Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open, oil bulls didn’t hold gained levels, which resulted in a pullback to the key support/resistance levels. What’s next?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

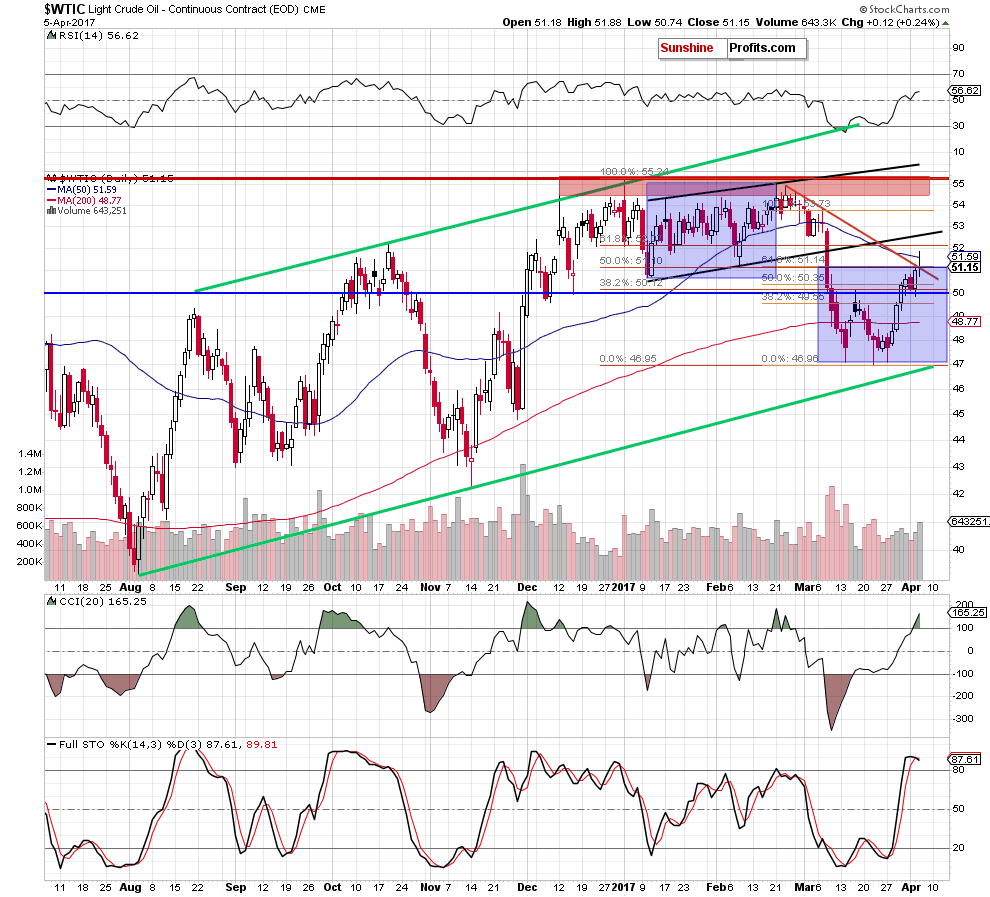

Looking at the daily chart, we see that although crude oil moved higher after the market’s open, oil bulls didn’t hold gained levels, which resulted in a pullback to the key support/resistance area (created by the 50% Fibonacci retracement based on the entire January – March downward move, the 61.8% retracement based on the March declines and the orange declining resistance line based on the February and March highs), which makes the very short-term picture unclear.

Nevertheless, thank to yesterday’s drop, crude oil invalidated the small breakout above the 50-day moving average, which is a negative sign. Additionally, the CCI climbed to the highest level since late February, while the Stochastic Oscillator generated the sell signal, which suggests that reversal and lower prices of the black gold are just around the corner.

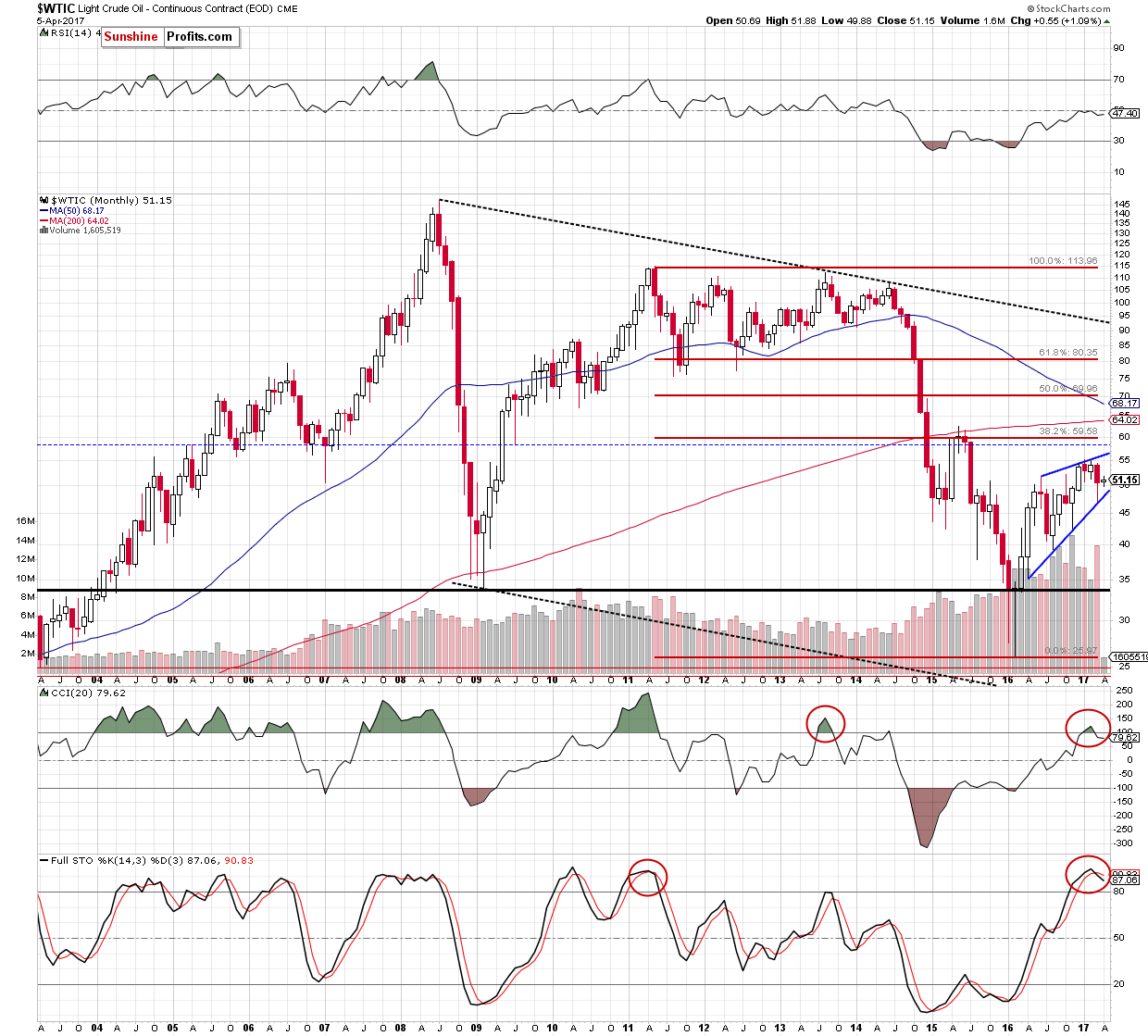

This scenario is also reinforced by the long-term picture.

From this perspective, we see that the lower border of the blue rising wedge triggered a rebound in the previous month. Despite this move, sell signals generated by the CCI and the Stochastic Oscillator remain in place, supporting oil bears and another attempt to move lower. At this point, it is worth keeping in mind that we saw a similar situation long time ago – in October 2013 (in the case of the CCI) and June 2011 (in the case of the Stochastic Oscillator). In both cases, the sell signals preceded bigger declines, which increases the probability that we’ll see similar price action in the coming weeks.

Summing up, short positions continue to be justified as crude oil remains in the very important resistance zone, which could encourage oil bears to act and trigger another downswing in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts