Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open supported by news from Iraq, the commodity reversed and erased most of gains after a bearish the EIA weekly report. In this way, light crude came back below the lower border of the trend channel and approached the key support line. What’s next?

Yesterday, after the market’s open crude oil increased on news of violence in Iraq. According to Iraqi state television, a suicide attacker detonated a car bomb in front of a government building in Erbil, which killed at least four and injured 29 people. As a reminder, Erbil is the capital of oil-producing region of Kurdistan. Therefore, such circumstances fueled worries over crude oil's export disruption from this area and pushed the price higher.

Despite this improvement, the commodity reversed after the U.S. Energy Information Administration reported that U.S. crude oil inventories rose by 2.6 million barrels in the week ending Nov. 14, missing expectations for a decline of 0.8 million barrels. Additionally, gasoline inventories increased by 1.0 million barrels, more than forecasts for a gain of 0.6 million barrels, which pushed crude oil below $75 once again. Are there any technical signals that we could see higher crude oil’s price in the near future? (charts courtesy of http://stockcharts.com).

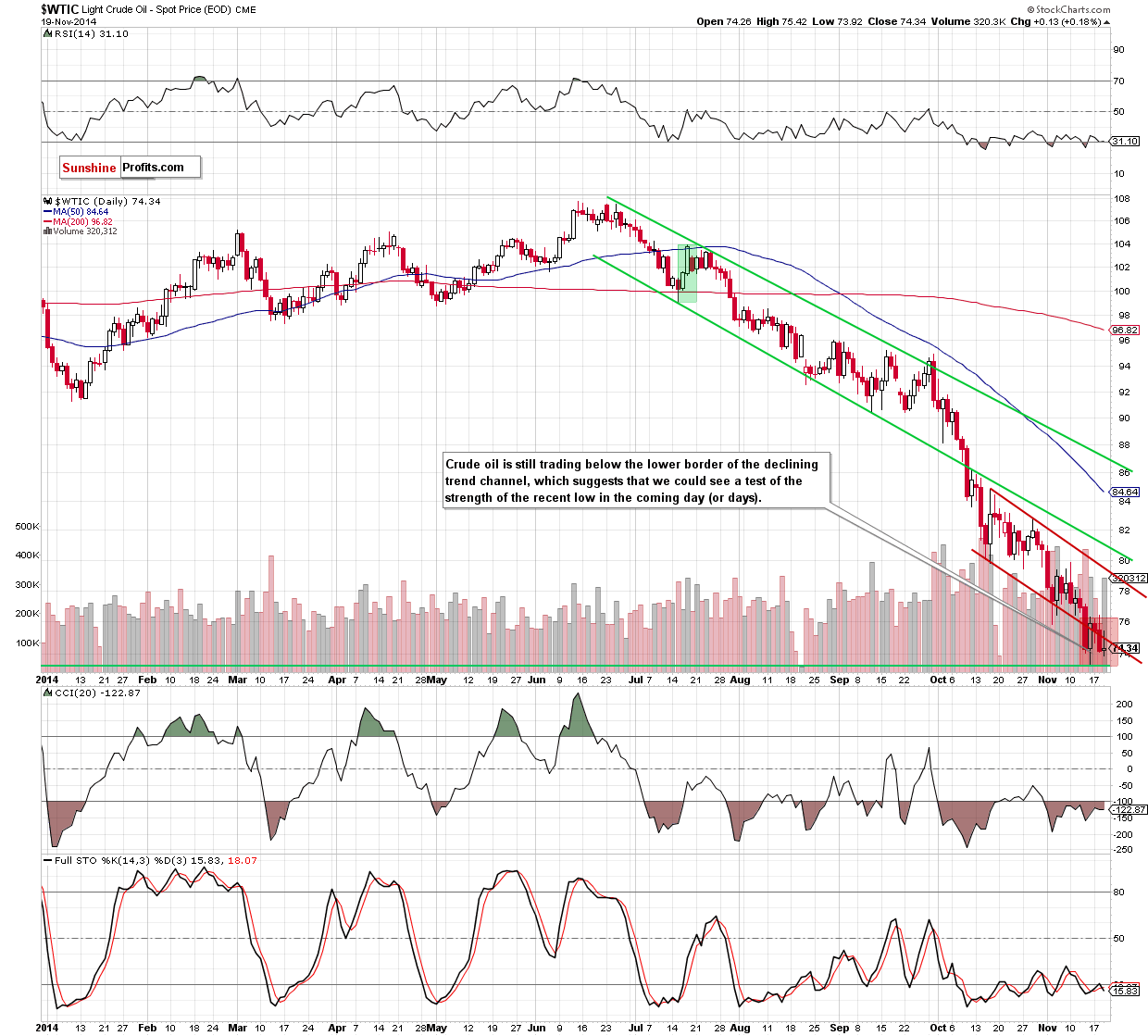

From the very short-term perspective, we see that although crude oil rebounded and came back above the previously-broken lower border of the declining trend channel, this improvement was only temporary. As you see, the commodity dropped and closed the day below this support/resistance line, which is a bearish signal that suggests further declines- especially when we consider this upswing as a verification of the breakdown. Nevertheless, despite this deterioration, we should keep in mind that even if the commodity tests the strength of the recent low in the coming day, the space for further declines seems limited as the 50% Fibonacci retracement still holds. If the proximity to this key support encourage oil investors to push the buy button, we could see a corrective upswing and the initial upside target would be the barrier of $80 and the previous lows.

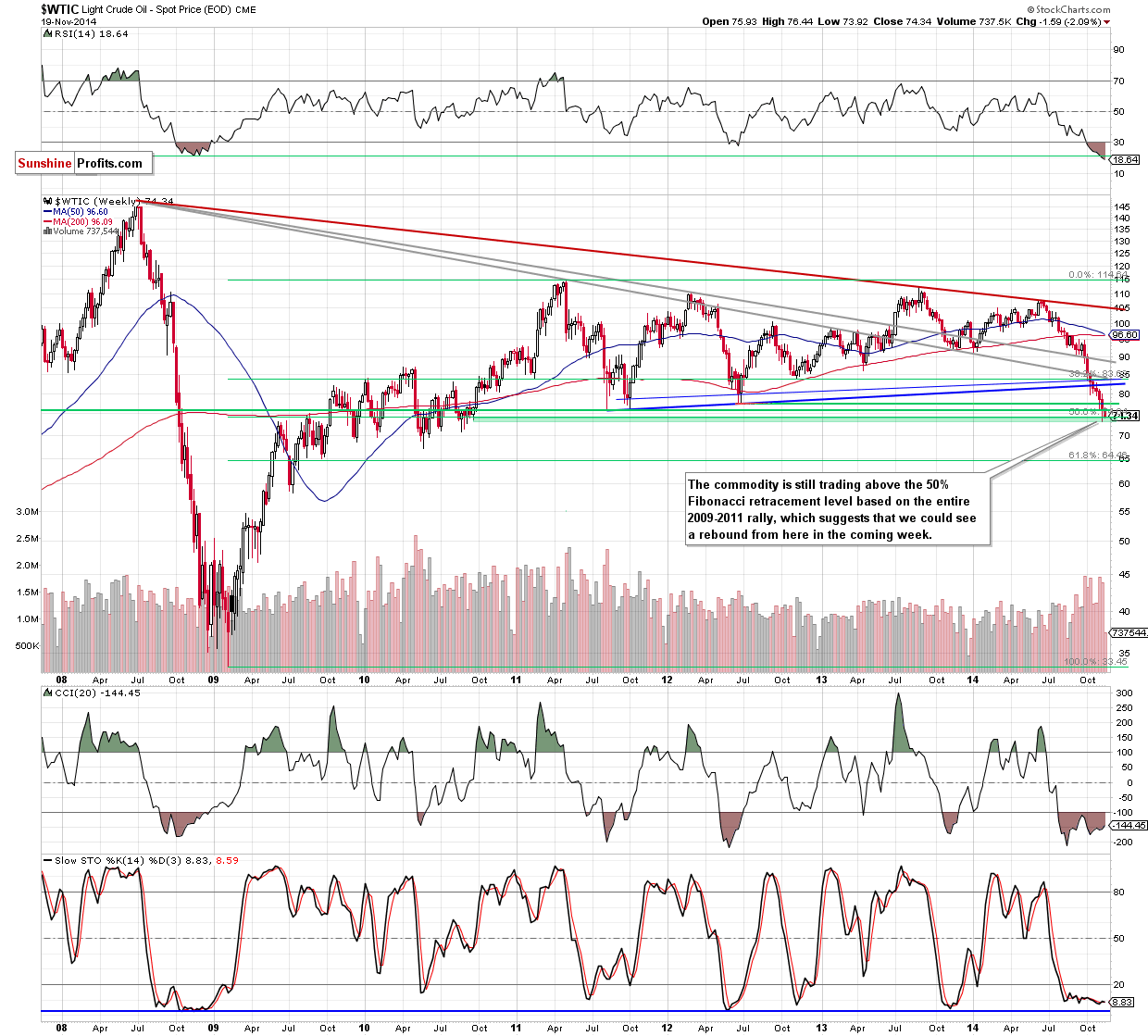

Summing up, although oil bulls didn’t manage to invalidate the breakdown below the lower border of the declining trend channel, crude oil is still trading above the 50% Fibonacci retracement. In our opinion, as long as this key support is in play, we are likely to see a rebound from here in the coming week (even if crude oil re-tests it’s strength).

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts