On Thursday, crude oil continued its rally and rose to a nine-week high as weekly jobless claims report beat expectations and weighted on price. Light crude gained 0.45% and hit its intraday high of $99.70 per barrel.

Yesterday, the U.S. Department of Labor said that the number of people filing for initial jobless benefits declined by 42,000 to a seasonally adjusted 338,000 last week. Analysts had expected U.S. jobless claims to fall by 35,000 to 345,000 from the previous week’s revised total of 380,000, which was the highest since March. This encouraging number bodes well for crude demand in the world's largest oil consumer adding to signs that the U.S. economy is strengthening.

Meanwhile, market players looked ahead to U.S. weekly supply data. In our previous Oil Trading Alert, we wrote that U.S. oil stocks were expected to have declined by 2.2 million barrels last week. As a reminder, widely watched supply and demand figures from the federal Energy Information Administration haves been delayed until today by the holiday.

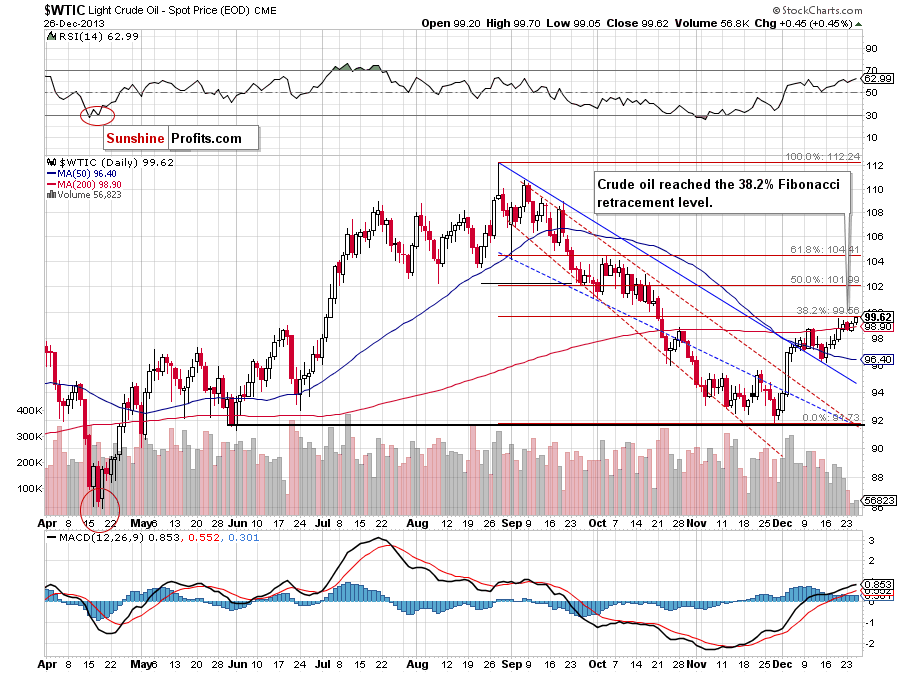

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

(…) recent days have formed a consolidation slightly below the monthly high. If oil bulls do not give up and invalidate a bearish engulfing pattern we will likely see an upswing to the 38.2% Fibonacci retracement level (at $99.56) or even to the psychological barrier of $100.

Looking at the above chart, we see that yesterday we had such price action. The buyers managed to push the price higher, which resulted in an upward move above the 38.2% Fibonacci retracement level. Additionally, a bearish engulfing pattern was invalidated, which is another positive sign. Taking only these facts into account, another upswing is likely to be seen. However, the nearest upside target is the psychological barrier of $100, which is a very important resistance level, therefore, it may trigger a pause or pullback. If oil bulls fail, the nearest support will be around $98.53, where the Tuesday’s low is.

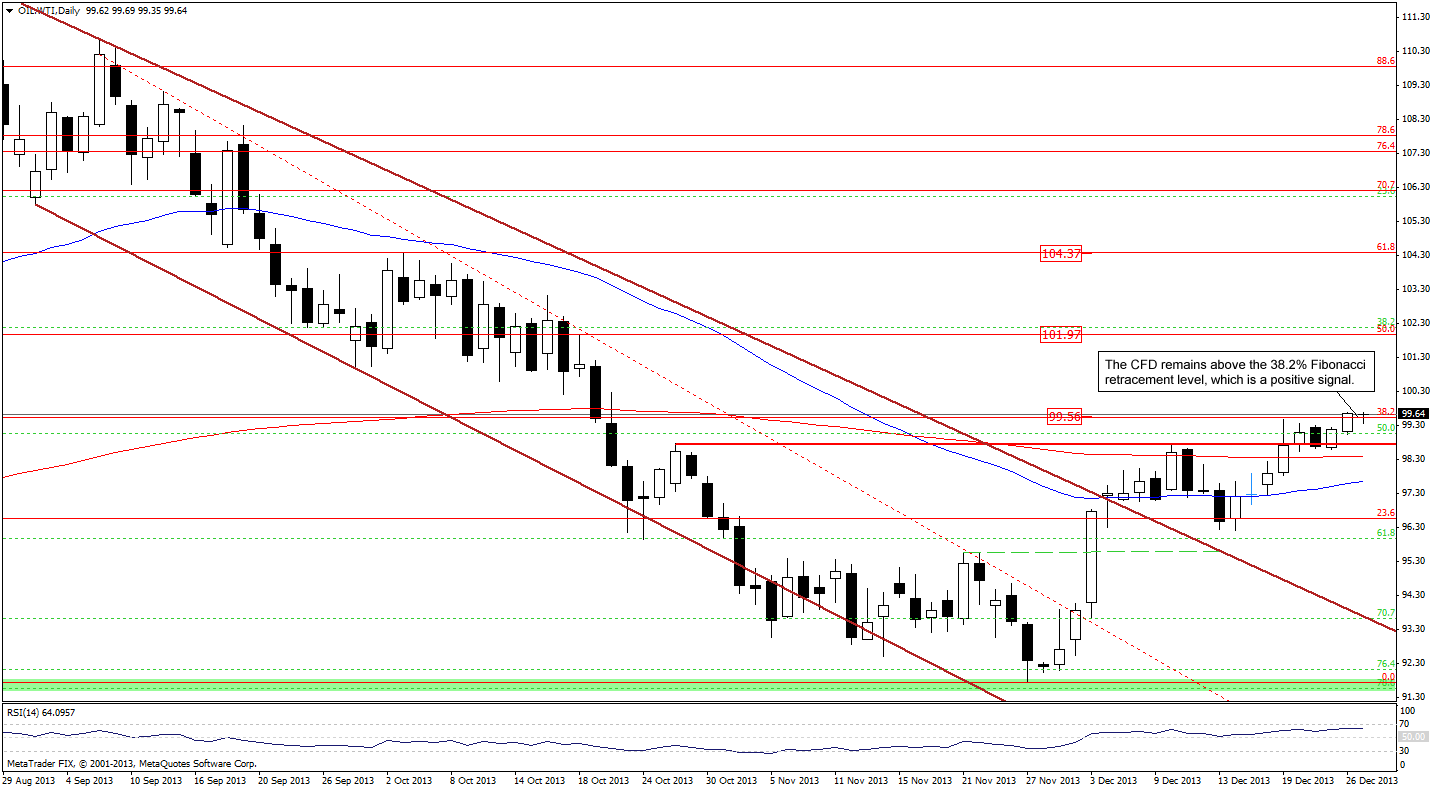

Having discussed the current situation in crude oil, let’s take a look at WTI Crude Oil (the CFD).

On the above chart, we see that yesterday’s increase invalidated a bearish engulfing pattern. This positive event encouraged buyers to act and push the price higher. In this way, WTI Crude Oil climbed above its upside target - the 38.2% retracement, which is a bullish sign. However, similarly to what we wrote in case of crude oil, the psychological barrier of $100 may trigger a pause or pullback. The nearest support is the Tuesday’s low around $98.61.

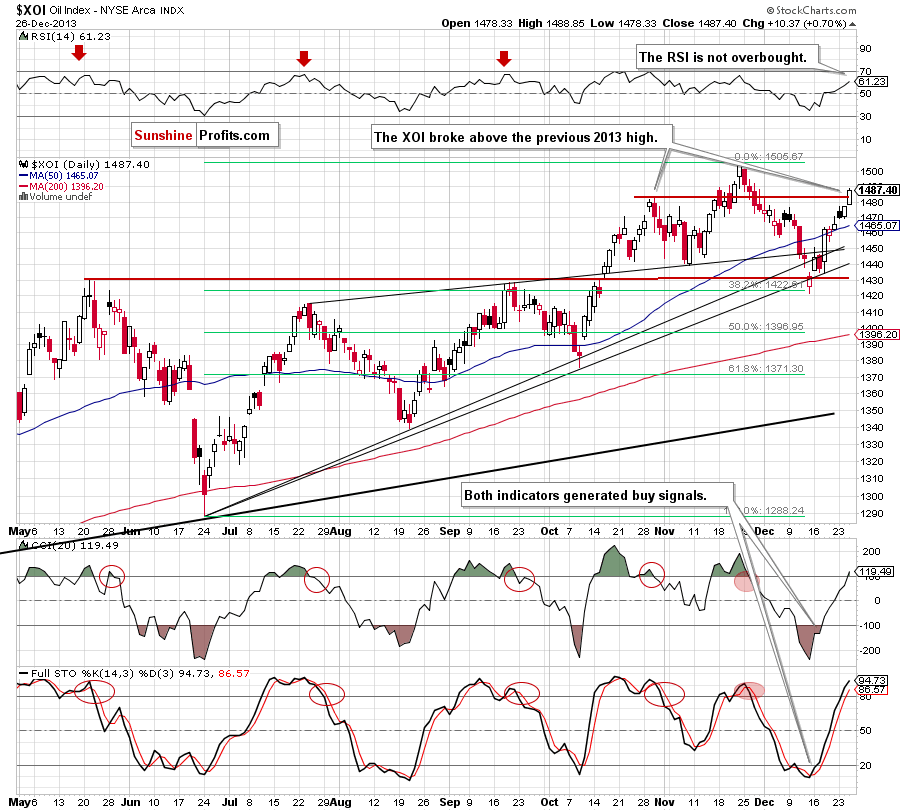

Once we know the above, let’s take a look at the NYSE Arca Oil Index (XOI) chart.

Looking at the above chart, we see that the situation has improved significantly. After a breakout above the neck line of the head and shoulders formation and the upper line of the medium-term rising wedge, the oil stock index extended its gains and broke above the previous 2013 high, which is a bullish sign. If the buyers do not give up, we may see further improvement and the next target will be the psychological barrier at 1,500.

Summing up, crude oil moved higher and reached the 38.2% Fibonacci retracement level, which is a positive sign for oil bulls. Although the proximity to the psychological barrier of $100 may trigger a pause or a pullback in the coming days, the situation remains bullish.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed with bullish bias

LT outlook: mixed

Trading position (short-term): Long. Stop-loss order for this position: $91.55. Stop-loss order for WTI Crude Oil (CFD): $91.30. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts