Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Wednesday, the price of light crude wavered between small gains and losses after mixed the EIA weekly report. Because of these circumstances, the commodity still remains in a consolidation. Is this a sign of strength or rather the last stop before new lows?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories declined by 2.1 million barrels in the week ended August 22, beating expectations for a decline of 1.3 million barrels. Despite this larger- than-expected drop in crude oil inventories, supplies in Cushing, Okla., rose by 500,000 barrels to 20.7 million barrels. At this point, it’s worth noting that crude oil prices have been sensitive to Cushing supply levels in recent months, and reports that they hit six-year lows earlier this summer boosted prices. Therefore, yesterday’s report, which showed a fourth weekly stockpile build at a key storage hub pushed the price down. Will we see further deterioration? (charts courtesy of http://stockcharts.com).

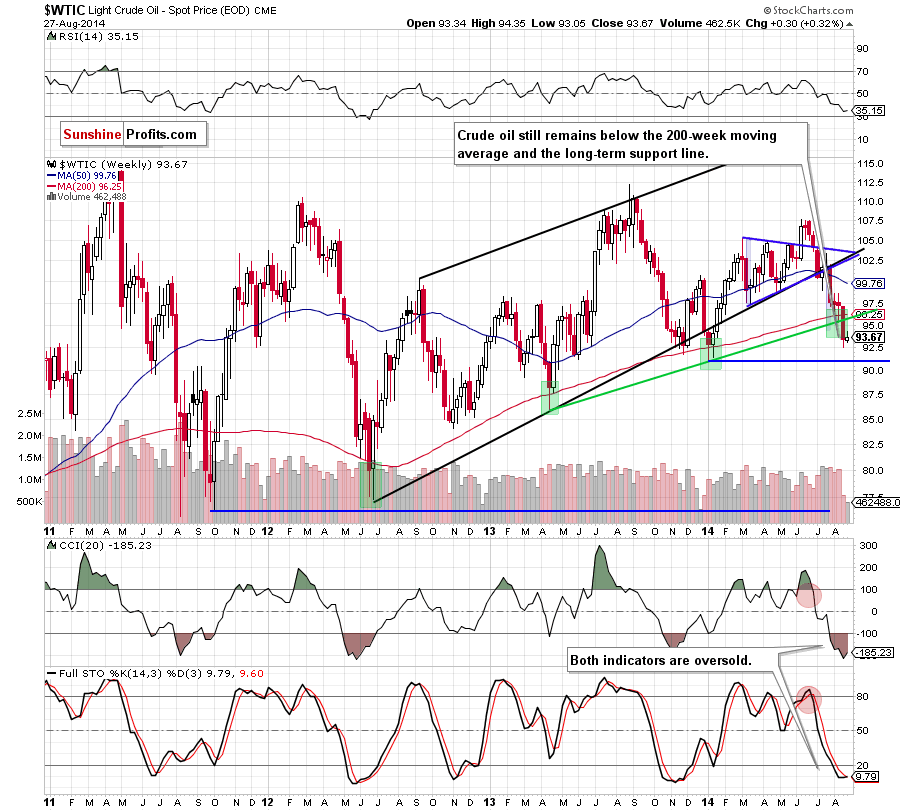

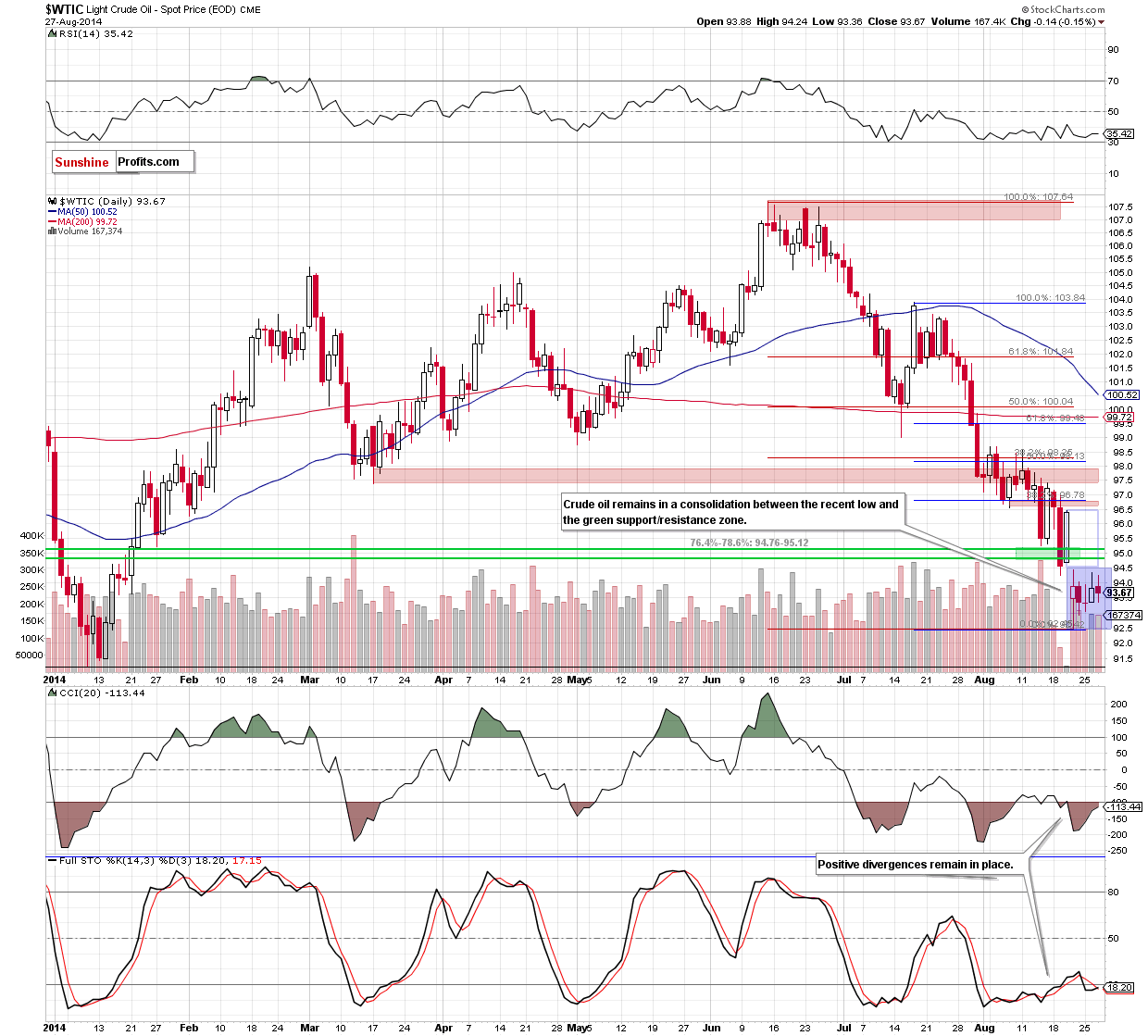

As you see on the above charts, the overall situation in the medium-, short- and also very short-term remains unchanged as crude oil is still consolidating between the recent low of $92.50 and the green support/resistance zone seen on the daily chart (well below the 200-week moving average and the rising, long-term support line). Taking all the above into account, we are convinced that our last commentary is up-to-date:

(…) On one hand, if oil bulls manage to push the price above the upper line of the formation, we’ll see an attempt to invalidate the breakdown below the green area. If they succeed, the initial upside target will be around $96.60, where the size of the upswing will correspond to the height of the consolidation (it’s worth noting that slightly above this level is the 38.2% Fibonacci retracement based on the Jul-Aug decline, which may pause further improvement). On the other hand, if crude oil extends losses and drops below the recent low, we’ll see further deterioration and a test of the strength of the Jan low of $91.24.

Summing up, contrary to expectations, the EIA weekly report didn’t bring a breakthrough and crude oil is trading in the consolidation, which means that the commodity could go both north or south from here. Therefore, we believe that staying on the sidelines waiting for more valuable clues about future moves is the best choice at the moment.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts