Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

Crude oil has a hard time “deciding” which way it really wants to head next. The commodity has been moving back and forth for some time now. The move that will follow such a lengthy consolidation will quite likely be significant. Is now a good time to be positioned for this move? Let’s take a closer look (charts courtesy of http://stockcharts.com).

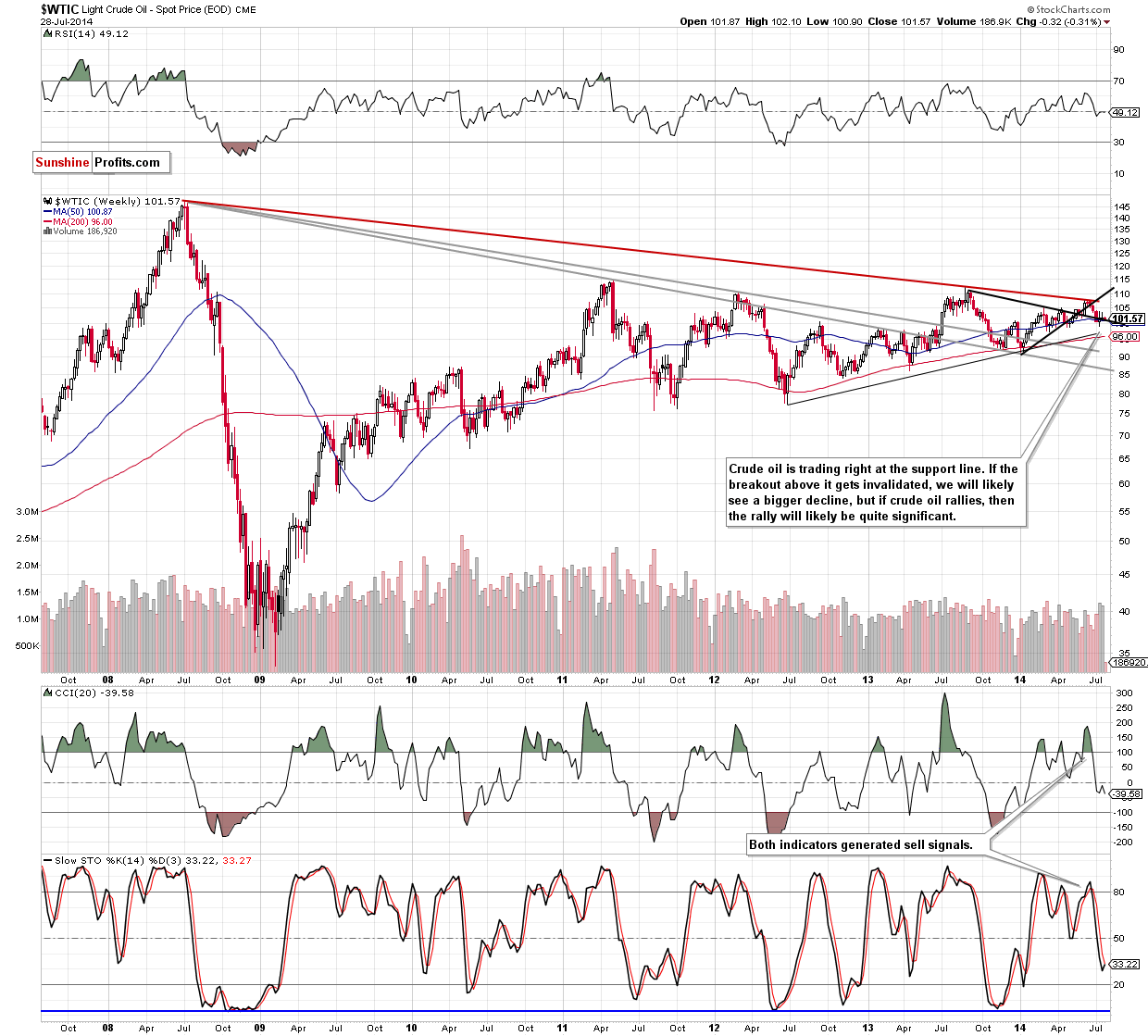

The long-term chart shows exactly why the situation in the crude oil can be compared to a coiled spring. The price is right at the declining support line, which means that if it moves higher, the previous breakout will be clearly verified. On the other hand, a move lower will invalidate the breakout, which will serve as a sell signal.

Since we can expect the next move to be significant, it seems particularly useful to monitor this market closely. Unfortunately, the short-term chart doesn’t provide us with much clues.

Generally, what we wrote previously remains up-to-date:

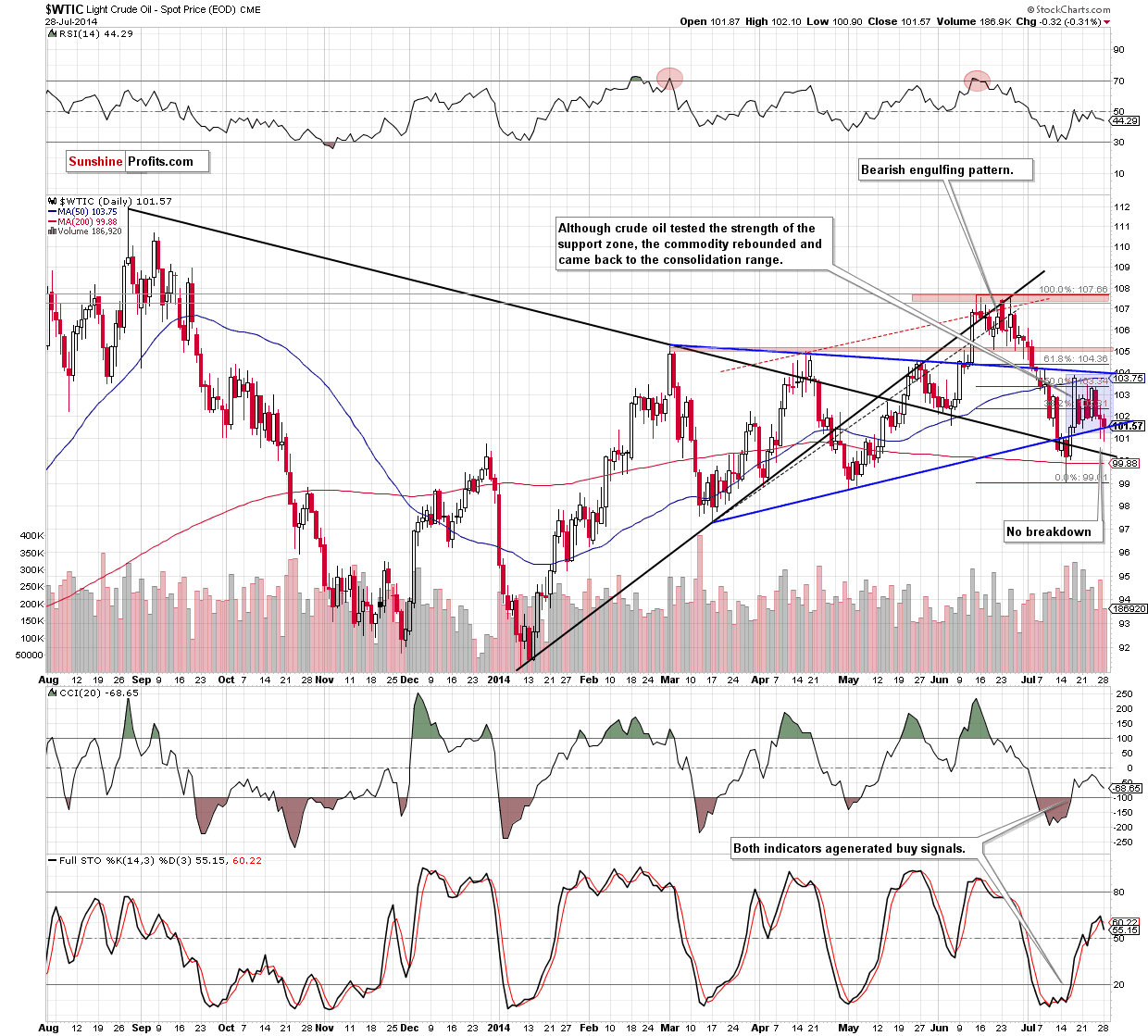

From the daily perspective, we see that oil bears tested not only the blue support line, but also the lower border of the consolidation. As we have pointed out before, they failed, which triggered a corrective upswing that took crude oil back to the levels that we saw several times in the previous week. (...) We can summarize the recent week in one simple sentence: although a lot happened, nothing really has changed. (...) the commodity is still trading (...) between the strong support zone (created by the Thursday’s low and the blue support line) and the strong resistance area (based on the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonacci retracement).

We will be happy to take action once the situation clarifies a bit. At this time, both: long- and short-term charts suggest that the wait-and-see approach is currently the preferred action. Opening any position before a breakout or a breakdown seems simply too risky. In consequence, the risk/reward ratio is not favorable enough to open any position at this time.

To summarize:

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Please note that this is the final Oil Trading Alert for this week. The next one will be posted on Monday, August 4. The following alerts will be posted normally. We apologize for this week‘s inconvenience and thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts