Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, the Organization of the Petroleum Exporting Countries decided not to cut output to support the market. In response, crude oil lost over 10% and dropped to its lowest level since Sep 2009. How low is too low?

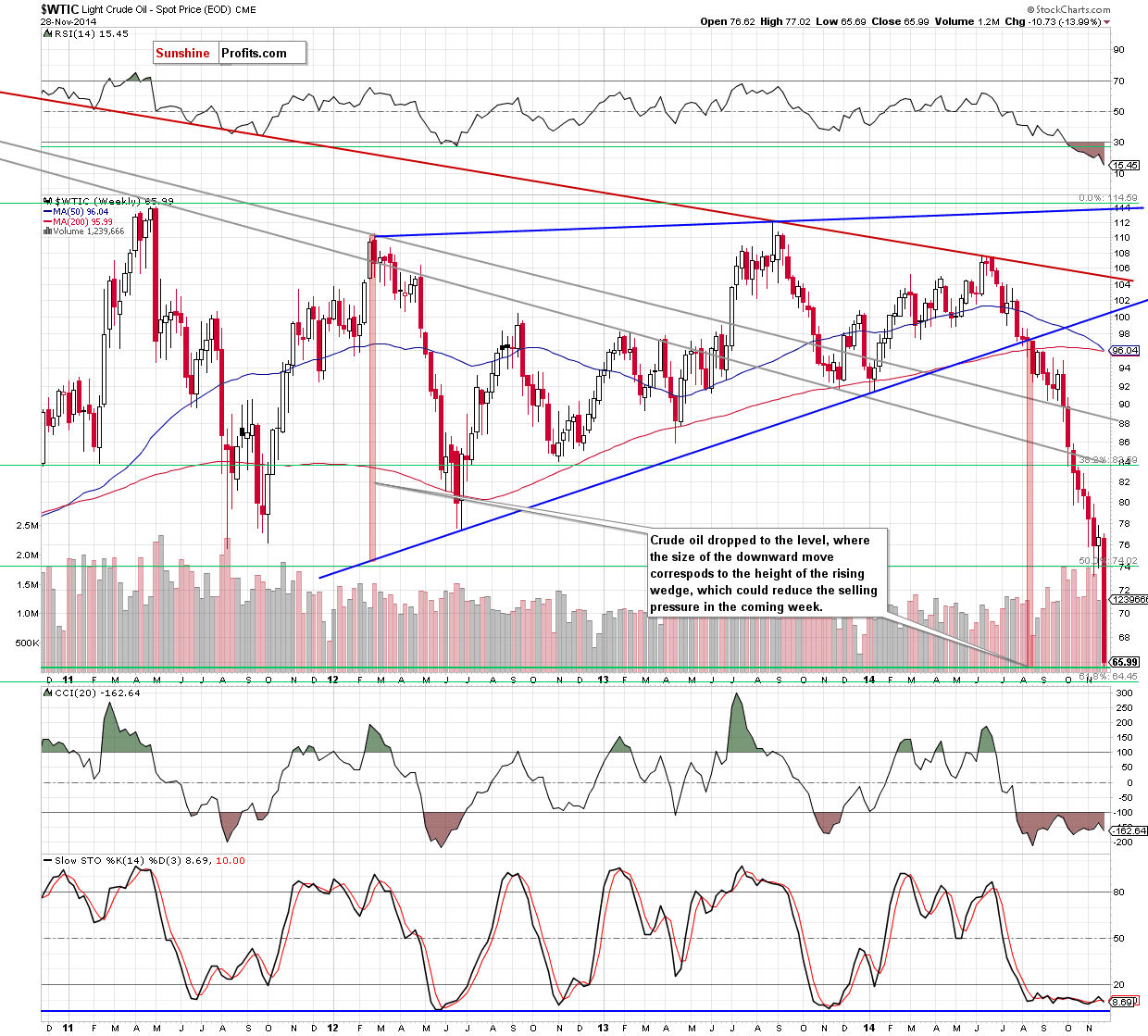

On Thursday, the Organization of Petroleum Exporting Countries said that it would keep its official production target unchanged at 30 million barrels a day. This decision disappointed market participants and pushed light crude to over a five year low of $65.69. Taking into account the recent price action, we decided to focus on two medium-term charts, which could give us some clues about future moves (charts courtesy of http://stockcharts.com).

From this perspective, we see that crude oil extended losses and dropped to the level, where the size of the downward move corresponds to the height of the rising wedge (marked with blue). Many times in the past, similar price action (an increase or a drop to the area, where the move is equal to the height of some technical formation) have reduced the selling pressure, which usually have had a positive impact on the commodity. Nevertheless, after such sizable decline it’s seems doubtful that this one technical factor would trigger a corrective upswing. Therefore, we zoomed out our picture and take a look at the same chart from a broader perspective.

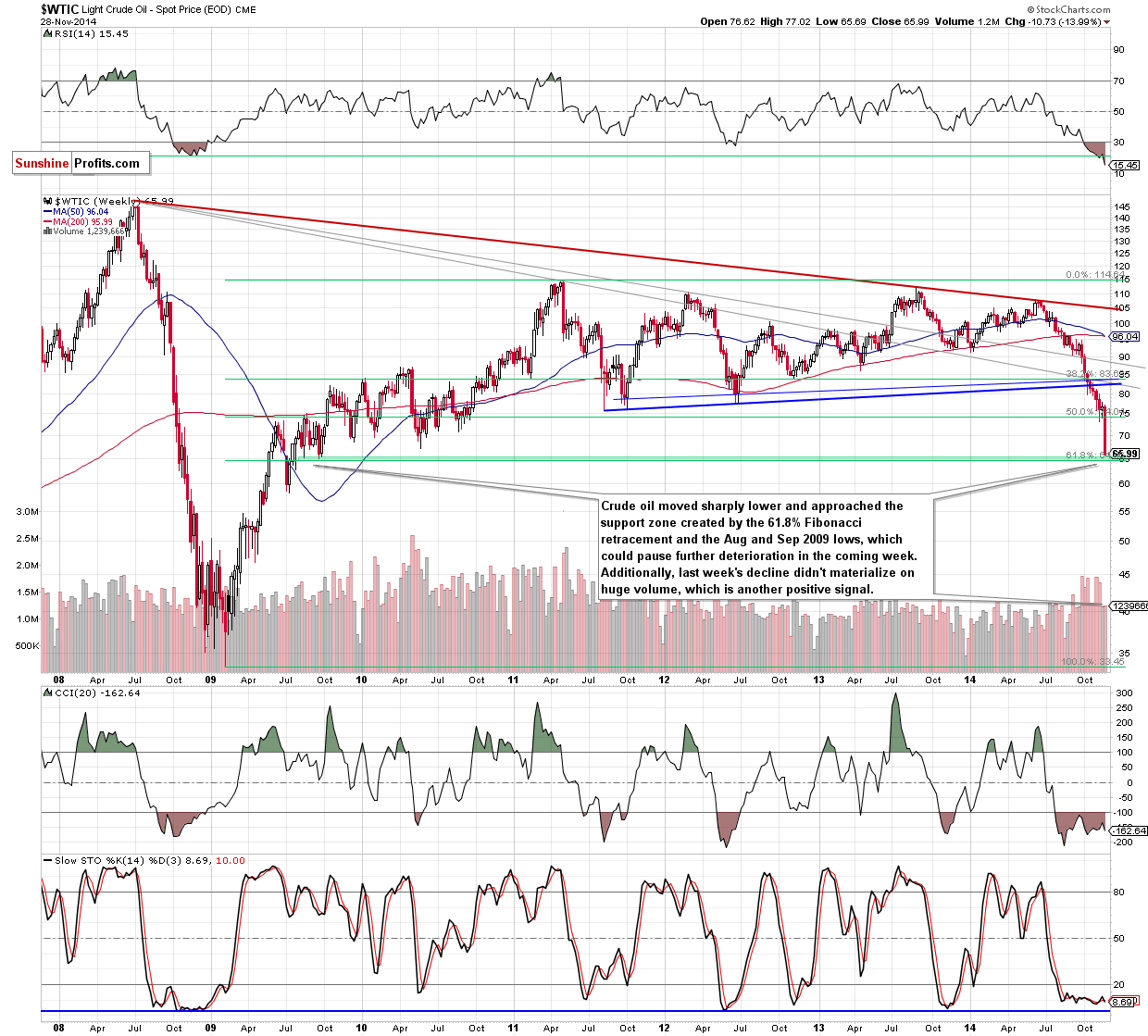

As you see on the above chart, with the recent downward move, crude oil approached the next support zone created by the 61.8% Fibonacci retracement and the Aug and Sep 2009 lows. Although light crude still has some room for declines, it seems that the space is limited, which suggests that a pause (or bigger corrective upswing) is just around the corner. Nevertheless, as long as there is no increase of (at least) $5.5 dollar, which won’t be followed by a fresh multi-year low, we do not recommend opening long positions. Why is such an increase is so important? Because since mid-Jul all smaller corrective upswings were nothing more than stops before new lows. Therefore, until we see stronger bullish signs, long positions will not be justified from the risk/reward perspective.

Summing up, although crude oil extended losses and hit a fresh multi-year low, it seems that the space for further declines is limited as the solid support area is quite close. Therefore, even if we see another downswing, we think that the 61.8% Fibonacci retracement will encourage oil bulls to act and we’ll see higher price in the coming days. Nevertheless, as long as there is no increase of (at least) $5.5 dollar, which won’t be followed by a fresh multi-year low, we do not recommend opening long positions.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts