Trading position (short-term; our opinion): No positions.

Although crude oil bounced off a two-year low on Friday, gaining 1.40%, ongoing concerns over signs of an abundance of light crude in combination with slumping demand outside of the U.S. continued to weight on the commodity. Will Friday’s upswing trigger a trend reversal?

Taking into account the recent price change, which was so significant, we decided to focus only on the long-term charts as it seems that only these charts have meaningful implications (charts courtesy of http://stockcharts.com).

Quoting our last commentary:

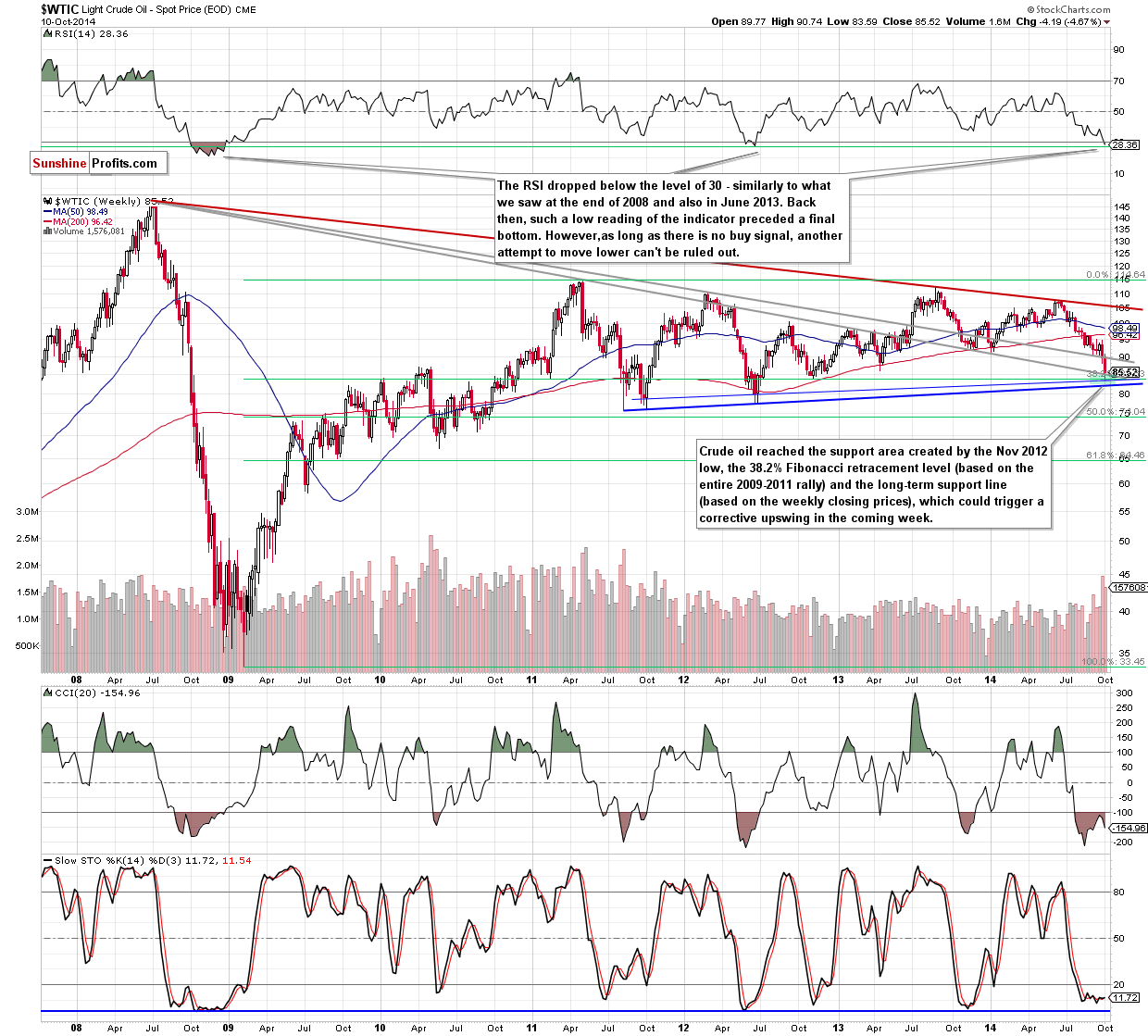

(...) we would like to draw your attention to the fact that crude oil reached the support area created by the combination of the Nov 2012 low, the 38.2% Fibonacci retracement level (based on the entire 2009-2011 rally) and the long-term blue support line (based on the weekly closing prices). Consequently, we could see a rebound from here in the coming week.

What’s interesting, at the same time, the RSI dropped below the level of 30. We saw similar readings of the indicators at the end of 2008 and also in June 2013. Back then such low readings of the indicator preceded a final bottom.

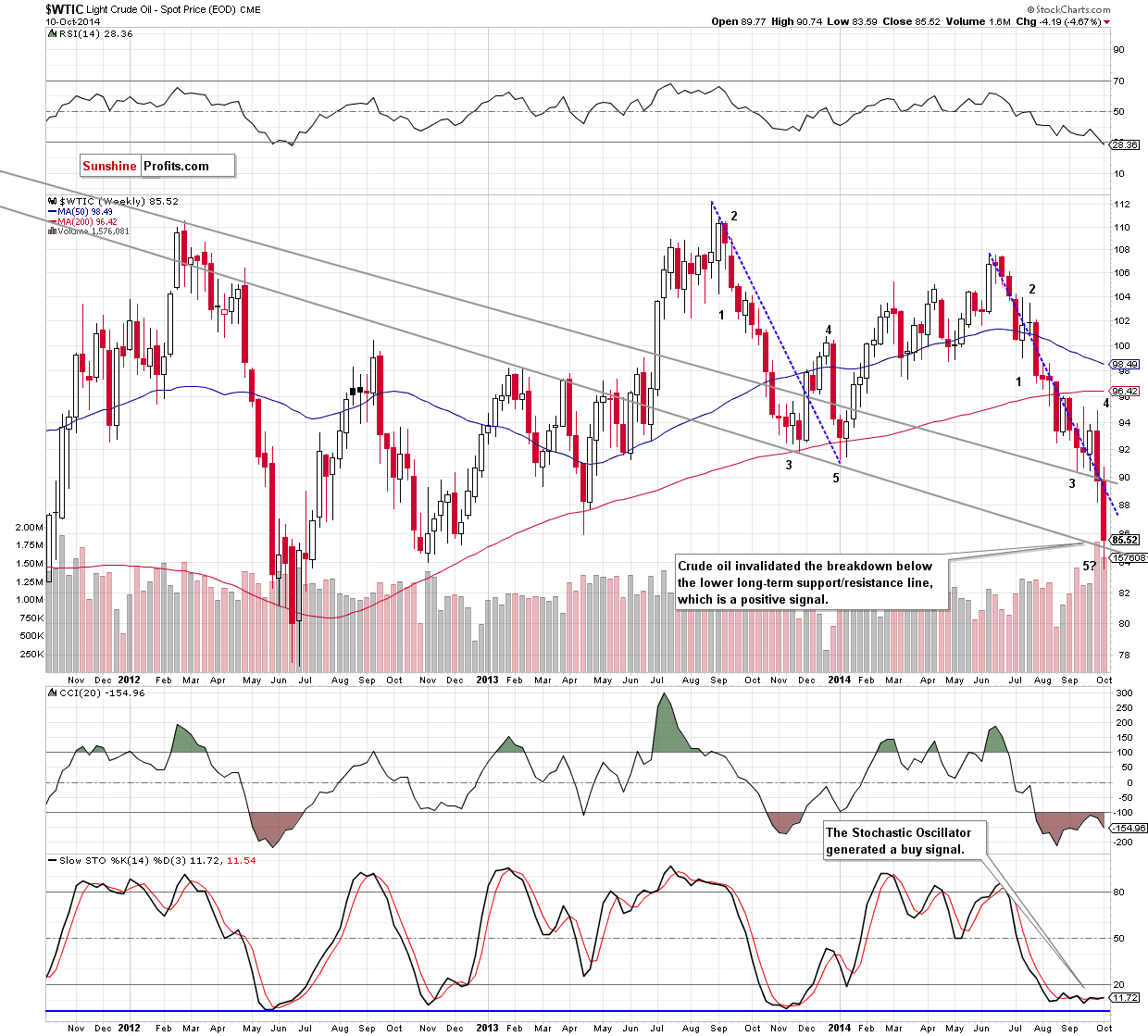

Looking at the weekly charts, we see that the above-mentioned support area encouraged oil bulls to act as we expected. As a result, crude oil bouced off the two year low and cllimbed above the lower grey support/resistance line. An invalidation of the breakdown is a strong bullish signal that suggests further improvement. Nevertheless, we should keep in mind that the commodity still remains under the solid resistance zone created by the upper long-term grey line, the previously-broken 61.8% Fibonacci retracement and the recent lows. Therefore, in our opinion, as long as this resistance is in play (and there are no buy signals, which could support the bullish case), the space for further growth is limited.

On the other hand, we should also keep in mind that even if light crude moves little lower, the space for furthers declines would be limited by the long-term blue support line based on the Aug 2011, Oct 2011 and Jun 2012 lows (currently around $82.42).

Before we summarize today’s Oil Trading Alert, we want you to keep in mind what we wrote on Friday about the link between the general stock market and crude oil:

(...) The general stock market declined recently and due to multiple industrial uses, crude oil quite often moves in tune with stocks. Since the general stock market has been declining and it seems quite close to reaching its bottom, we could expect the negative impact on crude oil to become a positive one.

Summing up, it seems that crude oil will move higher rather sooner than later and that the coming move will be rather significant (tradable). Taking into account the link between the general stock market and crude oil, we need to see some indication that markets have stabilized before getting more optimistic. Nevertheless, we are planning to re-enter the long position at lower prices or after seeing a confirmation that the final bottom is indeed in.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts