On Friday, crude oil continued its rally and rose to a fresh monthly high after the EIA data showed a larger-than-expected drawdown in crude oil inventories. Thanks to this, light crude broke above the psychologically important level of $100 per barrel for the first time since Oct. 22.

The U.S. Energy Information Administration reported on Friday in its weekly report that U.S. crude oil inventories fell by 4.73 million barrels in the week ended Dec. 20, far surpassing market expectations for a decline of 2.32 million barrels. The report also showed that total gasoline inventories fell by 616,000 barrels compared to expectations for a gain of 1.26 million barrels. These numbers were very bullish and clearly showed that a lot of the crude oil has been rapidly turned into product by U.S. refineries, which confirms that demand is on the rise.

Meanwhile, refining capacity utilization rose 1.2 points to 92.7% of capacity, while analysts expected the operating rate to stay unchanged in the week.

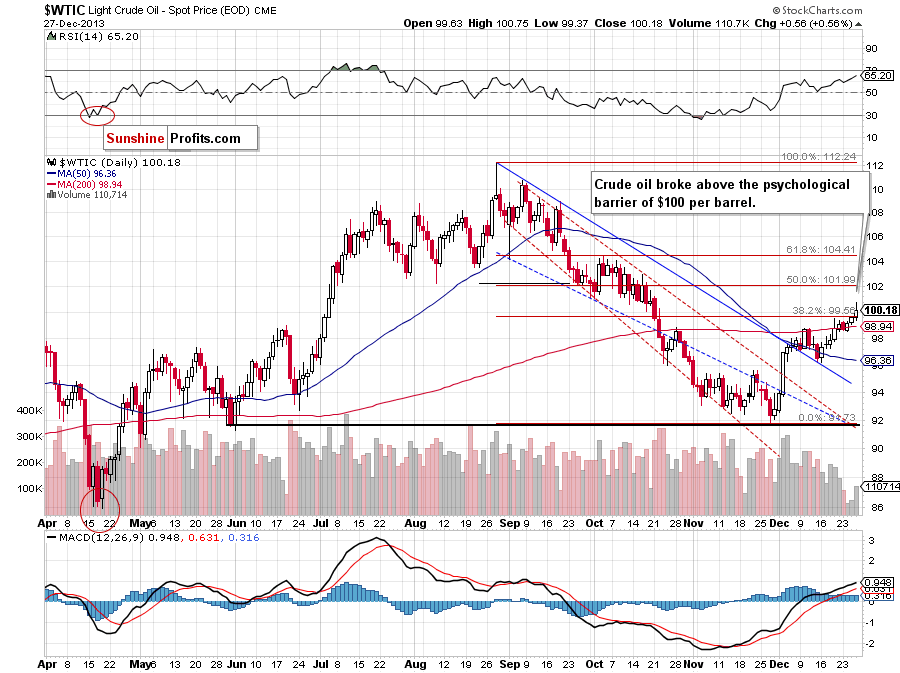

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

(…) the buyers managed to push the price higher, which resulted in an upward move above the 38.2% Fibonacci retracement level. Additionally, a bearish engulfing pattern was invalidated, which is another positive sign. Taking only these facts into account, another upswing is likely to be seen.

Looking at the above chart, we see that the situation has improved significantly. Crude oil continued its rally and broke above the psychological barrier of $100. Additionally, the breakout materialized on relatively high volume, which confirms the strength of the buyers. Light crude closed the day above this psychologically important level and it seems that we may see further improvement. In this case, if oil bulls push the price higher the first upside target will be around $102, where the 50% Fibonacci retracement level is.

Please note that the nearest support is the Dec. 19 high (at $99.49.). The next is the 200-day moving average (currently at $98.94), slightly above the Dec. 24 low.

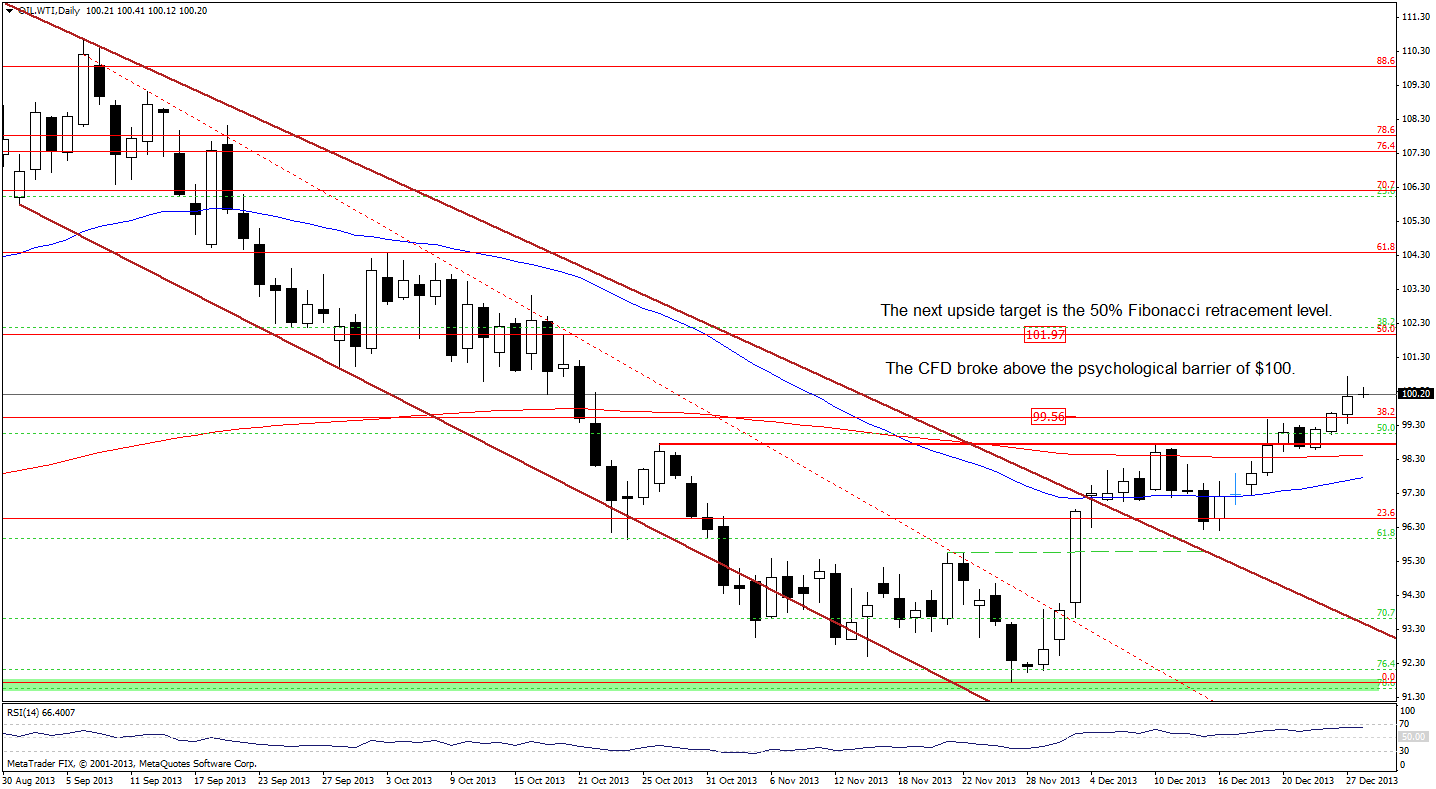

Having discussed the current situation in crude oil, let’s take a look at WTI Crude Oil (the CFD).

On the above chart, we see that Friday’s increase took WTI Crude Oil above the psychological barrier of $100, which is a bullish signal. If this positive event encourages buyers to act and they push the price higher, we may see further improvement and the next upside target will be the 50% retracement around $102 per barrel. On the other hand, if the buyers fail, the nearest support will be the previously-broken 38.2% Fibonacci retracement level.

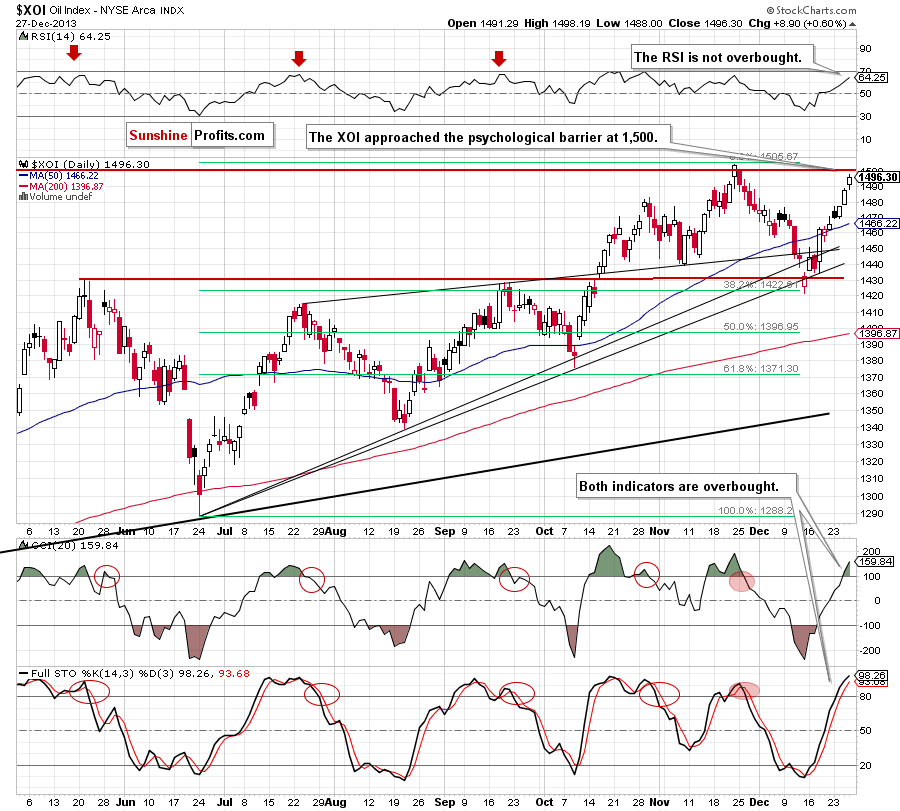

Once we know the above, let’s take a look at the NYSE Arca Oil Index (XOI) chart.

Quoting our previous Oil Trading Alert:

(…) after a breakout above the neck line of the head and shoulders formation and the upper line of the medium-term rising wedge, the oil stock index extended its gains and broke above the previous 2013 high, which is a bullish sign. If the buyers do not give up, we may see further improvement and the next target will be the psychological barrier at 1,500.

Looking at the above chart, we see that the situation has improved once again. The XOI continued its rally and hit a daily high at 1,498. With this upward move, the oil stock index approached the psychological barrier at 1,500 and it seems that if the buyers manage to push the price higher once again, we will likely see a move to the annual high. However, we should keep in mind that the CCI and Stochastic Oscillator are overbought, which may encourage sellers to act in the near future. On the other hand, the RSI still has some room for further growth and this supports the bullish case.

Summing up, crude oil moved higher and broke above psychologically important level of $100, which is a positive sign for oil bulls. Consequently, the situation remains bullish.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): Long. Stop-loss order for this position: $91.55. Stop-loss order for WTI Crude Oil (CFD): $91.30. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts