Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. In other words, closing the previous short positions and taking profits off the table appears justified at this time.

On Monday, crude oil lost 3.78% after non-OPEC producers didn’t make a commitment to join OPEC in limiting oil output levels. Thanks to these circumstances, light crude slipped under $47 and reached an important support zone. Will it manage to stop further declines in the coming days?

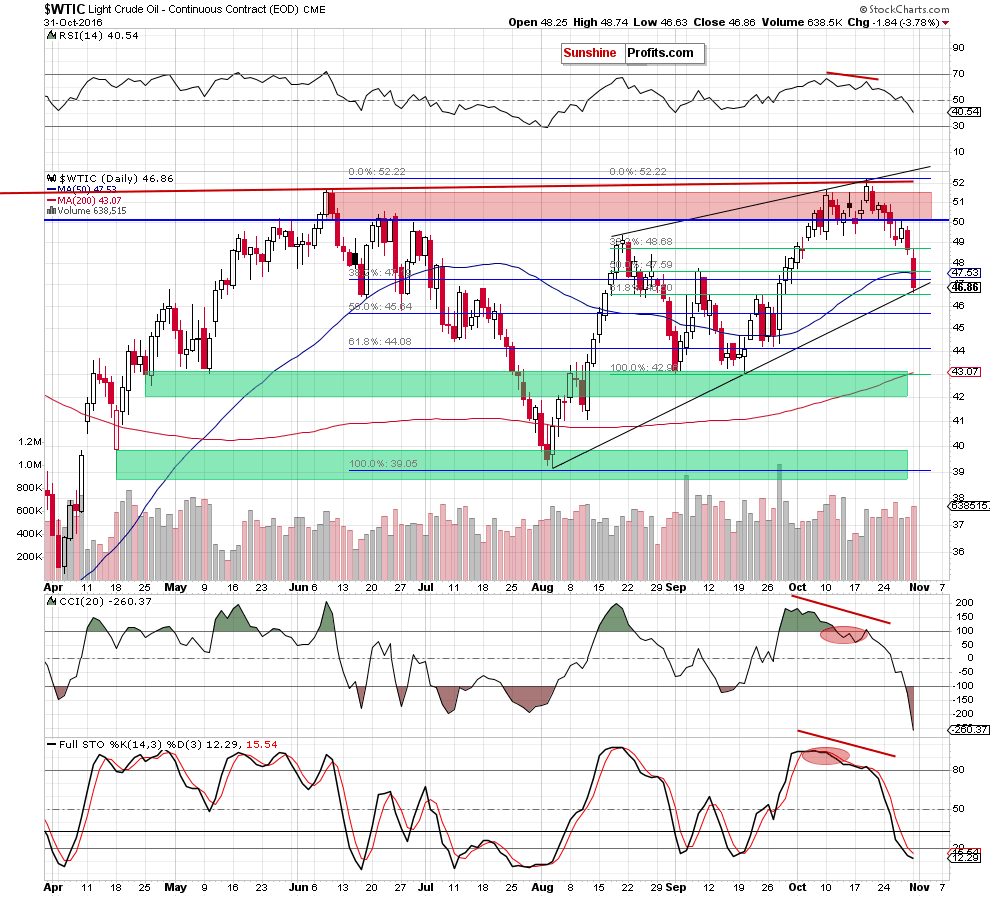

Let’s examine the daily chart and find out what can we infer from it (charts courtesy of http://stockcharts.com).

On Thursday, we wroe the following:

(...) if oil bears push the commodity under the recent lows, we’ll see a drop to around (...) $46.50 (61.8% Fibonacci retracement based on the Sep-Oct upward move and the black rising support line based on the Aug and Sep lows)

From today’s point of view, we see that the situation developed in line with the above scenari and crude oil declined to our downside target. What’s next? Taking into account the importance of this support area (the 61.8% Fibonacci retracement based on the Sep-Oct upward move, the Sep 22 and Sep 23 highs and the black rising support line based on the Aug and Sep lows) and the fact that the CCI and Stochastic Oscillator are already oversold, we think that rebound from current levels is very likely. Therefore, in our opinion, closing short positions (we opened them when crude oil was trading around $51.60) and taking profits off the table is the best decision at the moment.

Summing up, crude oil moved sharply lower and declined to the solid support area, which in combination with the current position of the indicators suggests that a rebound is just around the corner and closing yet another profitable trade is justified from the risk to reward point of view.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts