Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 1.65% as the combination of bearish comments from Russia and OPEC leaders, a progress in resolving a strike in Nigerian port and a stronger greenback pushed the commodity lower. In these circumstances, light crude declined sharply and approached the recent low. Time for a double bottom?

Yesterday, Saudi Arabia's oil minister said that the OPEC would maintain output levels in a bid to retain its market share, which had a negative impact on the commodity. Additionally, Russian President Vladimir Putin said that the country's economy will restructure itself to handle low oil prices that could last as long as two years in a worst-case scenario, even if prices fell as low as $40 a barrel. On top of that, dockworkers in Nigeria suspended a strike and allowed port activities to resume, raising the possibility of renewed oil exports there (as a reminder, Nigeria is the largest oil producer in Africa).

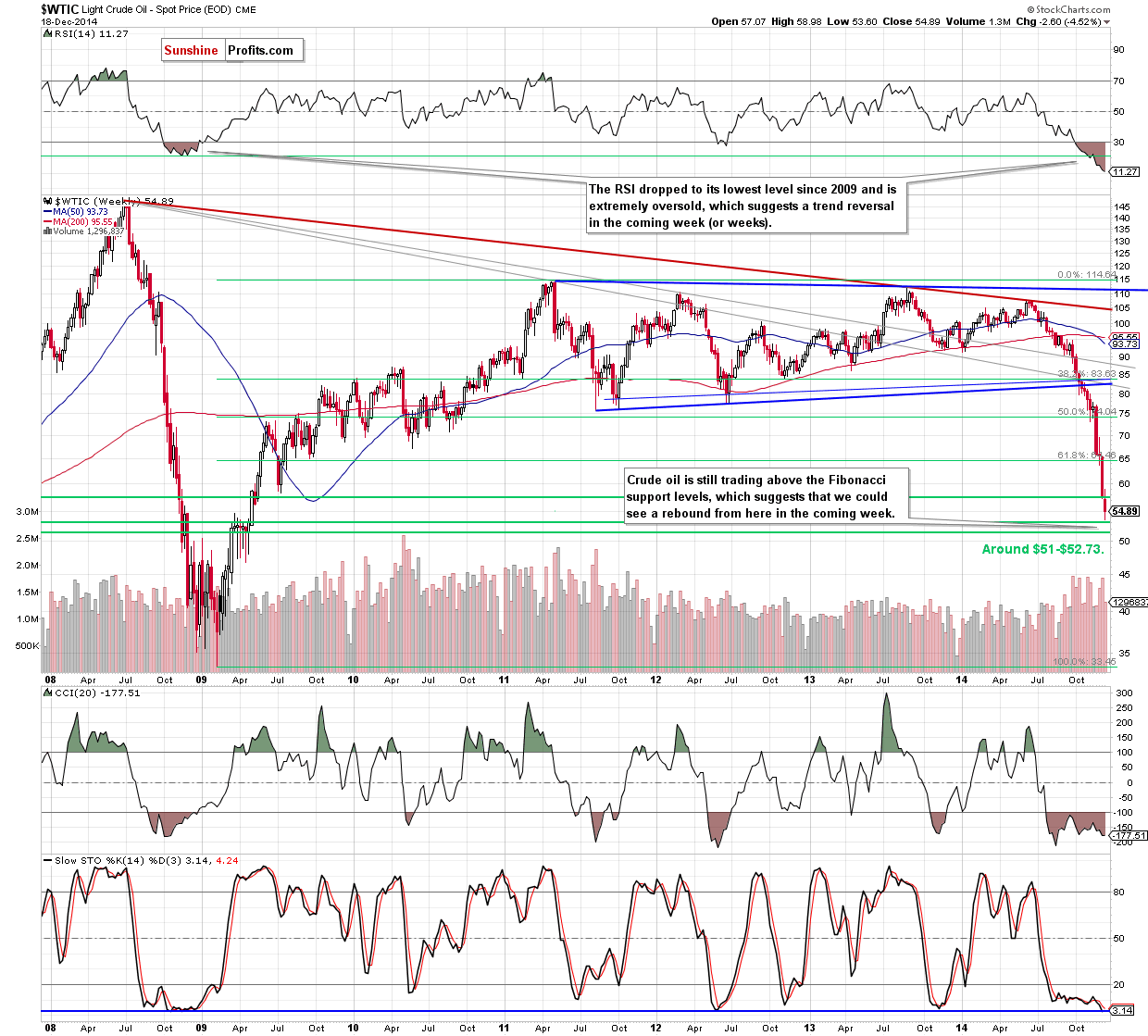

These news in combination with a stronger U.S. currency (which increased after the U.S. Department of Labor showed that the initial jobless claims in the week ending December 12 fell by 6,000 to 289,000 beating analysts’ expectations for an increase of 1,000) triggered a sharp decline in crude oil, which approached the commodity to the recent low. Will we see a rebound from here and a post double-bottom rally? (charts courtesy of http://stockcharts.com).

In our previous Oil Trading Alert, we wrote the following:

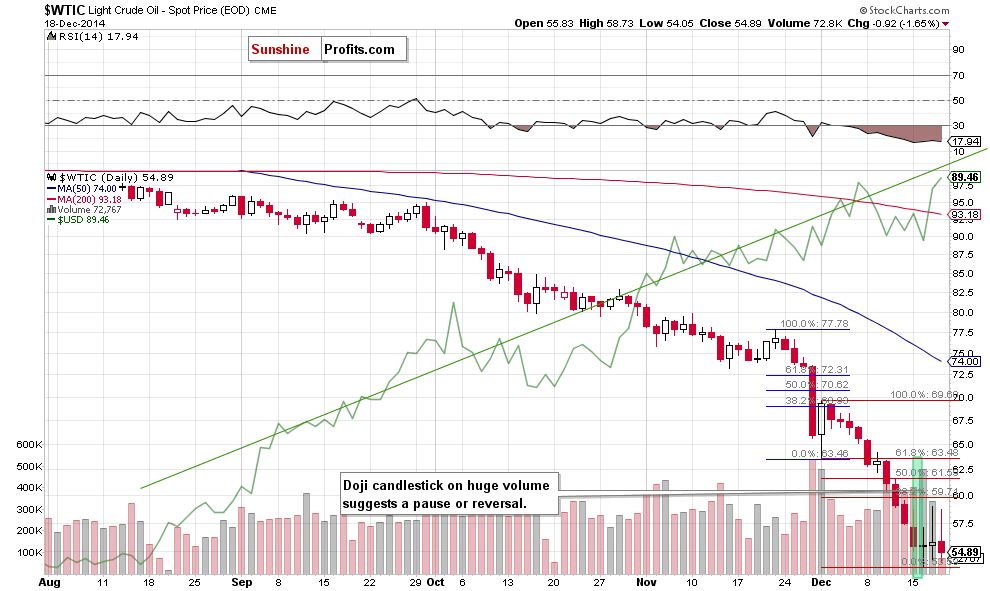

(…) the commodity bounced off the recent multi-year low and approached the 38.2% Fibonacci retracement (based on the entire Dec decline). What’s next? As you see on the daily chart, the proximity to the first Fibonacci resistance triggered a pullback yesterday, which suggests that as long as we do not see a successful breakout above this level, further improvement is questionable and a test of the recent lows should not surprise us.

Looking at the daily chart, we see that the situation developed in line with the above-mentioned scenario and crude oil declined sharply, approaching the recent low. Although this is a negative signal, we should keep in mind that yesterday’s downswing materialized on tiny volume (compared to the previous days), which suggests that oil bears were not as strong as it seemed on the first glance. Taking this fact into account and combining it with the proximity to the recent low and the support zone (created by the 76.4% and 78.6% Fibonacci retracement levels and reinforced by the doji candlestick), it seems to us that we could see a rebound from here in the coming days. If this is the case, the initial upside target for oil bulls would be Wednesday’s high and the 38.2% Fibonacci retracement (based on the entire Dec decline).

Before we summarize today’s alert, we would like to add one more quote from yesterday:

(…) at the beginning of the month (…) although crude oil corrected over 38.2% of earlier downward move, oil bulls didn’t manage to push the commodity higher, which translated to a fresh 2014 low. Therefore, we think that a trend reversal (and an upward move to the initial upside target around $70) will be likely only if we see an upswing above $59.50, which won’t be followed by a fresh low.

Summing up, although crude oil moved lower, we think that the proximity to the recent low and the support zone (marked on the weekly chart) will trigger another upswing in the coming days (especially when we factor in the fact that yesterday’s downswing materialized on tiny volume). If this is the case, we could see another attempt to break above the 38.2% Fibonacci retracement (based on the entire Dec decline). If oil bulls manage to push the commodity above this resistance, we’ll consider opening long positions. Until this time, no positions are justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts