Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 0.42% as Federal Reserve Chair Janet Yellen signaled that the Fed will likely continue tapering monthly bond purchases if the economy improves. Thanks to this news, light crude hit a fresh six-week high and closed the day above $100 once again.

Ms. Yellen signaled that recent soft economic data has not swayed the central bank from a strategy of trimming its monthly bond purchases by $10 billion at each of its policy meetings this year. She repeated the Fed's January policy statement, saying that if the economy improves as the Fed expects, the Fed "will likely reduce the pace of asset purchases in further measured steps at future meetings." She also emphasized that the bond-buying program is "not on a preset course" and officials will base their decisions about the pace of the program on their economic outlook as well as their view of the costs and benefits of the program.

Although the decision to further taper monetary stimulus program pushed light crude lower, the price rebounded quickly as investors concluded that it signals a more robust economy, which will demand more fuel and energy.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

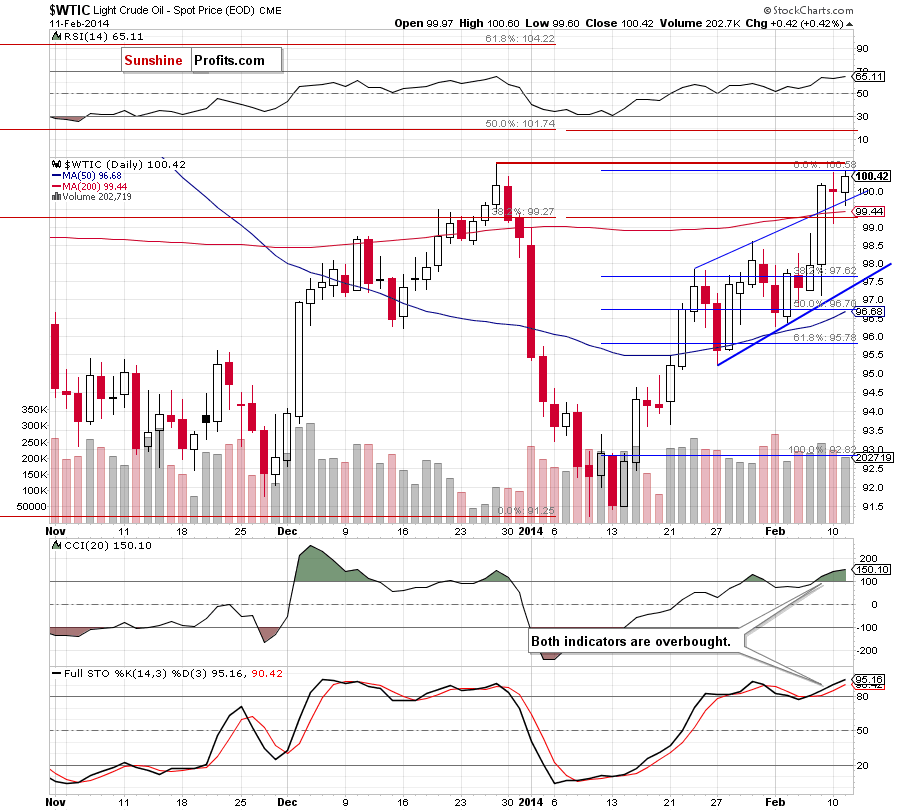

On the above chart, we see that the very short-term situation has improved slightly as crude oil extended gains and hit a fresh monthly high of $100.60. Despite this increase, light crude still remains below the resistance level created by the December high. Therefore, what we wrote in our last Oil Trading Alert remains up-to-date also today.

(…) from this perspective, we should consider two scenarios. On one hand, if the breakout above the upper border of the rising trend channel is not invalidated and crude oil increases above the December high, we may see further improvement and the upside target would be the 50% Fibonacci retracement. On the other hand, if light crude invalidates the breakout, we will likely see a bigger pullback and the downside target will be the lower border of the rising trend channel (currently slightly above $97). Please note that the CCI and Stochastic Oscillator are overbought, which suggests that a correction is just around the corner.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

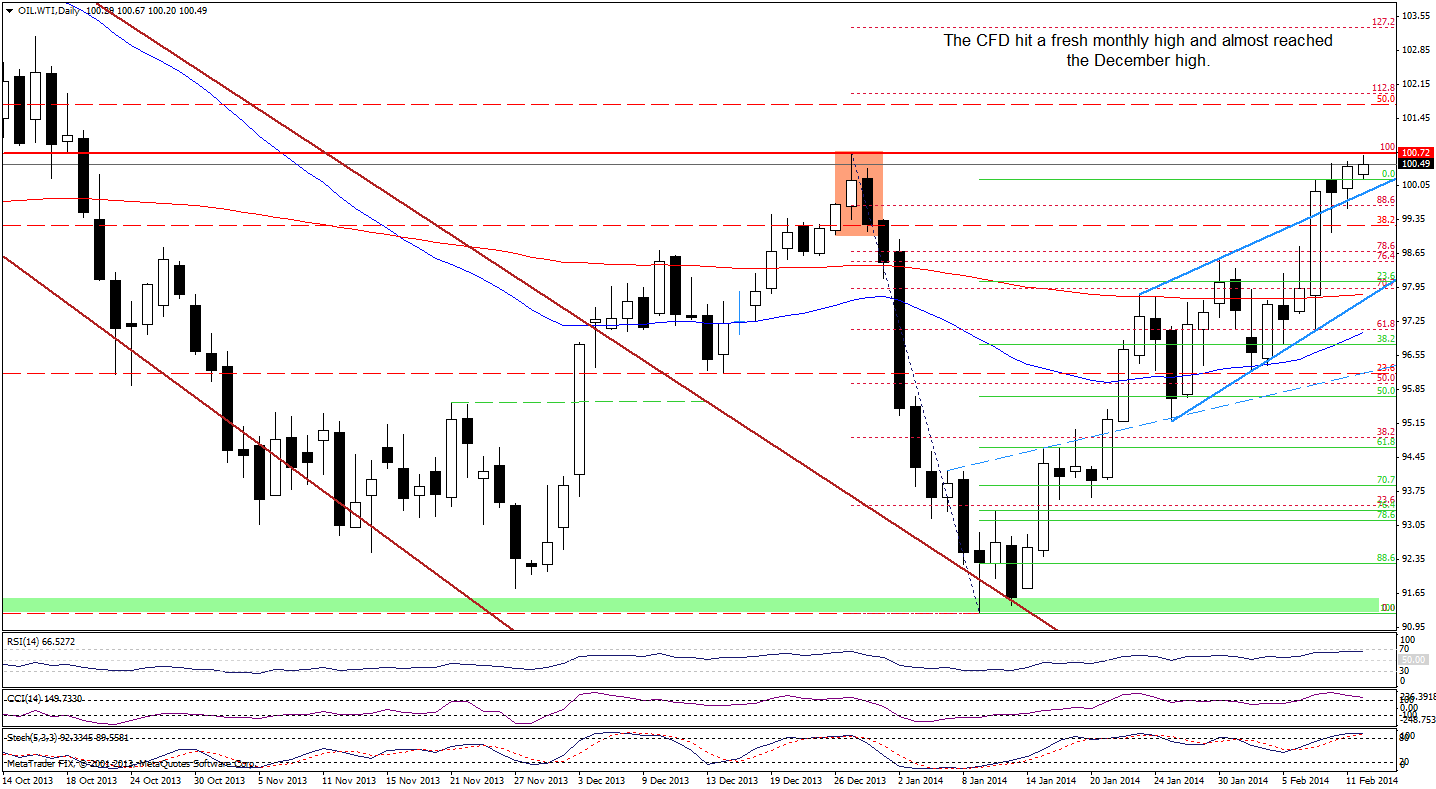

Looking at the above chart, we see that oil bears tried to invalidate the breakout above the upper border of the rising trend channel yesterday. Despite a small drop below this important support line, the buyers didn’t give up and pushed the price higher, which triggered an upswing that took the CFD to a fresh monthly high. Earlier today, we saw further improvement and WTI Crude Oil almost touched the December high (which is still reinforced by a bearish engulfing candlestick pattern).

From this perspective, if the CFD breaks above this important resistance level, we will likely see further increases and the first upside target will be the 50% Fibonacci retracement level around $101.70. However, if oil bulls fail and WTI Crude Oil closes the day below the upper border of the rising trend channel, it will be a strong bearish signal that will likely trigger further deterioration. At this point it’s worth noting that the Stochastic Oscillator and CCI are overbought (additionally, there is a negative divergence between the latter indicator and the CFD), which is a negative signal that may encourages sellers to act. Nevertheless, as long as WTI Crude Oil remains above the upper border of the rising trend channel, another attempt to move higher can’t be ruled out.

Summing up, although crude oil hit a fresh monthly high, the overall situation hasn’t changed much and we still should consider two scenarios. As mentioned earlier, if the breakout above the upper border of the rising trend channel is not invalidated and crude oil increases above the December high, we may see further improvement and the upside target would be the 50% Fibonacci retracement. On the other hand, if light crude invalidates the breakout, we will likely see a bigger pullback and the downside target will be the lower border of the rising trend channel (currently slightly above $97). The CCI and Stochastic Oscillator are overbought, which suggests that a correction is just around the corner.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, there were no changes in crude oil that justify opening short or long positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts