Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

The combination of the bearish EIA weekly report, soft retail sales numbers and waning worries that conflicts in Ukraine and Iraq will disrupt supplies from these regions pushed the price lower after the market’s open. Although the commodity rebounded in the following hours, light crude is still trading in a narrow range. Will we see a breakthrough in the coming days?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories rose by 1.4 million barrels in the week ended Aug. 8, missing expectations for a decline of 2.0 million barrels.

Additionally, the U.S. Commerce Department reported that retail sales were little changed in July, disappointing expectations for a 0.2% increase, while core retail sales (without automobile sales) dropped by 0.1% in July, missing forecasts for a 0.4% increase.

These bearish numbers in combination with waning geopolitical factors pushed down the price, which resulted in a drop to an intraday low of $96.75. As we mentioned earlier, although the commodity rebounded in the following hours, crude oil still remains near the recent lows. Are there any technical factors that could drive the price higher or lower in the near future? Let’s check (charts courtesy of http://stockcharts.com.)

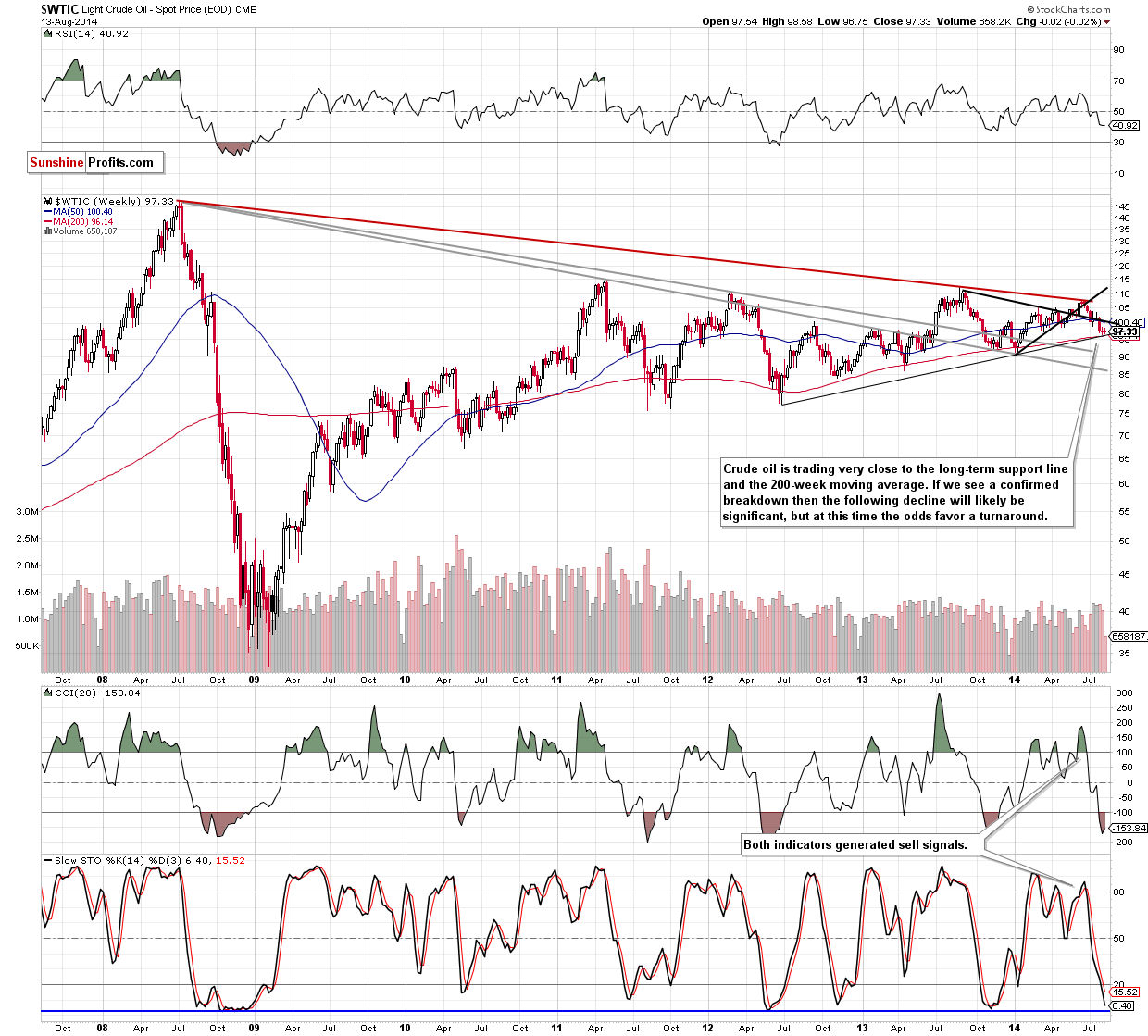

The long- and medium-term outlook remains unchanged as crude oil is still trading slightly above 2 strong support levels: the rising, long-term support line and the 200-week moving average. Therefore, our previous commentary is still up-to-date:

The price currently rests at the long-term support. The combination of the rising support line based on 2 major tops and the 200-week moving average is something that should make you alert – it certainly makes us alert. The combination of these two support levels is strong enough to stop the current decline, but on the other hand, if it is broken, we will likely see a quite significant slide. Consequently, we keep monitoring this area with extra attention.

What is the short-term perspective?

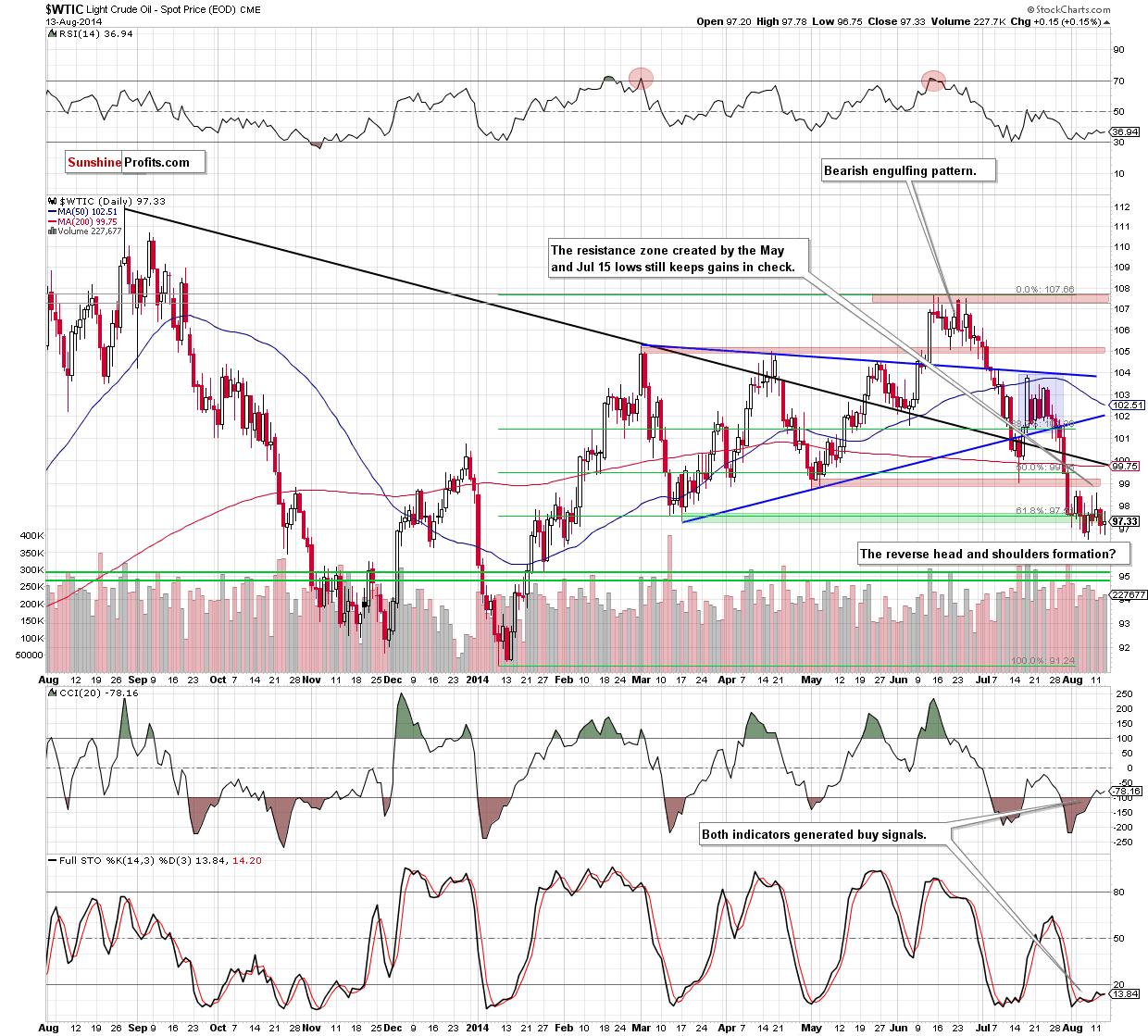

Looking at the above chart, we see that although crude oil extended losses after the market’s open, oil bears didn’t manage to push the commodity lower, which resulted in a rebound. Despite this upswing, light crude reversed and slipped to slightly above the Tuesday closing price, which means that what we wrote in our previous Oil Trading Alert is up-to-date:

(…) crude oil still remains between the recent lows and the resistance zone created by the May and Jul 15 lows, which makes the very short-term situation unclear. However, when we take a closer look at the chart, we can see a potential reverse head and shoulders formation. If this is the case, and the commodity is building a right shoulder at the moment, we may see a short-term trend reversal in the near future. Please note that this scenario is currently reinforced by the medium-term outlook that we discussed above and the current position of the indicators (the CCI and Stochastic Oscillator generated buy signals). Nevertheless, as long as there is no breakout above the neck line (based on the Aug 4 and Aug 11 highs), another sizable move is not likely to be seen.

Summing up, although we saw some “action” yesterday, the very short-term picture remains unclear as there is no breakout above the neck line and the nearest resistance zone nor breakdown below the recent lows and the strong support zone that emerges from the medium-term perspective. Taking all the above into account, we are convinced that staying on the sidelines waiting for another profitable buying or selling opportunity is the best choice for this moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

On an administrative note, there will be no regular Oil Trading Alert on Friday - we will post the next one on Monday, Aug 18. Thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts