Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil lost 0.35% as a stronger U.S. dollar and bigger-than-expected increase in gasoline and distillate stockpiles weighed on the price. As a result, light crude pulled back once, but did this move change anything?

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories declined by 3.7 million barrels in the week ended November 28, beating expectations for an increase of 1.3 million barrels. Despite this bullish numbers, the report also showed that gasoline inventories increased by 2.1 million barrels, missing expectations for a gain of 1.1 million, while distillate stockpiles rose by 3.0 million barrels. As a result, light crude moved lower and approached Tuesday’s low.

Additionally, the Institute of Supply Management showed that its non-manufacturing PMI increased to 59.3 in November, beating analysts’ expectations for a rise to 57.5, which fueled expectations that the Federal Reserve will hike interest rates in 2015. In response to this data, the U.S. dollar moved higher, making crude oil more expensive for buyers in other currencies. How did these fundamental factors affect the technical picture of the commodity? (charts courtesy of http://stockcharts.com).

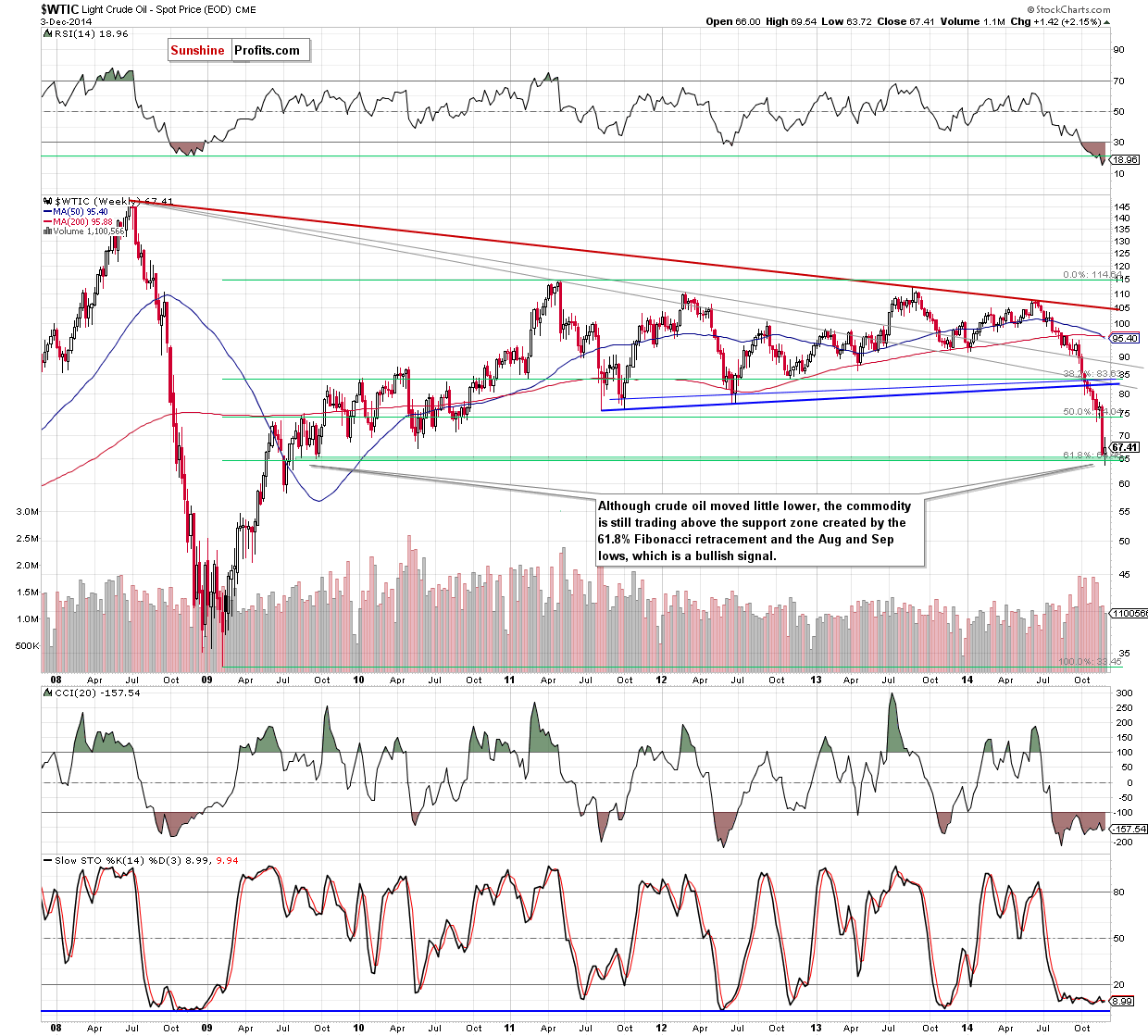

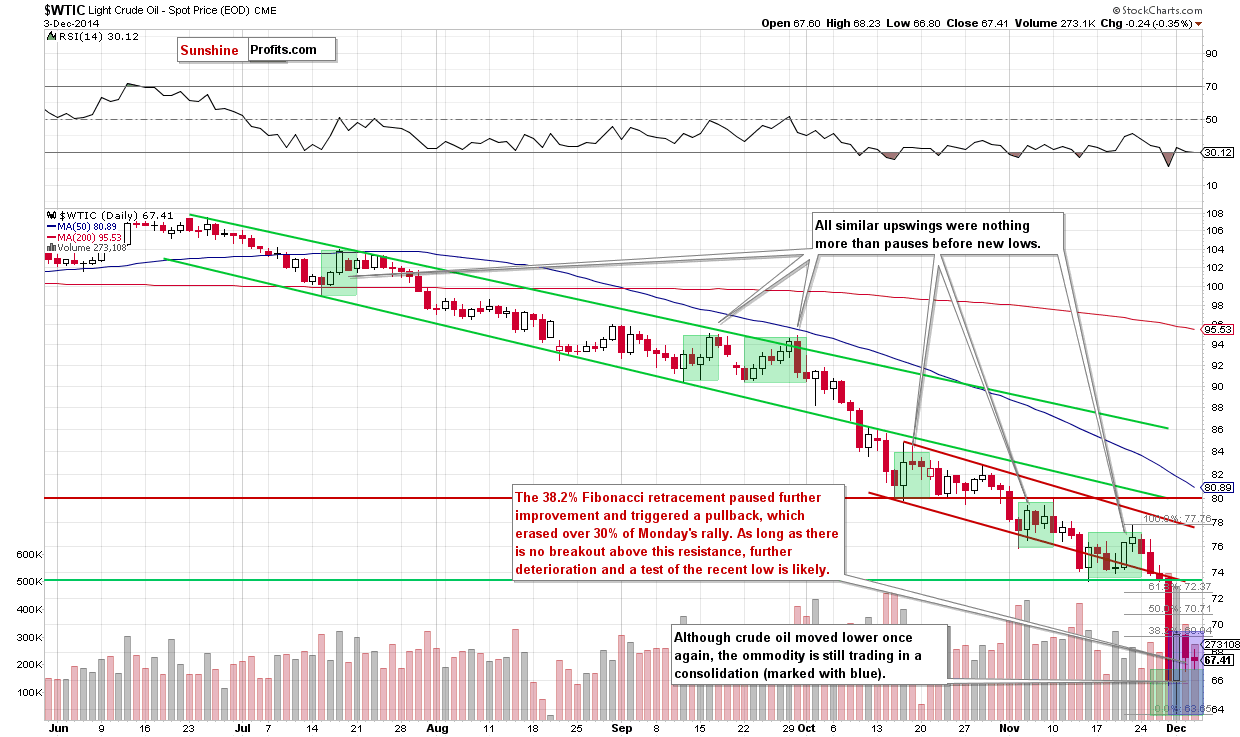

Looking at the above charts, we clearly see that although crude oil pulled back once again, yesterday’s move didn’t change the overall picture of the commodity. The reason? As you see on the daily chart, light crude is still trading in a consolidation (marked with blue) above the solid support zone created by the 61.8% Fibonacci retracement and the Aug and Sep 2009 lows. Taking these facts into account, we believe that our last commentary is up-to-date:

(…) Did this move change anything? Not really, because as long as the commodity is trading in a narrow range between the solid support zone (created by the 61.8% Fibonacci retracement and the Aug and Sep 2009 lows) and the 38.2% Fibonacci retracement, bigger upswing or downswing is not likely to be seen.

(…) please keep in mind that Monday’s upswing was much bigger ($5.82) than the previous ones and materialized on huge volume, which is a positive step toward the trend reversal. Nevertheless, as long as the key resistance is in play, another pullback and a test of the strength of the recent low is likely.

Summing up, although crude oil moved lower once again, the overall situation is still unclear to open any positions. Additionally, as we have pointed out before, as long as the commodity is trading in a narrow range between the support and resistance lines, bigger upswing or downswing is not likely to be seen. Therefore, waiting on the sidelines waiting for the confirmation that the final bottom is in is the best choice at the moment.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts