Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Wednesday, crude oil moved higher after the market’s open, supported by the bullish EIA weekly report. However, news that Libya agreed to open two of its ports for oil exports pushed the commodity to the lowest level since mid-June. In this way, light crude reached an important medium-term support line. Will it trigger a corrective upswing?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories declined by 3.2 million barrels in the week ended June 27, beating expectations for a decline of 2.3 million barrels. The report also showed that gasoline inventories decreased by 1.2 million barrels, compared to forecasts for a gain of 0.4 million barrels, while distillate stockpiles rose by 1.0 million barrels, above expectations for an increase of 0.8 million barrels.

Despite these bullish numbers, the commodity reversed as news that Libyan rebels who have seized eastern oil ports have agreed to reopen terminals in Es Sider and Ras Lanuf. The prospect of resumed Libyan oil exports, which should add 500,000 barrels per day of crude back into the global energy market, pushed the price below $105 per barrel. Will we see further deterioration? Let’s check (charts courtesy of http://stockcharts.com).

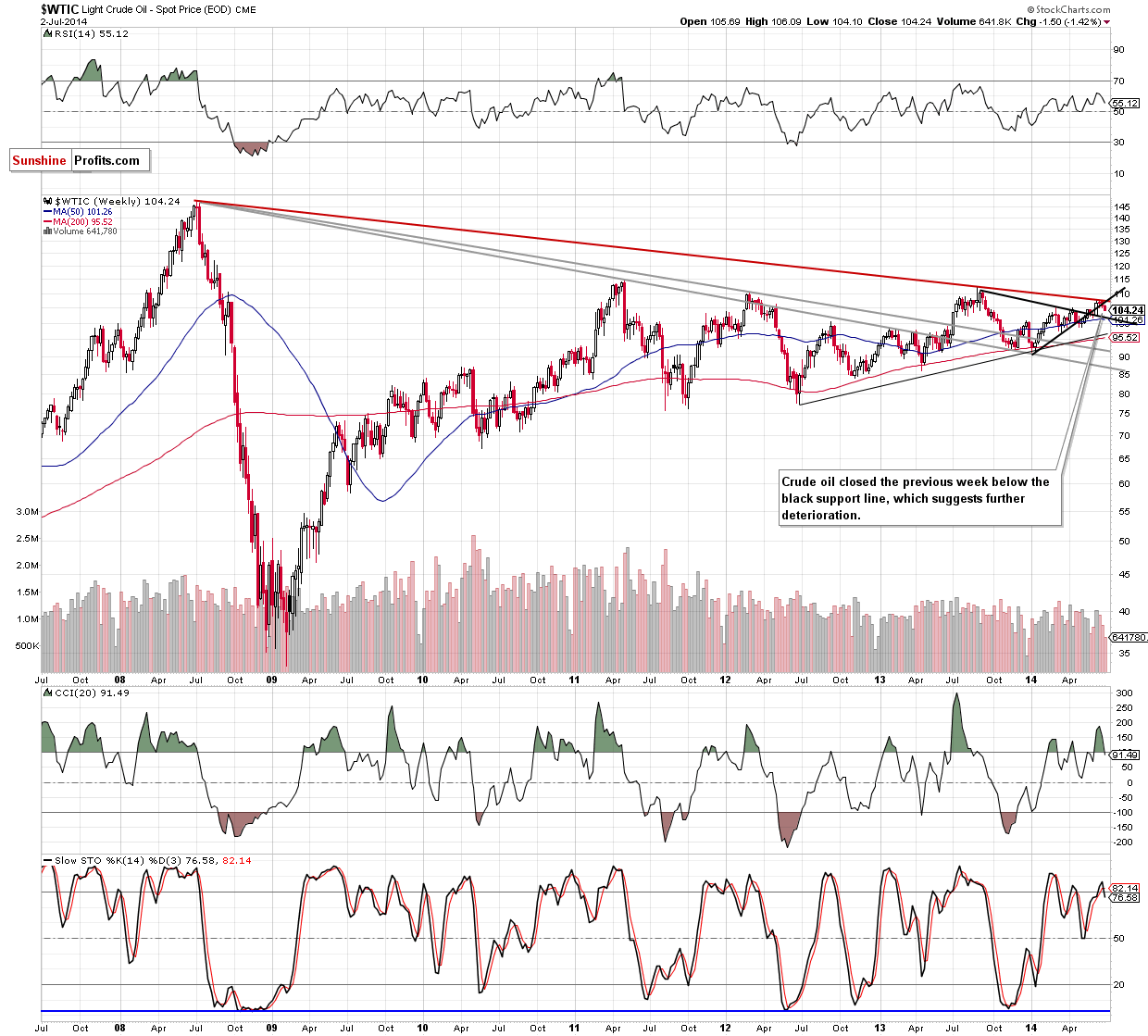

From this perspective, we see that crude oil extended declines below the previously-broken medium-term black rising line, which suggests further deterioration. Therefore, what we wrote in our last Oil Trading Alert is up-to-date:

(…) If (…) oil bulls do not invalidate the breakdown, we’ll see a downward move to around $102, where the declining black medium-term support line and the 50-week moving average are.

Once we know the medium-term picture, let’s take a closer look at the daily chart.

Quoting our last Oil Trading Alert:

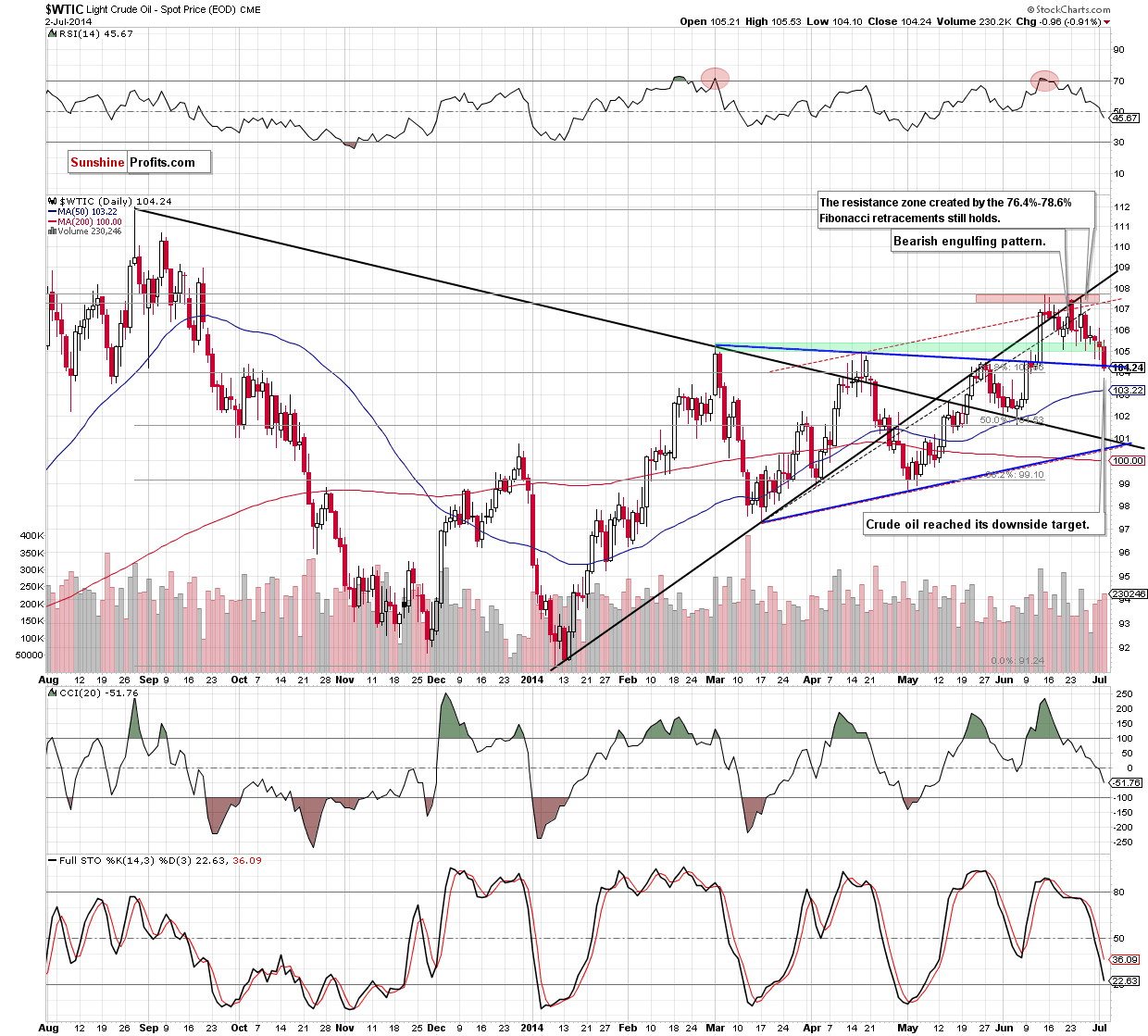

(…) If this support zone holds, we’ll see another corrective upswing to around $107.30-$107.68, where the resistance zone is. On the other hand, if oil bears do not give up and show their claws one again, we will see a breakdown in the nearest future and a correction to at least the previously-broken blue support line (currently around $104.40). Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish scenario.

Looking at the daily chart, we see that oil bears realized the above-mentioned scenario as crude oil reached its downside target yesterday. With this downswing, the commodity broke below the blue support line and closed the day slightly below it. If this strong bearish signal trigger further deterioration, we will likely see a drop to around $103.22, where the 50-day moving average is. Please note that this scenario is currently reinforced by sell signals generated by the indicators.

Summing up, crude oil moved lower and reached its downside target, closing the day slightly below the medium-term support line, which is a strong negative signal. Taking this fact into account and combining it with the current position of the indicators, we remain bearish and think that further correction and lower values of crude oil are still ahead us. Therefore, short-term positions (which are already profitable) are justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts