Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

On Wednesday, crude oil gained 1.06% as geopolitical concerns and the dollar's decline offset a larger-than-expected increase in U.S. crude-oil stockpiles. Because of these circumstances, light crude hit a five week high. Can it climb higher in the nearest future? Are there any technical factors that can stop oil bulls? If you want to know our take on these questions, we invite you to read our today's Oil Trading Alert.

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories rose by 4.03 million barrels in the week ended April 4, well above expectations for a build of 1.3 million barrels (while distillate stockpiles increased by 0.23 million barrels). Despite this larger-than-expected increase in U.S. crude-oil stockpiles, the price of light crude was supported by ongoing tensions over Ukraine. Government authorities and pro-Russian separatists have clashed, spurring concerns that the crisis could evolve into a larger conflict between Russia and the West, including sanctions against Russia's oil sector.

Crude oil received also some support from the dollar's decline after details from the Federal Reserve's most recent meeting showed no signs of higher interest rates ahead. As a reminder, a drop in the U.S. dollar typically boosts commodities priced in the dollar as it appears less expensive to potential buyers holding other currencies.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

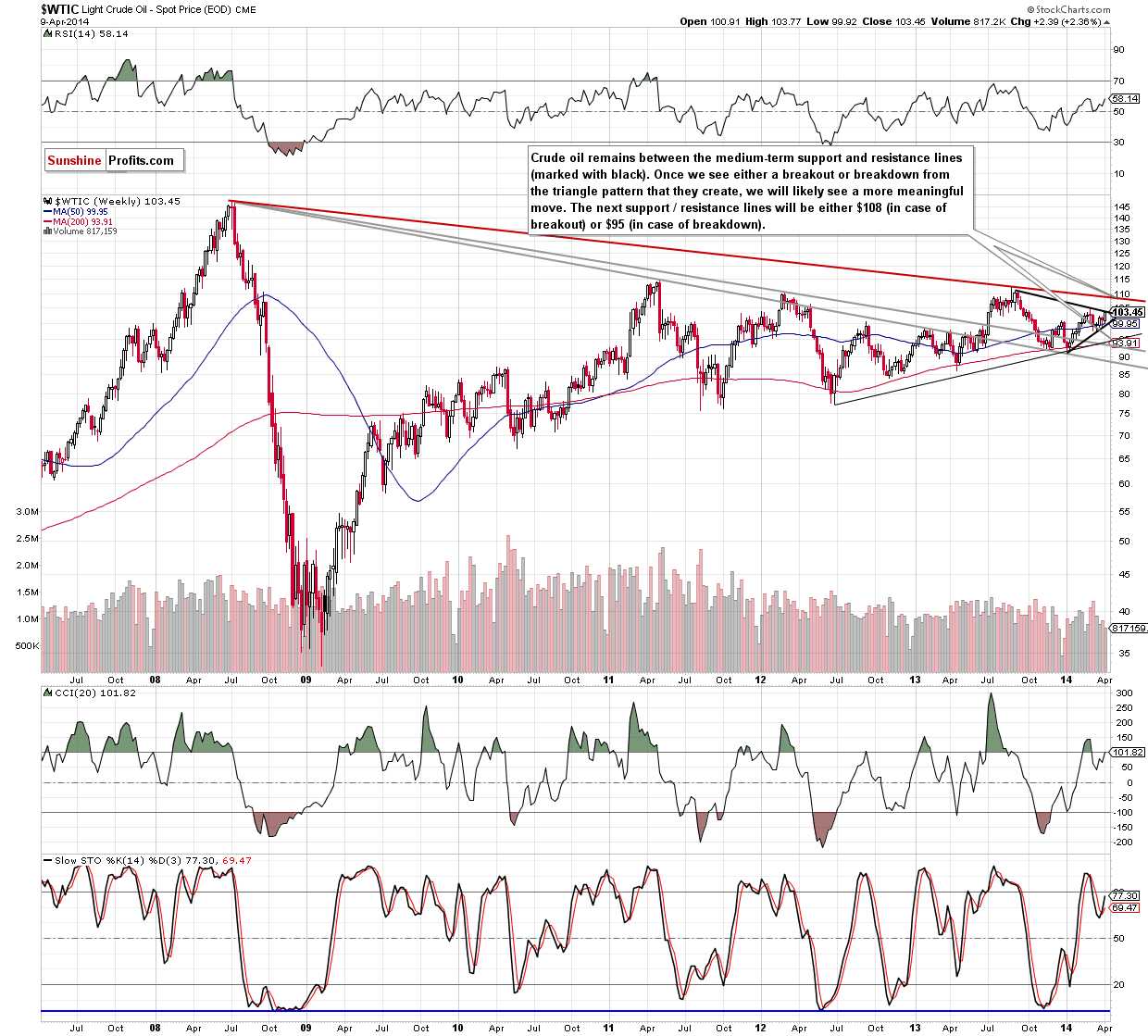

Looking at the weekly chart, we see that crude oil reached the resistance line based on the September and March highs, which is also the upper line of a triangle. Taking this fact into account, we should consider two scenarios. On one hand, if oil bulls do not give up and succesfully push the price of light crude above this important line, we will likely see an increase to around $108, where the long-term resistance line (marked with red) is. However, if they fail, we may see a pullback to the previously-broken 50-week moving average (currently at $99.95). Please note that this area is supported by the medium-term support line (based on the January and March lows), which is also the lower border of the black triangle. Looking at the current position of the indicators, we see that they still support buyers as buy signals remain in place.

Before we summarize today’s Oil Trading Alert, let’s zoom in on our picture and move on to the daily chart.

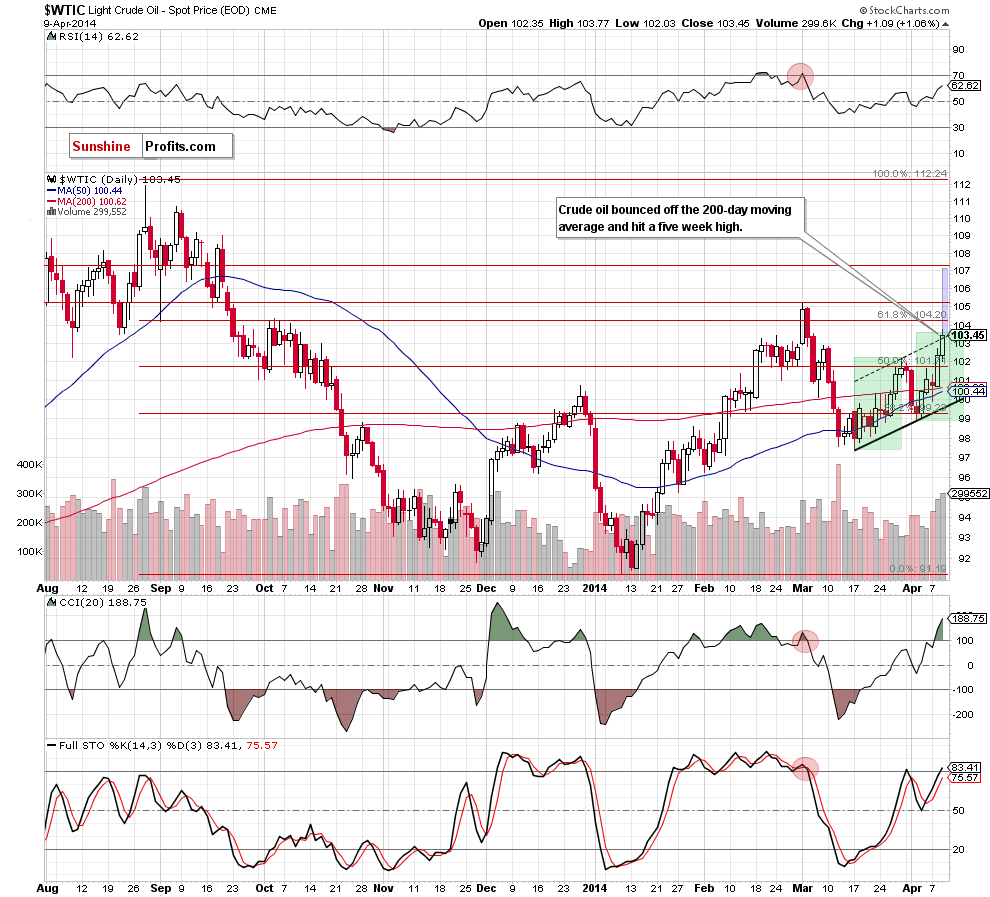

From this perspective, we see that crude oil bounced off the support zone (created by the 200-day and 50-day moving averages) and succesfully broke above the March 7 high. With this upward move, light crude also climbed above the dashed resistance line, which is the upper line of the rising trend channel. According to theory, if this breakout is not invalidated, we may see an increase to around $107, where the price target is (and corresponds to the height of the trend channel). At this point, it’s worth noting that recent upswing materialized on increasing volume, which confirms the strength of the buyers. Despite these positive circumstances, we should keep in mind the medium-term resistance line marked on the weekly chart. Additionally, when we compare an upward move between the March 17 low and the March 28 high to the recent increase (from the April’s low), we notice that they are almost the same. Taking these facts into account, it seems that a pause should not surprise us.

Summing up, the situation has improved significantly as crude oil bounced off the support zone and climbed above the previous highs. As mentioned earlier, with this upswing light crude reached an important medium-term resistance, which may pause further improvement in the coming day (or days).

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We plan to open the speculative positions once we see either a breakout or breakdown on the long-term chart. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts