Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

On Monday, crude oil lost 1.20% as the combination of disappointing U.S. housing data and ongoing concerns that global supply is plentiful weighed on the price. As a result, light crude slipped to $90.41, hitting a fresh multi-month low. Will the support zone be strong enough to stop further deterioration?

Yesterday, the National Association of Realtors reported that U.S. existing home sales declined 1.8% to 5.05 million units last in August, missing analysts’ expectations for 1% increase. These disappointing numbers fueled fears that U.S. may consume less fuel and energy than once thought, pushing the commodity to its lowest level since the beginning of May. Will we see further deterioration? Or maybe there are some positive factors that could drive light crude higher? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

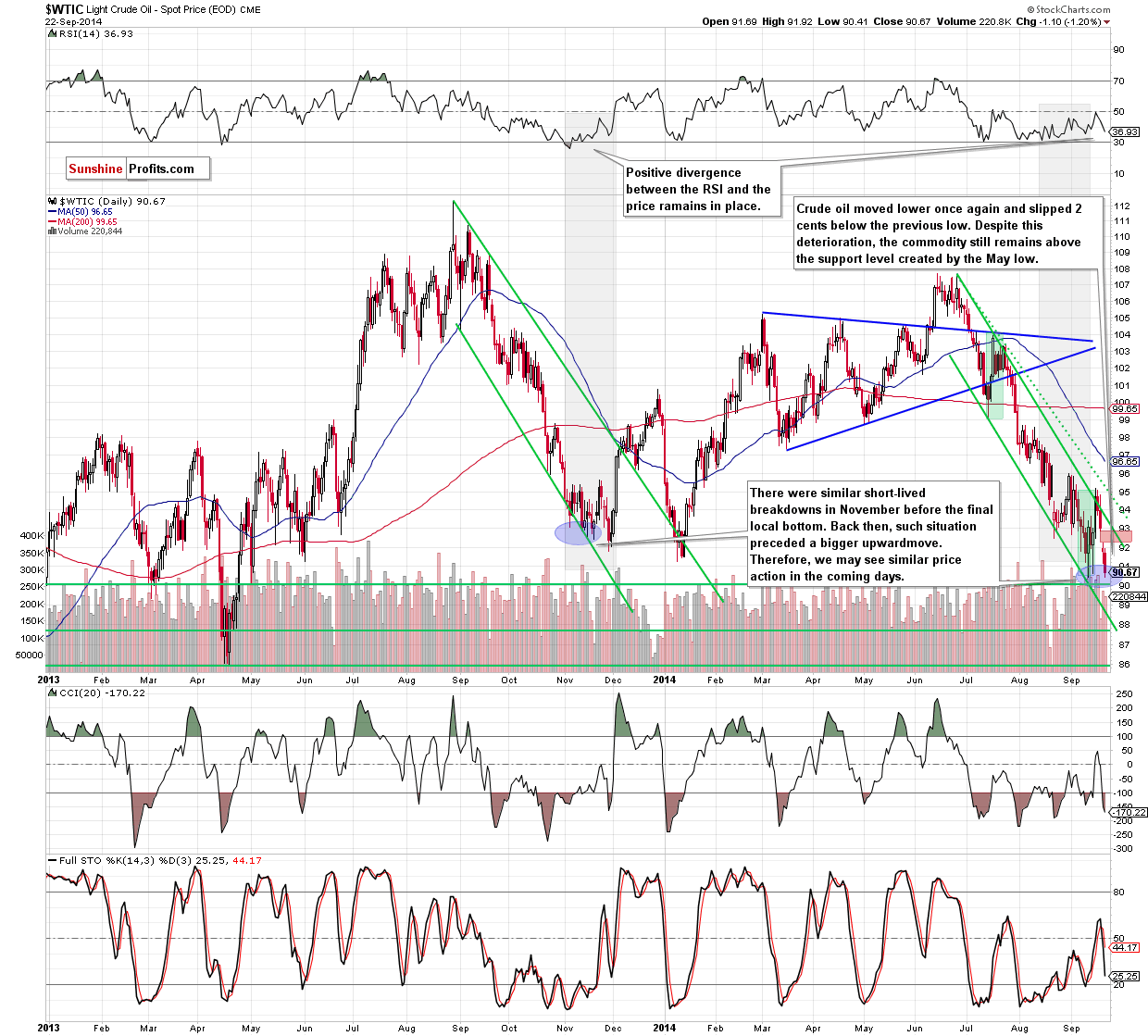

Looking at the above chart, we see that crude oil extended losses and declined to its lowest level since the begining of May. Is this drop as bearish as it looks at first glance? In our opinion the answer is no. Why? Fristly, the commodity slipped only by 2 cents below the previous low (on an intraday basis) and closed the day above it. Secondly, yesterday’s move materialized on lower volume than the day before, which suggests that the selling pressure waned. Thirdly, and most importantly, when we take a closer look at the above chart and compare the current situation to the one that we saw in November, we clearly see that back then, there were similar short-lived breakdowns, which preceded a local bottom and a bigger upward move. What’s interesting, positive divergence between the RSI and the price remains in place (the same situation we saw in November). What does it mean for crude oil? Taking all the above into account and comining with a fact that the history tends to repeat itself, we still believe that the next sizable move will be to the upside.

Will the medium-term picture support this bullish scenario? Let’s zoom out our picture and find out.

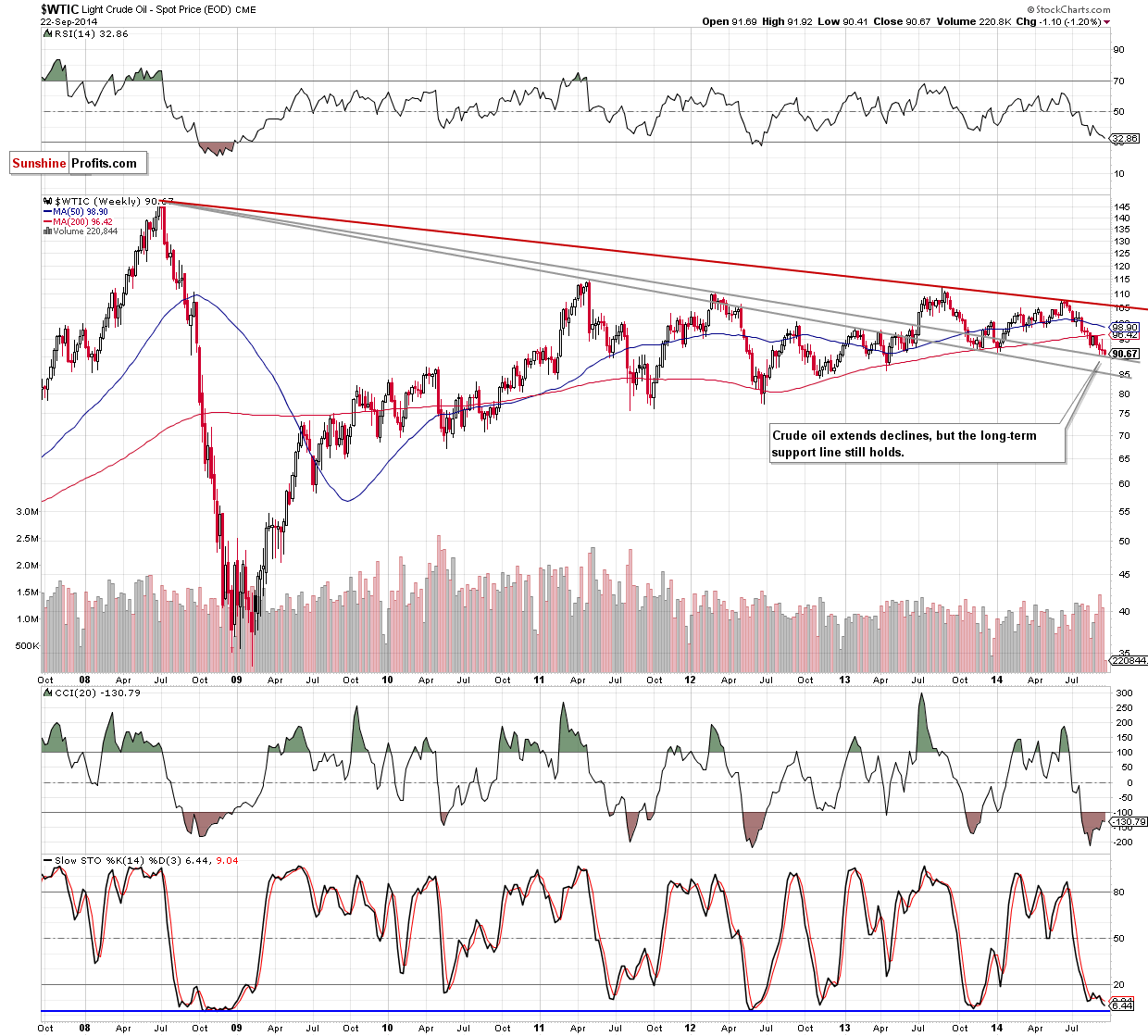

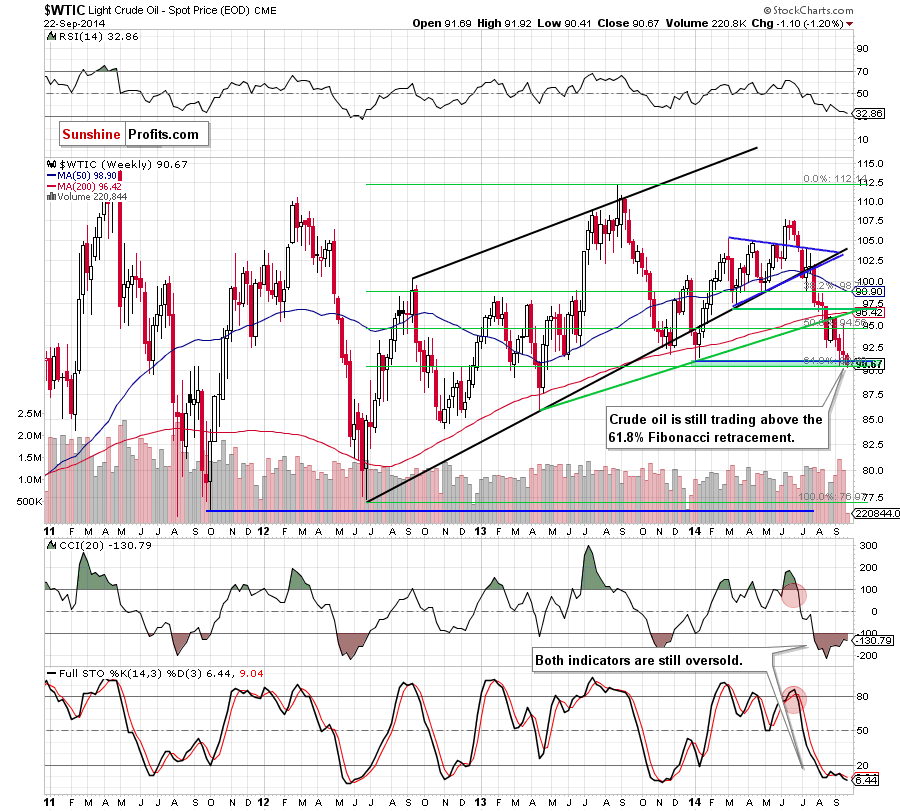

Looking at the above charts we see that despite yesterday’s drop, the situation in the medium term hasn’t changed as crude oil is still trading above the solid support zone created by the long-term declining support line and the 61.8% Fibonacci retracement, which successfully stopped further deterioration in the previous week. Therefore, we are convinced that as long as there is no breakdown below these levels, another sizable downward move is not likely to be seen.

Summing up, although crude oil moved lower, the size of a breakdown and the pace of its invalidation says that it was only an intraday deterioration. Additionally, the medium- and short-term support zones and positive divergence between the RSI and the price are still in play. Therefore, although there will likely be bumps along the road, the similarity to the situation that we saw in November (when crude oil hit several fresh intraday lows before the local bottom materialized) suggests that the space for further declines is limited and the bigger upward move is just around the corner. Taking all the above into account, we believe that keeping long positions is still justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts