Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Monday, crude oil lost 0.33% as weak Chinese import data and a stronger U.S. dollar weighed on the price. Because of these circumstances, light crude extended losses and hit a nine-month low of $91.80. Will the proximity to the strong support zone encourage oil bulls to act in the coming days?

Yesterday, official data showed that Chinese trade surplus widened to a record high of $49.8 billion in August from $47.3 billion in July, compared to estimates for a surplus of $40.0 billion. Data also showed that China's exports rose 9.4% from a year earlier, beating expectations for an 8% increase, however, imports declined 2.4% last month, disappointing forecasts for a 1.7% gain. At this point, it’s worth noting that imports declined for the second straight month, underlining concerns over the health of the world's second largest economy. Additionally, China's oil-import growth is slowing, limiting its power to lift the price of the commodity. As a result, crude oil extended losses and hit an intraday low of $91.80. Will we see further deterioration in the coming days? (charts courtesy of http://stockcharts.com).

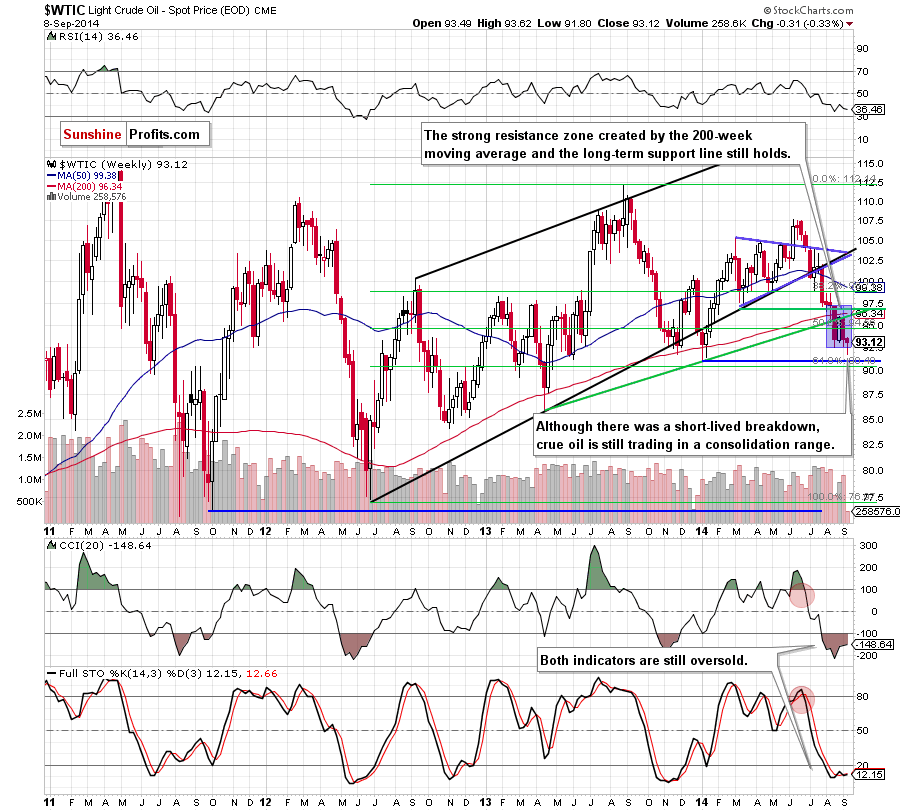

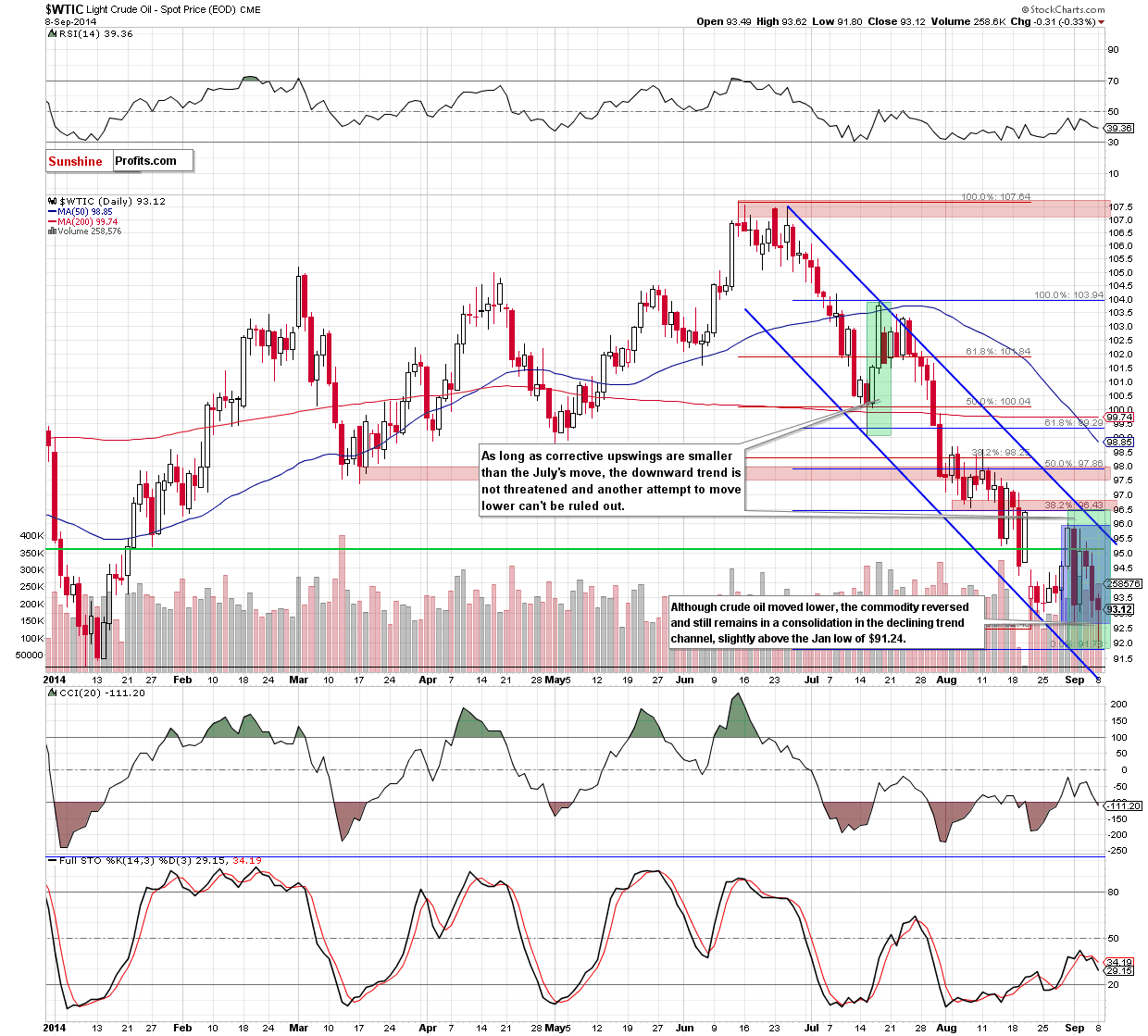

Looking at the above charts, we clearly see that the situation in the medium-, short- and even very short term hasn’t changed much as light crude is still trading in the medium- and very short-term consolidations. As you see, although crude oil declined below the recent lows, the commodity rebounded and closed the day above them, invalidating earlier breakdown. Is this as bullish signal as it seems at the first glance? In our opinion, the answer is: no. We think that the major force behind this upswing was the proximity to the strong support zone created by the Jan low of $91.24, the 61.8% Fibonacci retracement level based on the Jun 2012-Aug 2013 rally and the lower border of the declining trend channel seen on the daily chart. Therefore, we believe that as long as this area is in play, another sizable downward move is not likely to be seen. Nevertheless, we should keep in mind that even if crude oil rebounds from here, the combination of the upper line of the blue trend channel and the 38.2% Fibonacci retracement (based on the Jul-Aug decline), will likely stop further improvement.

Finishing today’s Oil Trading Alert, we would like to drive your attention to the fact that as long as corrective upswings are much smaller than the July’s move (which means that oil bulls are weaker than they were in July), we think that the downward trend is not threatened and another attempt to test the strength of the above-mentioned support zone should not surprise us.

Summing up, although crude oil extended losses and broke below the recent lows, this deterioration was only temporarily and finally yesterday's session didn’t change the overall picture of the commodity. Taking this fact into account, we are convinced that opening long positions is currently not justified from the risk/reward perspective. Nevertheless, we do not recommend opening short positions either as the space for further declines might be limited (especially when we factor in the strong support zone created by the Jan low of $91.24, the 61.8% Fibonacci retracement level based on the Jun 2012-Aug 2013 rally and the lower border of the declining trend channel).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts