Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 1.27% as the combination of a stronger greenback and an unexpected surge in U.S. crude supplies continued to weigh on the price. As a result, light crude slipped below $55, but did this move change anything?

On Wednesday, the U.S. Energy Information Administration showed in its weekly report that U.S. oil supplies rose by 7.3 million barrels in the week ended Dec. 19, missing analysts‘ expectations for a 2.4 million barrels drop. It was the highest December‘s level, which affected the price negatively not only on Wednesday, but also on the next trading day. Additionally, another increase in the USD Index watered down the commodity, making it less attractive among investors holding currencies other than the US Dollar. Did these fundamental factors change the technical picture of crude oil? (charts courtesy of http://stockcharts.com).

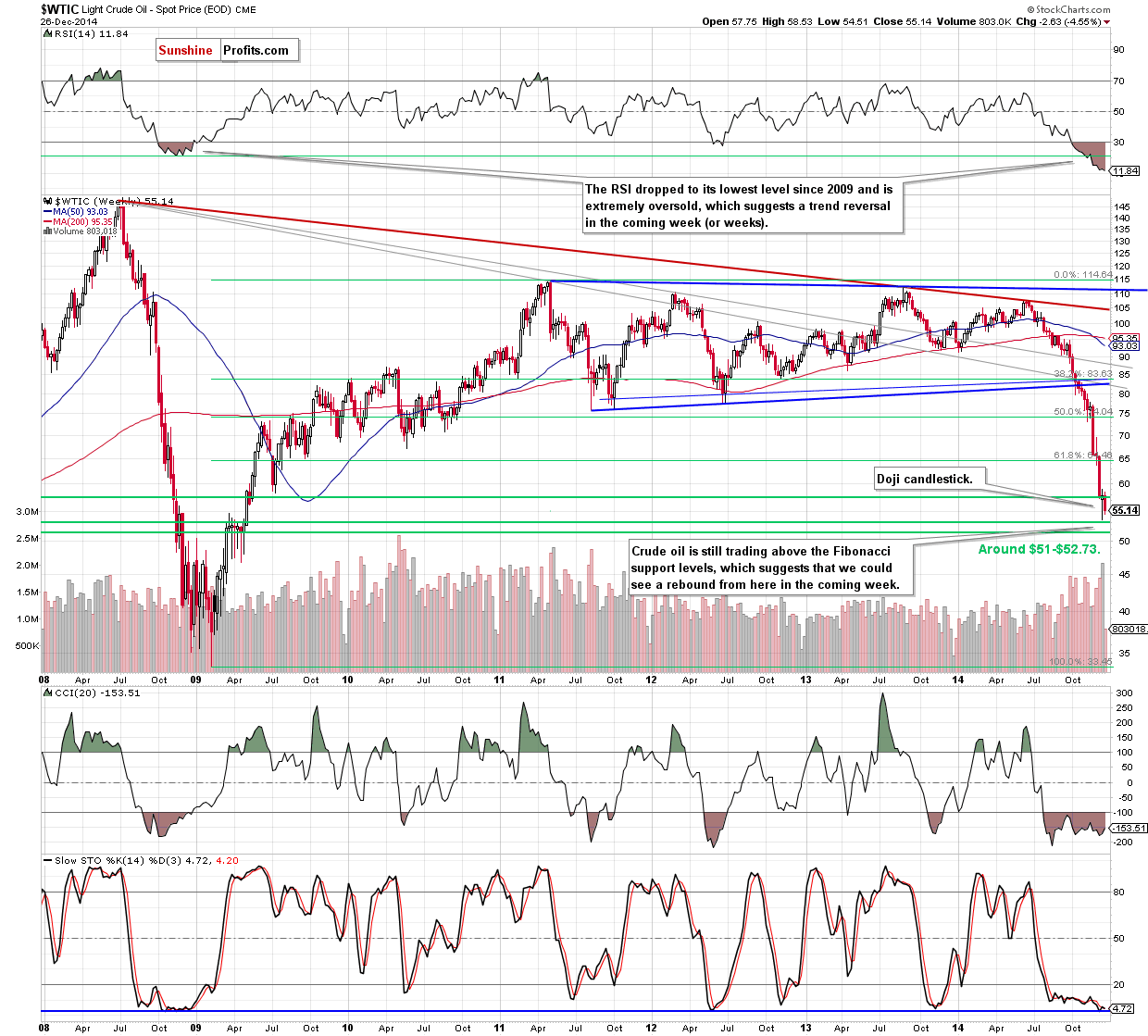

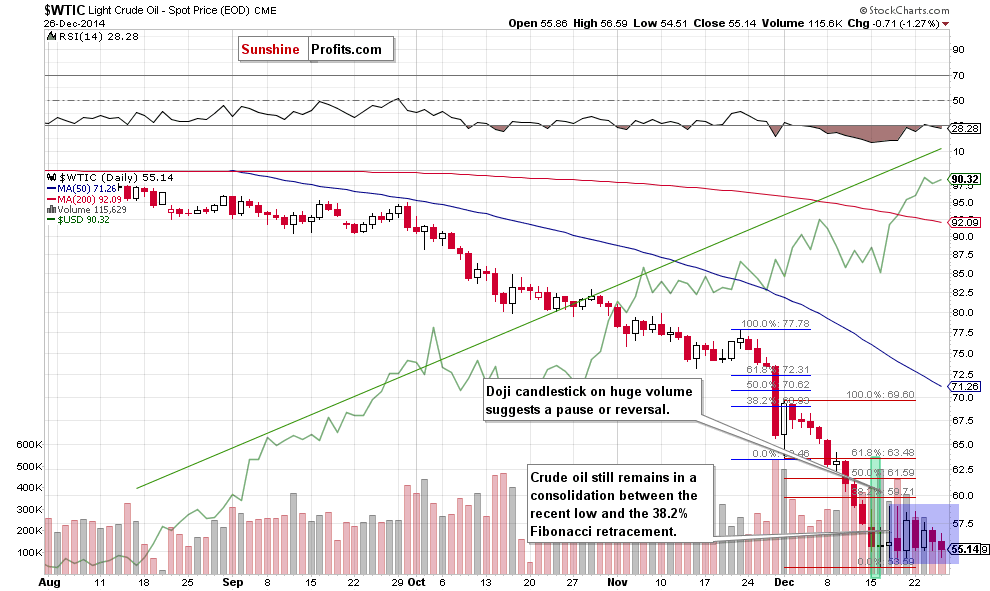

Looking at the above charts, we see that although crude oil moved lower on Friday, the overall situation remains unchanged as the commodity is still trading a consolidation (marked with blue) between the 38.2% Fibonacci retracement (based on the entire Dec decline) and the recent lows. Taking this fact into account, we believe that our last commentary is up-to-date:

(…) crude oil is still trading in a narrow range between the 38.2% Fibonacci retracement (based on the entire Dec decline) the (…) support zone. Therefore, we think that as long as there is no successful breakout above this resistance (or breakdown under this support), opening any positions is not justified from the risk/reward perspective. The reason? When we take a closer look at the daily chart, we see that there was a bigger and sharp corrective upswing at the beginning of the month. Back then, although crude oil corrected over 38.2% of earlier downward move, oil bulls didn’t manage to push the commodity higher, which translated to a fresh 2014 low. Therefore, we think that a trend reversal (and an upward move to the initial upside target around $70) will be likely only if we see an upswing above $59.50, which won’t be followed by a fresh low. Until this time, another pullback and test of the recent low is likely.

Before we summarize today’s alert, we would like to draw your attention to the U.S. dollar – crude oil link. As you see on the daily chart, although the greenback extended gains in the recent days, hitting fresh 2014 highs, crude oil didn’t drop to a new low. Instead, the commodity has been trading in the consolidation, which may be the first sign of strength. Taking this important event into account, we can initially assume that even if the U.S. currency moves higher, it will not necessarily translate into lower values of crude oil.

Summing up, although crude moved little lower on Friday, the overall situation in the commodity hasn’t changed much as light crude is trading in a narrow range. Please keep in mind that if oil bulls manage to push light crude above the 38.2% Fibonacci retracement (based on the entire Dec decline), we’ll consider opening long positions. Until this time, no positions are justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts