Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Friday, crude oil lost 0.54% as worries over a supply glut weighed on investors’ sentiment. As a result, the commodity reversed and approached the recent low. Will we see further deterioration in the coming days?

On Friday, there were no disturbing news or fundamental developments that could drive the price of crude oil higher or lower. Therefore, ongoing concerns over signs of an abundance of light crude weighed on the price of the commodity and pushed it below $93 once again. Will we see lower values of crude oil in the nearest future? Let’s check the technical picture of light crude and find out (charts courtesy of http://stockcharts.com).

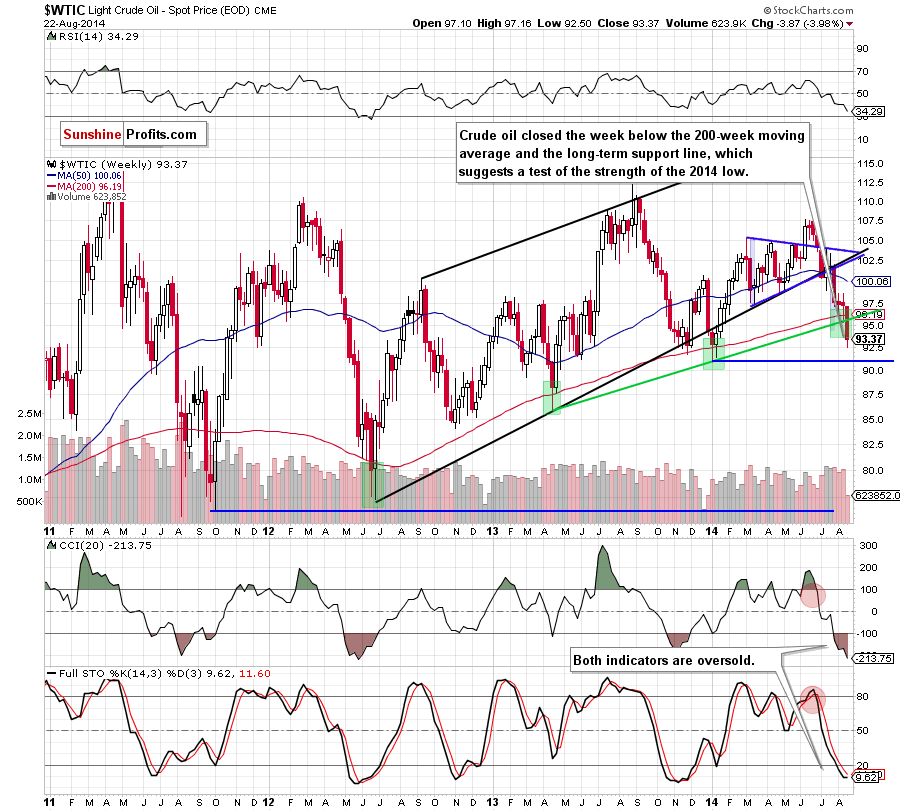

The situation in the medium term has deteriorated as crude oil closed the previous week below the 200-week moving average and the rising, long-term support line. Taking this strong bearish signal into account, we think that what we wrote on Friday is still valid:

(…) if the commodity closes this week under these two important support levels, we’ll see further deterioration and a test of the strength of the January low of $91.24. Please note that although the current position of the indicators suggests that a pause or a trend reversal is just around the corner, we think that as long as there are no buy signals, another attempt to move lower is more likely than not.

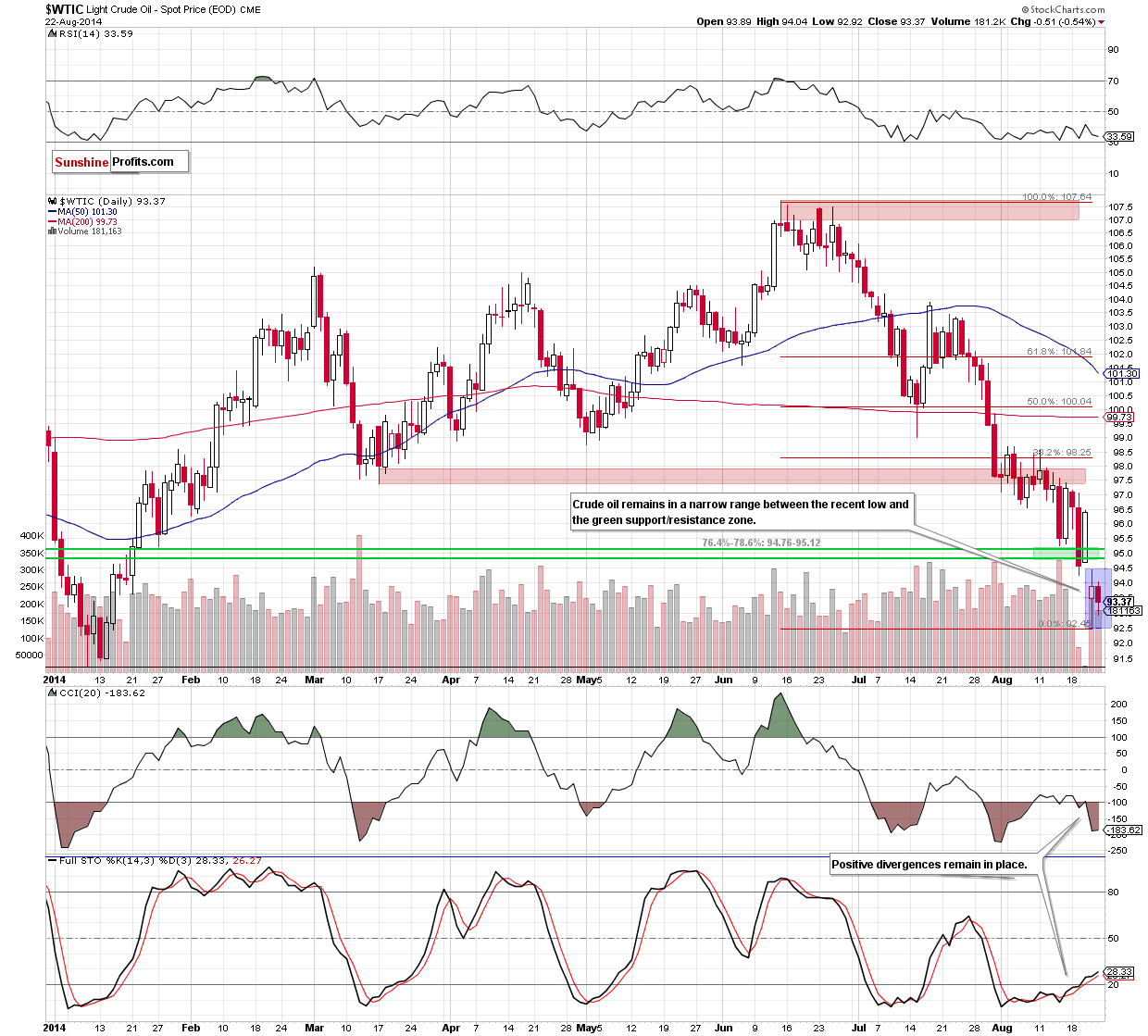

What can we infer from the daily chart? Let’s check.

From this perspective, we see that crude oil reversed once again and erased over 50% of Thursday’s upswing. On the above chart, we also see that the commodity is still trading between the recent low and the green support/resistance zone. Therefore, what we wrote in our previous Oil Trading Alert is up-to-date:

(…) taking into account the fact that yesterday’s upswing didn’t even push light crude above the previous lows, it seems to us that as long as there is no invalidation of the breakdown below the green (…) zone (which serves as the nearest resistance at the moment), another attempt to test the strength of the 2014 low can’t be ruled out.

Summing up, crude oil closed the previous week below two important medium-term support levels and the short-term support zone, which is a strong bearish signal that suggests a test of the strength of the January low of $91.24. Taking all the above into account, we still think that staying on the sidelines waiting for another profitable opportunity is the best choice at the moment.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts