Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 1.46% as market fears over Ukrainian geopolitical tensions eased after Russian President Vladimir Putin statement. These circumstances encouraged investors to lock in gains and pushed light crude to slightly above $103 per barrel.

From today’s point of view, it seems that events in Eastern Europe were the primary driver in the market yesterday – especially when we take into account the fact that there were no important economic data that could influent the price of light crude. In first public comments since Russian troops entered the Crimea region last week, Russian President Vladimir Putin said he saw no reason to send troops further into Ukraine, and troops ceased military exercises that had increased tensions. He also said that Moscow reserved the right to use force in Ukraine’s Crimea region in the event of “lawlessness” but added that such a move would be a last resort. The price of light crude also dipped after the Russian defense minister ordered troops engaged in military exercises near Ukraine’s borders to return to their bases. Although easing of tensions triggered the market decline, the situation on the ground in mainly Russian-speaking Crimea remained tense and could have an impact on the oil market in the near or further future (especially when we take into account the fact that Russia is the world's second-largest crude oil exporter).

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

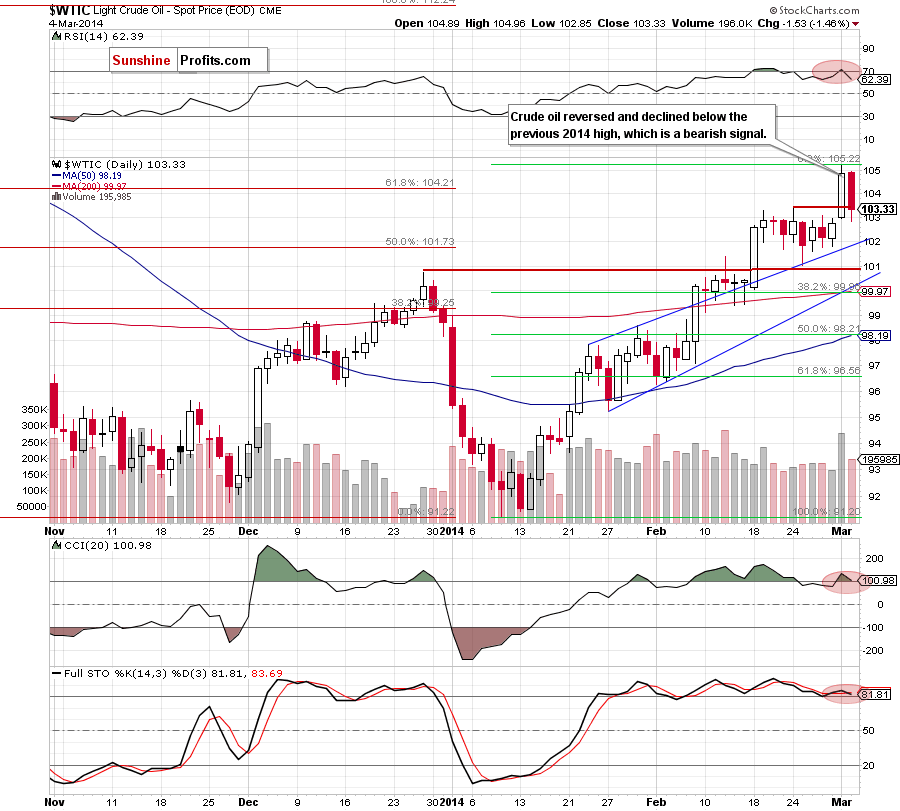

Looking at the daily chart, we see that despite Monday’s sharp increase, oil bulls didn’t manage to push the price higher after the market open. Such weakness triggered a pullback, which erased most of Monday’s gains and took crude oil below the previous 2014 high. Although the buyers tried to initiate a corrective upswing in the following hours, light crude closed the day below February high, which is not a positive signal. From this perspective, we see that the current correction is shallower than a corrective move that we saw in January, which means that the short-term uptrend is not threatened at the moment. However, when we factor in the current position of the indicators, it seems that further deterioration is just around the corner. Please note that the RSI and Stochastic Oscillator generated sell signals, while the CCI is very close to doing it. If oil bulls do not trigger a corrective upswing today, crude oil may extend losses and drop to the upper line of the rising trend channel (which successfully stopped sellers at the end of the previous month) in the coming day (or days).

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

In our previous Oil Trading Alert, we wrote the following:

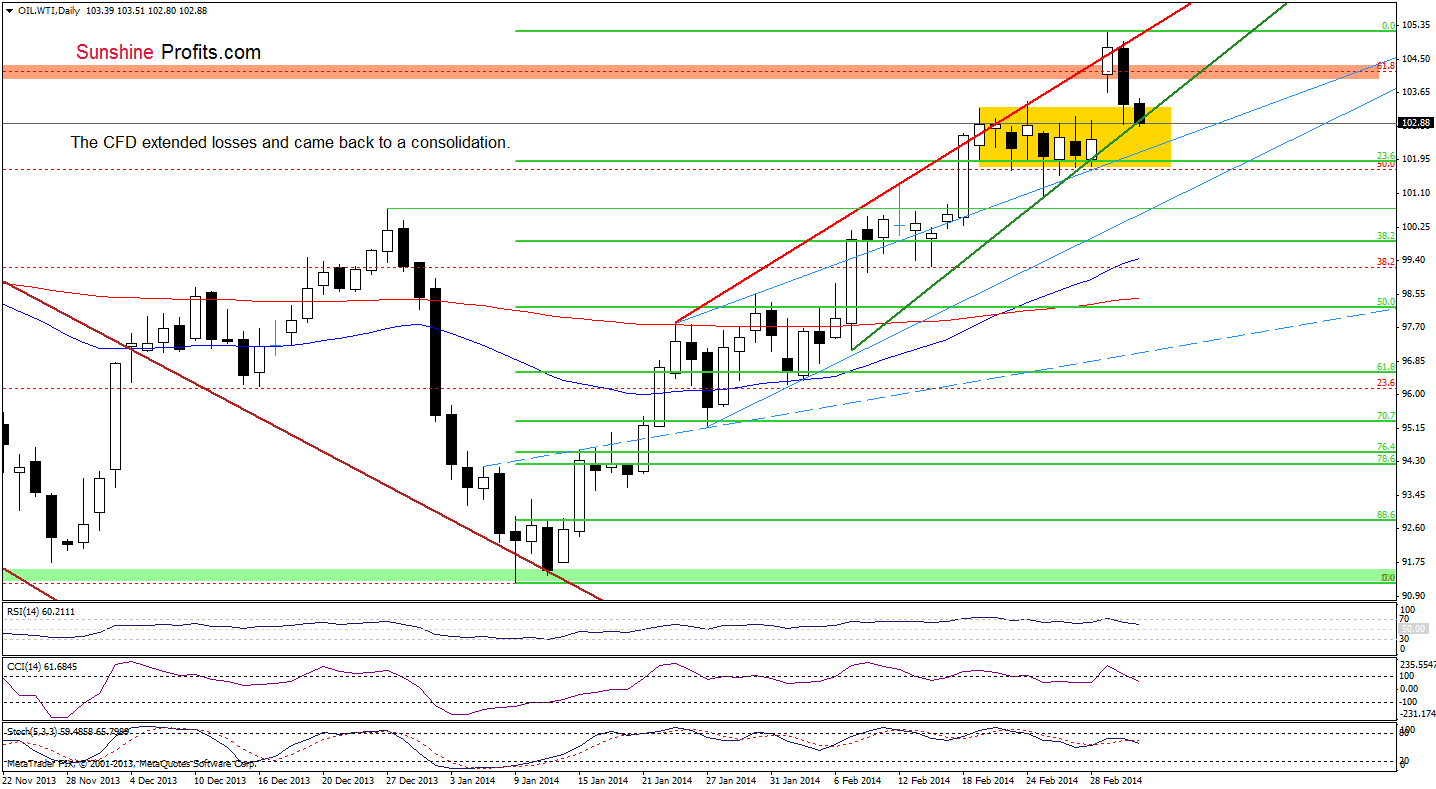

(…) WTI Crude Oil (…) broke above the very short-term rising line and the 141.4% Fibonacci extension. However, as it turned out, this improvement was only temporary and the CFD invalidated these breakouts earlier today, which is a bearish signal. If this encourage oil bears to act, we will likely see further deterioration and a comeback to the consolidation range. At this point, it’s worth noting that the RSI declined below the level of 70 generating a sell signal, which suggests that a pause or a pullback is just around the corner.

As you see on the above chart, yesterday, the sellers triggered a downswing, which took back WTI Crude Oil to the consolidation range. Although this deterioration was only temporary and the CFD rebounded in the following hours (closing day above the upper line of the consolidation), oil bears didn’t give up and initiate another downswing earlier today. Thanks to this move, the CFD is currently trading (at least at the moment when these words are written) in the consolidation (marked with a yellow rectangle). When we take a closer look at the above chart, we see that WTI Crude Oil declined to the very short-term rising support line (marked with dark green). If it is broken, we will see a drop to the upper line of the rising wedge (marked with thin blue lines), which successfully stop declines in February. Please note that the CCI and Stochastic Oscillator generated sell signals, which supports the bearish scenario and suggests further deterioration.

Summing up, the very short-term outlook for crude oil has deteriorated as crude oil declined below the February high and the 61.8% Fibonacci retracement level. As mentioned earlier, the RSI and Stochastic Oscillator generated sell signals (while the CCI is very close to doing it), which suggests that crude oil may extend losses and drop to the upper line of the rising trend channel in the coming day (or days). In our yesterday’s summary, we wrote that a pullback in crude oil would be more likely, if the CFD closed a gap between Monday low and Friday high and returned to the consolidation range. Earlier today we saw such price action, which suggests that this bearish scenario is quite likely in the nearest future.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, although crude oil declined sharply, the current situation is not bearish enough to justify opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts