Trading position (short-term; our opinion): No positions.

On Monday, crude oil lost 0.77% after Goldman Sachs cut its price forecasts for the first quarter of 2015. Additionally, bearish European data released earlier affected negatively the price of light crude. As a result, the commodity hit a fresh multi-month low and slipped below $80 for the second time this month. Will this psychologically important level withstand the selling pressure in the coming days?

Yeserday, German research institute Ifo showed that its index of business climate dropped to 103.2 in October from 104.7 in the previous month. This key indicator of economic health in Europe's largest economy dropped for the sixth straight time to the lowest level in two years, which renewed fears of a European recession.

Additionally, later in the day, Goldman Sachs cut its oil forecasts for the first quarter of 2015. The bank's Brent forecast is now $85 a barrel (down from $100 a barrel previously) and its first-quarter forecast for the U.S. benchmark is $75 a barrel (down from $90).

In this environment, the price of light crude declined to its lowest level since June 2012, breaking below $80 a barrel for the second time this month. Will this psychologically important level withstand the selling pressure in the coming days? (charts courtesy of http://stockcharts.com).

In our previous Oil Trading Alert, we wrote the following:

(…) Friday’s move took crude oil below the blue rising line once again. In this way, the commodity closed the week under this resistance, which suggests that we will see another test of the strength of the barrier of $80 in the coming week.

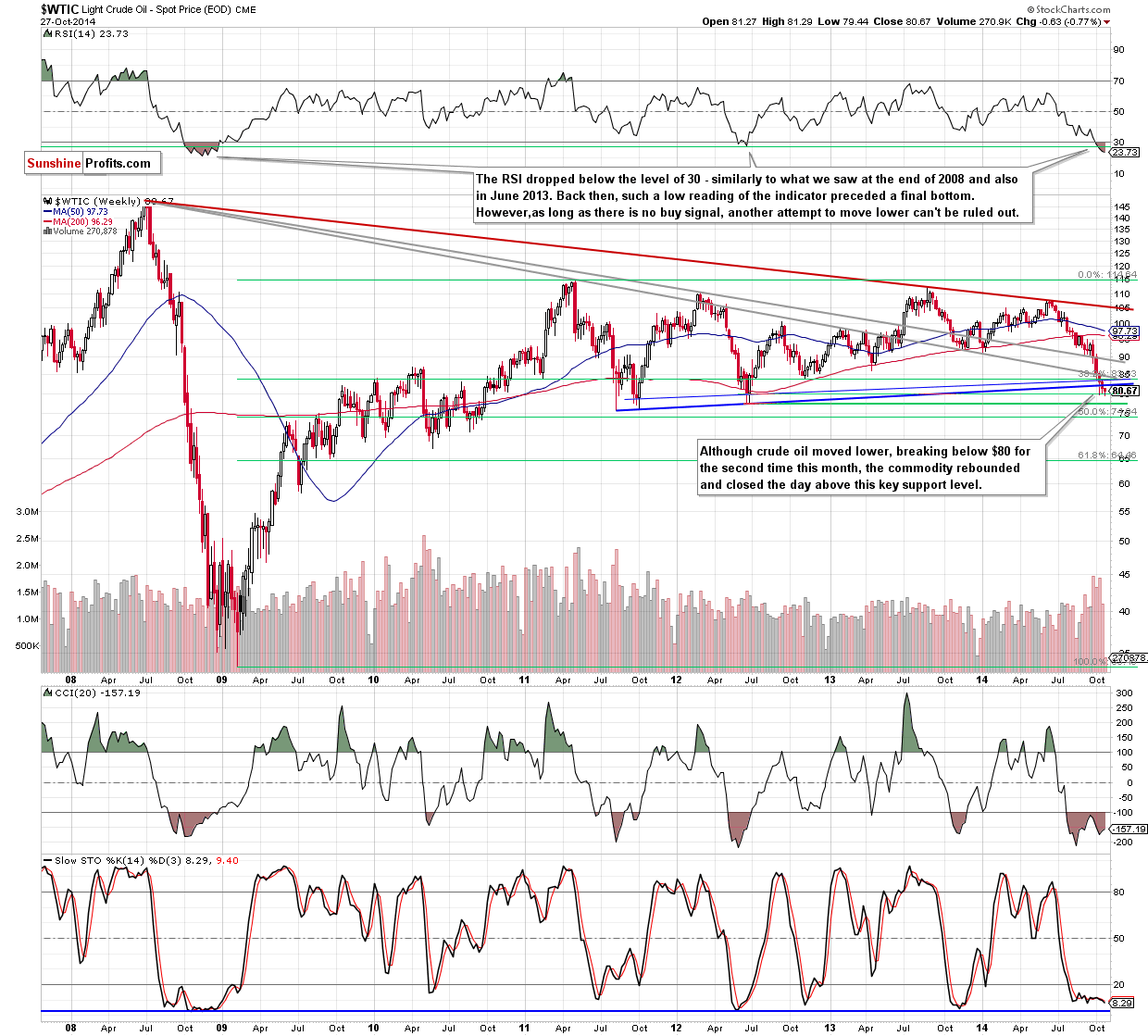

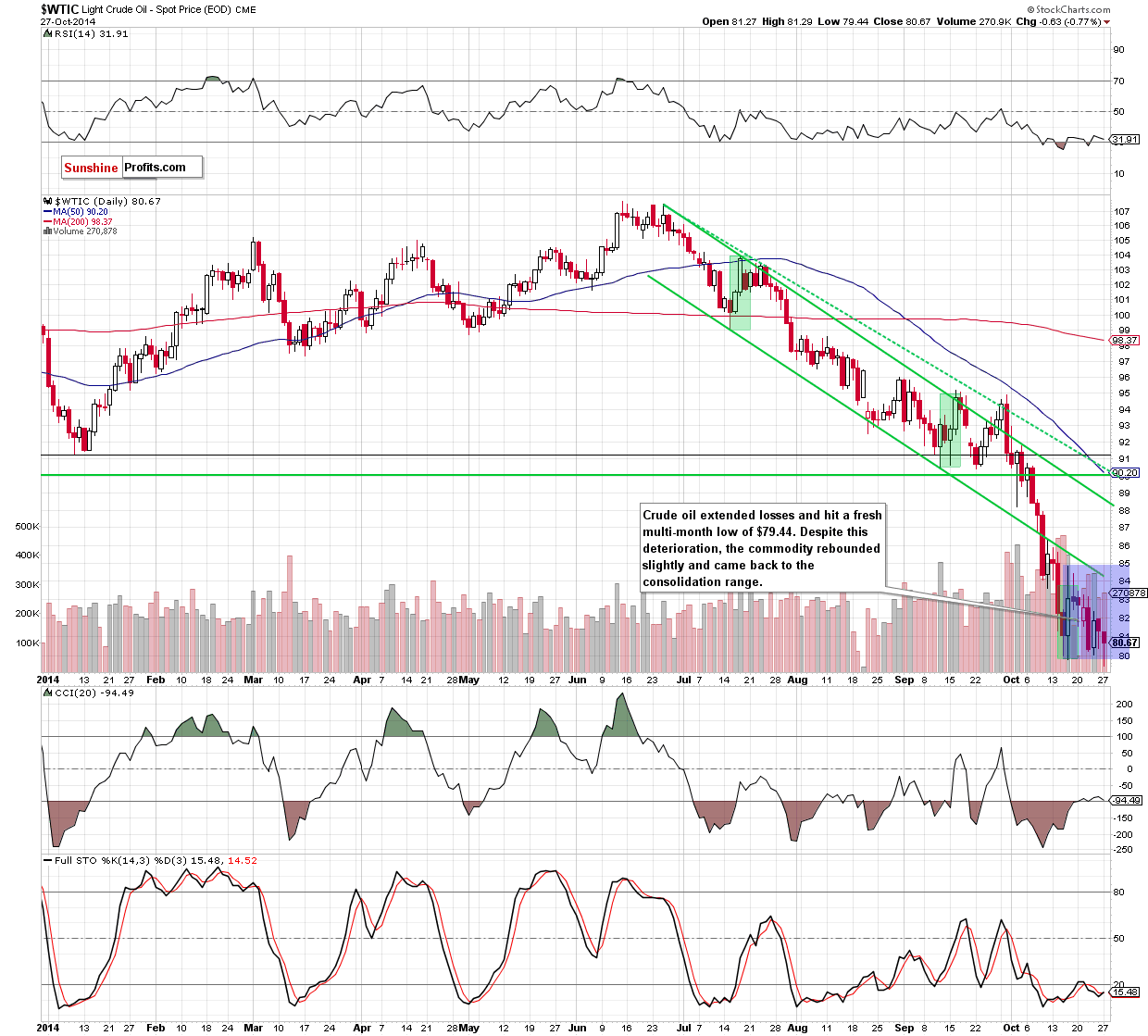

Looking at the above charts, we see that oil bears showed their claws once again and pushed crude oil lower as we expected. In this way, the commodity slipped not only below the key support level of $80, but also hit a fresh multi-month low of $79.44. Despite this drop, light crude rebounded and closed the day above this psychologically important level, invalidating earlier breakdown. Although this is a bullish signal, it seems to us that it’s too early to say with conviction that the final bottom is in. The reason? Earlier this month, we saw a similar invalidation (when crude oil dropped below $80 for the first time), but as it turned out later, it resulted only in an increase to the first solid resistance zone. Taking this fact into account, and combining it with the very short-term picture (crude oil is still trading in the consolidation range), we think that even if crude oil will rebound from here, the moment of truth for the commodity will come after an increase to around $84, where the lower border of the declining trend channel and the lower long-term grey resistance line are. If oil bulls manage to push light crude above it, a sizable (and profitable) upward move will be more likely. Until this time, another attempt to move lower can’t be ruled out (please keep in mind that the next downside target for oil bears would be around $77.28, where the Jun 2012 low is).

Summing up, although crude oil declined below $80 once again, the breakdown was invalidated very quickly, which suggests that the commodity could move higher – similarly to what we saw earlier this month. In our opinion, even if we see such price action, a sizable (and profitable) upward move will be more likely after a breakout above the resistance zone created by the lower border of the declining trend channel and the lower long-term grey resistance line. Until this time, another attempt to move lower can’t be ruled out. Therefore, staying on the sidelines and waiting for the confirmation that the declines are over is the best choice.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts