Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Wednesday, crude oil gained 1.33% as the combination of the bullish EIA weekly report and ongoing concerns over tensions between Russia and Ukraine supported the price. Thanks to these circumstances, the commodity erased the Tuesday’s decline, but did this show of “strength” change the very short-term outlook?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories declined by 4.0 million barrels in the week ended July 18, well beyond expectations for a decline of 2.8 million barrels. This bigger-than-expected drop in oil stockpiles fueled sentiments that demand is on the rise, which pushed the commodity above $103 once again.

Additionally, yesterday’s reports that two Ukrainian jet fighters were shot down over the city of Donetsk fueled worries that the conflict could threaten Russian oil exports and also supported the price of light crude.

Once we know fundamental factors, which influenced the commodity yesterday, let’s check whether there are any technical factors that could support the price or not (charts courtesy of http://stockcharts.com).

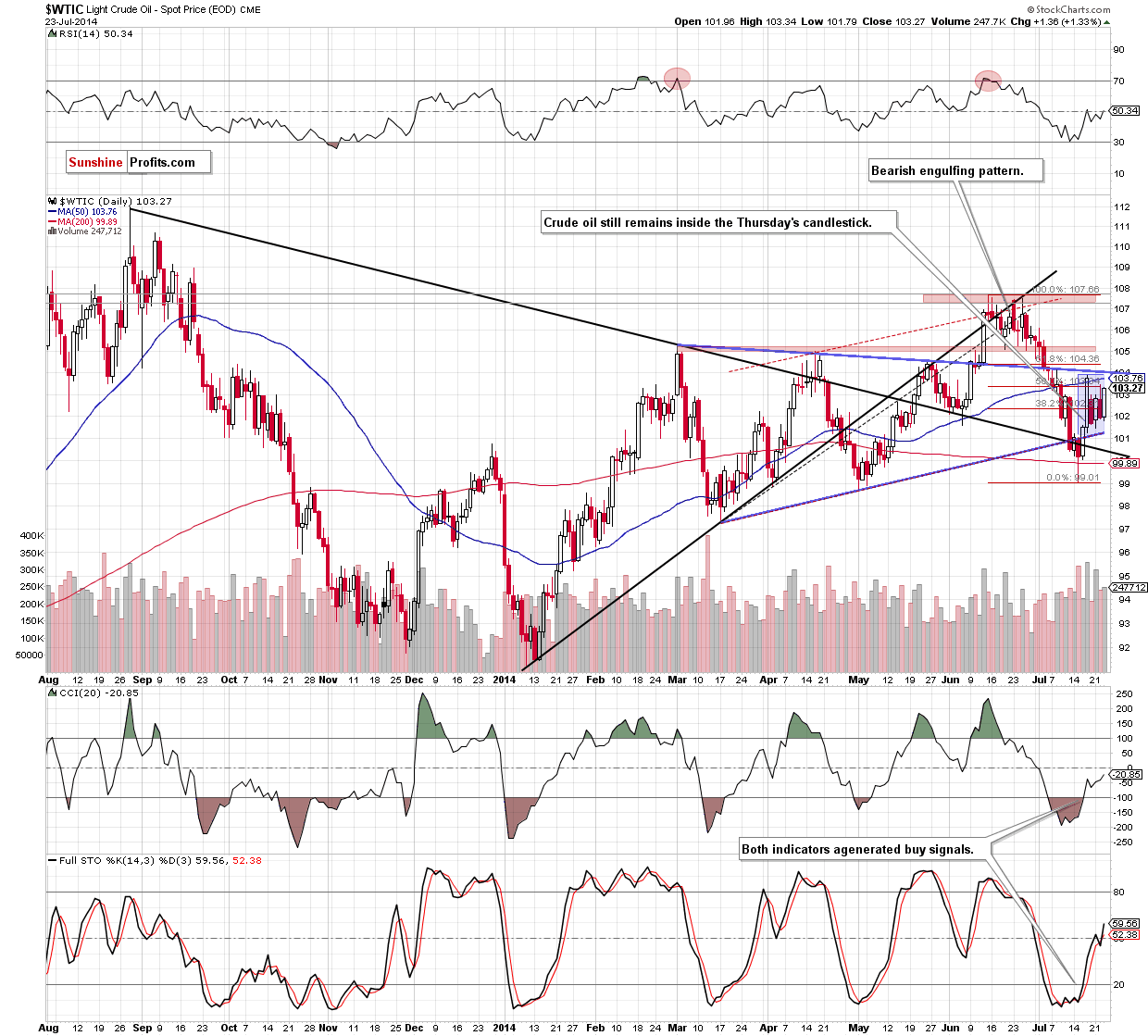

The medium-term picture is still mixed as the commodity remains between the lower and upper line of the blue triangle. Today, we’ll focus on the very short-term picture.

Looking at the above chart, we see that although crude oil moved higher and corrected all Tuesday’s decline, yesterday’s price action didn’t change the very short-term picture. We saw similar moves in the previous days and from today’s point of view we can summarize the recent week in one simple sentence: although a lot happened, nothing really has changed. As you see on the daily chart, the commodity is still trading inside the Thursday’s candclestick between the strong support zone (created by the Thursday’s low and the blue support line) and the strong resistance area (based on the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonacci retracement). Nevertheless, we should keep in mind that buy signals generated by the indicators are still in play, which suggests that oil bulls may take their chance to improve the very short-term picture in the coming day (or days).

To emphasize that Wednesday’s session didn’t change anything, we summarize the current situation in the same way as we did yesterday:

Summing up,,(...) yesterday’s price action didn’t change the very short-term picture. Therefore, we remain convinced that as long as there is no breakout above the resistance zone or a breakdown below the support zone another sizable move is not likely to be seen. Just like we wrote yesterday, it’s too early to say that anything has really changed and opening any position at the moment is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts