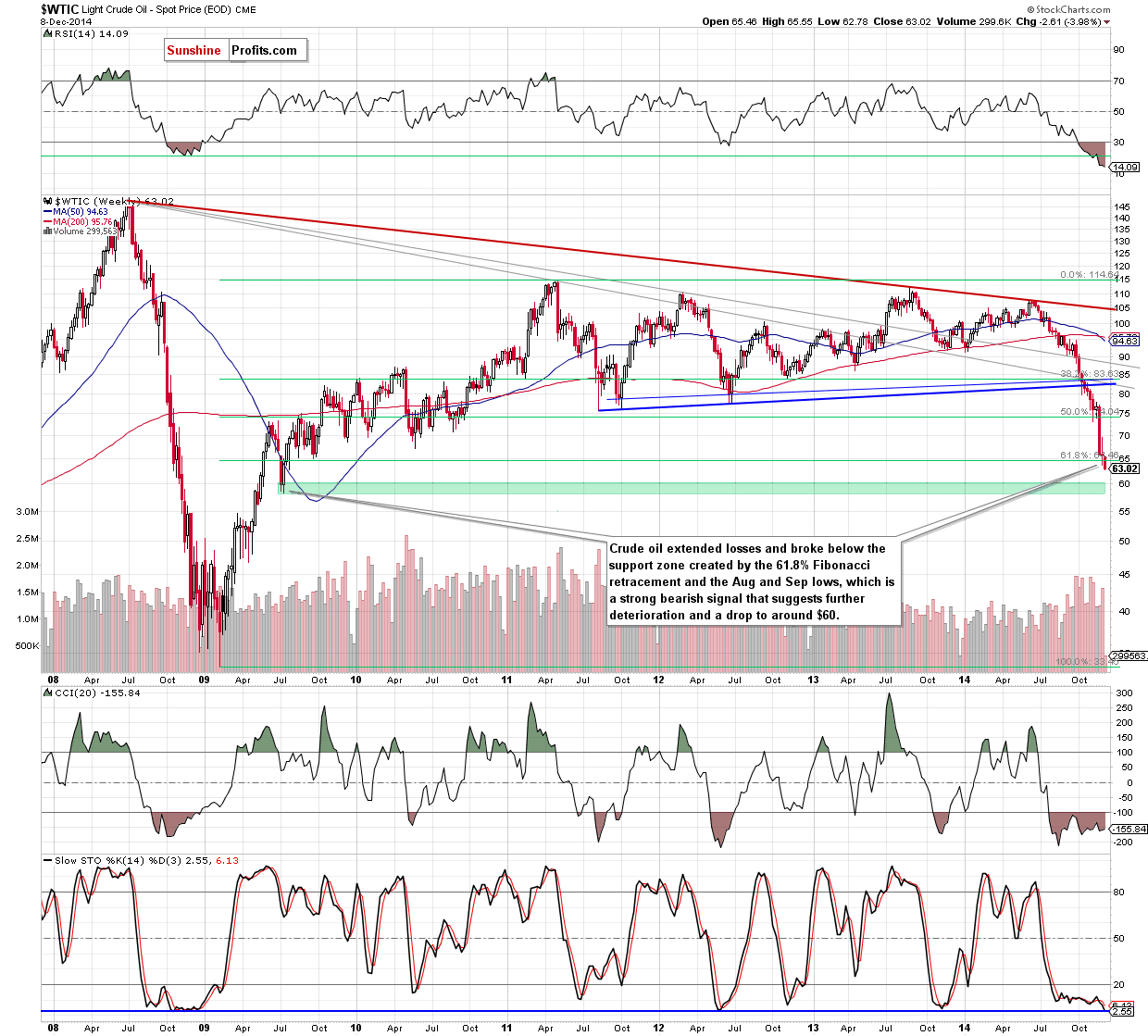

(…) crude oil moved lower for the fourth time in a row and closed the week at its lowest level since mid-Jul 2009. In our opinion, this suggests that we’ll see further deterioration in the coming day and a test of the strength of the recent low and the solid support zone (created by the 61.8% Fibonacci retracement and the Aug and Sep 2009 lows).

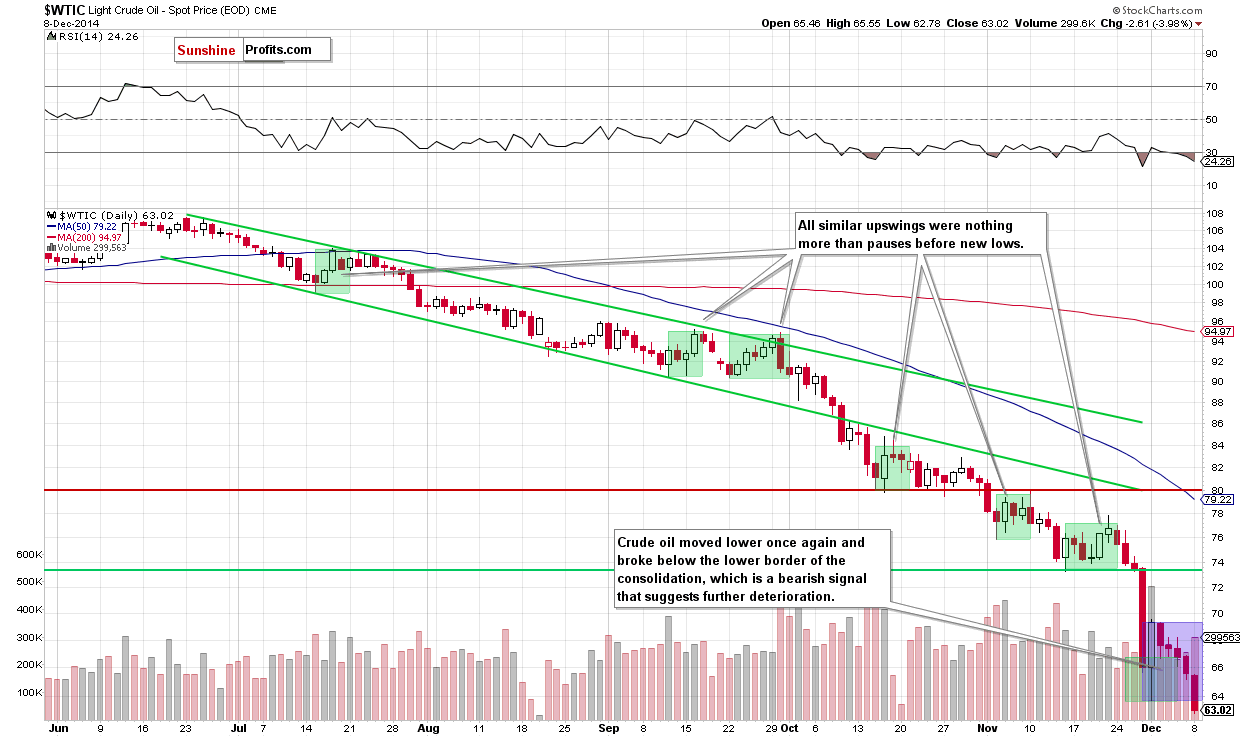

From the daily perspective, we see that oil bears not only tested the above-mentioned support zone as we expected, but also managed to push the commodity lower. In this way, light crude broke below the lower border of the consolidation and hit a fresh multi-year low of $62.78. This is a negative signal that suggests further deterioration. How low could crude oil go? We believe that the best answer to this question wil be what we wrote in our last commentary:

(…) What could happen if oil bears win and push the commodity lower? If crude oil extends losses and broke below the above-mentioned support zone, we could see a drop even to around $58.32-$60, where the Jul 2009 lows (in terms of intraday and weekly closing prices) are.

Before we summarize today’s alert we want you to keep in mind what we wrote about the current situation in the USD Index (as a reminder, the U.S. dollar was one of the major forces, which affected the price of the commodity in recent weeks).

(…) USD Index moved higher earlier this month and reached the strong resistance area created by the 2009 and 2010 highs. On Friday, we saw a breakout above these levels, which is a strong bullish signal that suggests further increase to the next upside target - the 38.2% Fibonacci retracement level based on the entire 2002 – 2008 decline (around 89.80). (…) Taking (…) into account (…) the fact that the space for further growth in the USD Index seems limited, we think that (…) if the index reverses and moves lower in the coming days, we’ll see a rebound in crude oil as a weaker U.S. dollar makes the commodity less expensive for buyers in other currencies.

Summing up, the overall situation in crude oil has deteriorated as the commodity extended losses and hit a fresh multi-year low. Despite this bearish signal, we do not recommend opening short positions as the space for further declines seems limited – especially when we factor in the current situation in the USD Index.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixeds

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts