Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Friday, crude oil gained 1.33% as better-than-expected U.S. data and worries over escalating tensions in eastern Ukraine supported the price. As a result, the commodity extended rally and reached an important resistance zone. Will it be strong enough to stop oil bulls?

On Friday, the Thomson Reuters/University of Michigan revised consumer sentiment index came in at 82.5 this month, beating expectations for a reading of 80.1. Additionally, the Chicago-area PMI rose to 64.3 in August from 52.6 in July, also beating expectations for an increase to 56.0.

Elsewhere, worries over escalating tensions in eastern Ukraine supported crude oil as well. The commodity gained for a second consecutive session on reports that Russian troops have entered Ukraine to assist pro-Moscow separatists, which sparked concerns that fresh sanctions could be slapped on Russia's energy sector.

In this environment, the price of light crude climbed to an intraday high of $96 per barrel. Will we see further improvement? Let’s check the technical picture of the commodity (charts courtesy of http://stockcharts.com).

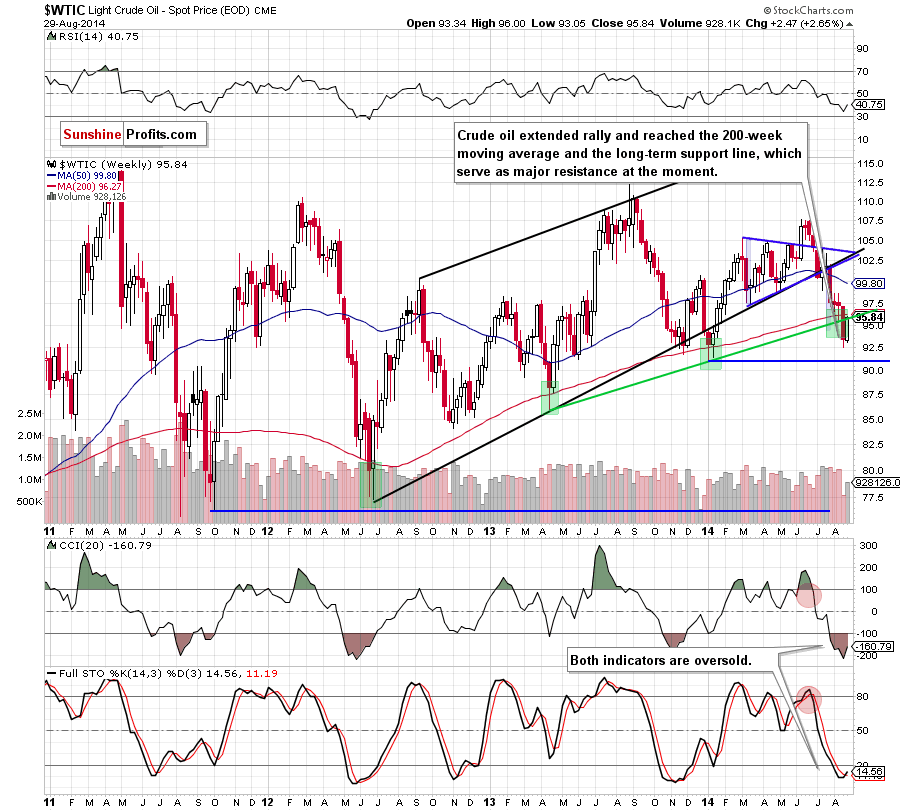

The situation in the medium term has improved slightly as crude oil extended gains and reached the previously-broken 200-week moving average and the rising, long-term support line, which together serve as the nearest resistance zone (around $95.70-$96.26). Consequently, we think that as long as there is no invalidation of the breakdown below these levels, the medium-term outlook remains bearish. Nevertheless, we keep in mind that the current position of the indicators suggests that a trend reversal is just around the corner (especially when we factor in the fact that the Stochastic Oscillator generated a buy signal).

Having say that, let’s take a closer look at the very short-term changes.

Quoting our last Oil Trading Alert:

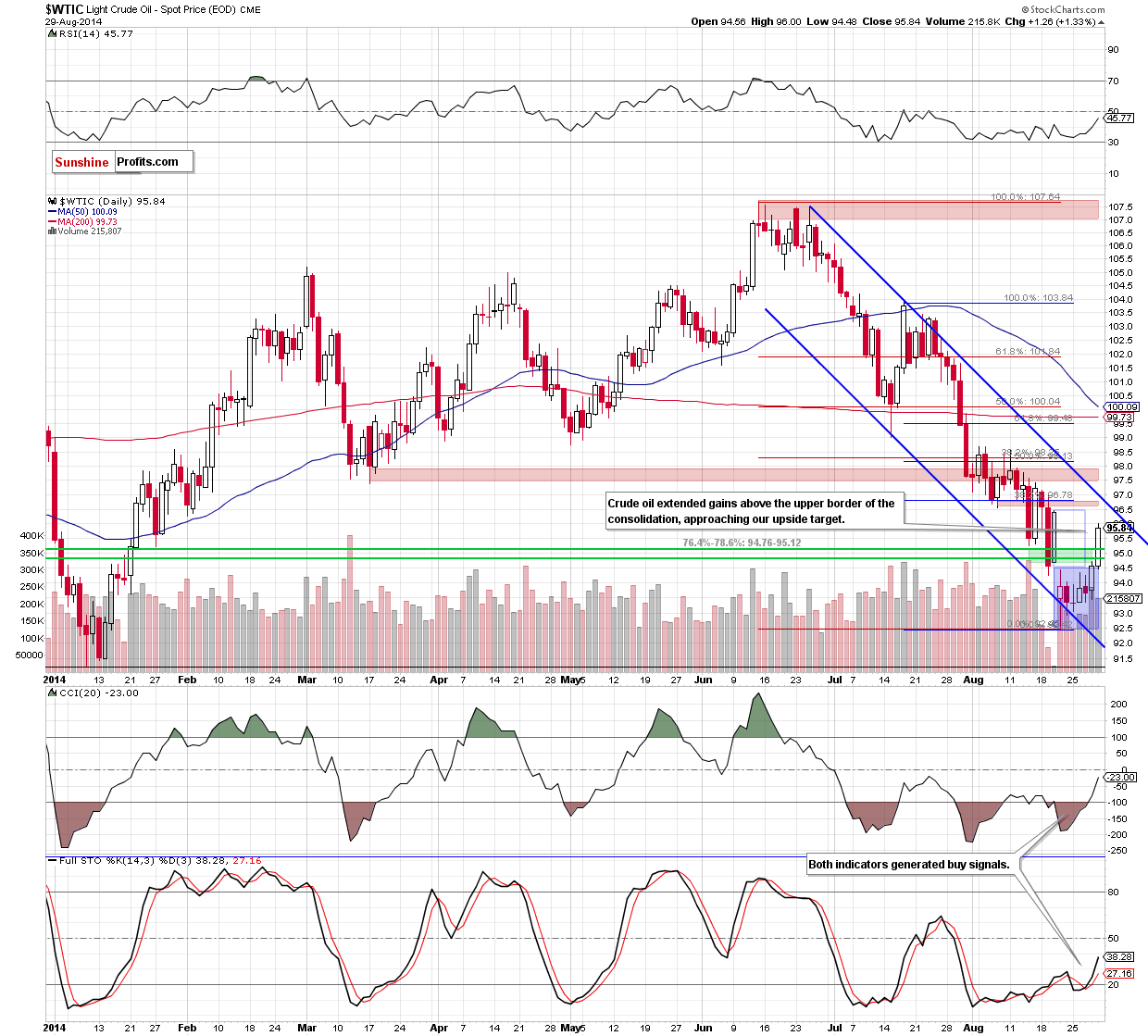

(…) if oil bulls manage to push the price above the upper line of the formation, we’ll see an attempt to invalidate the breakdown below the green area. If they succeed, the initial upside target will be around $96.50, where the size of the upswing will correspond to the height of the consolidation (it’s worth noting that slightly above this level is the 38.2% Fibonacci retracement based on the Jul-Aug decline, which may pause further improvement).

Looking at the above chart, we see that crude oil extended gains above the upper line of the consolidation and climbed to an intraday high of $96. Taking into account buy signals generated by the CCI and Stochastic Oscillator, oil bulls will likely try to reach the above-mentioned upside target. Please keep in mind that this area is reinforced by the upper line of the declining trend channel (marked with blue), which may trigger a pullback in the nearest future.

Summing up, crude oil extended gains and reached the previously-broken 200-week moving average and the rising, long-term support line. Although the very short-term picture suggests further improvement as light crude remains above the upper line of the consolidation and buy signals are still in play, it seems to us that this medium-term resistance zone could trigger a pullback in the coming day (or days). If this is the case, we may see a comeback to the upper border of the formation. Therefore, we think that it’s worth to stay on the sidelines waiting for a confirmation/ invalidation of the above.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts