Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

Although crude oil declined sharply after the market’s open, hitting an intraday low of $101, the commodity reversed as upbeat U.S. data supported the price. In this way, light crude tested the strength of the support zone for the first time since mid-July. Will it withstand the selling pressure in the coming week?

On Friday, the Census Bureau showed that U.S. durable goods orders rose 0.7% last month, beating expectations for a 0.5% gain. Additionally, core durable goods orders (without transportation items) increased by 0.8% in the previous month, also beating expectations for a 0.6% gain. These bullish numbers fueled expectations that U.S. economy will demand more fuel and energy and pushed the commodity well above $101 per barrel. Will light crude move higher in the coming days? Let’s check (charts courtesy of http://stockcharts.com).

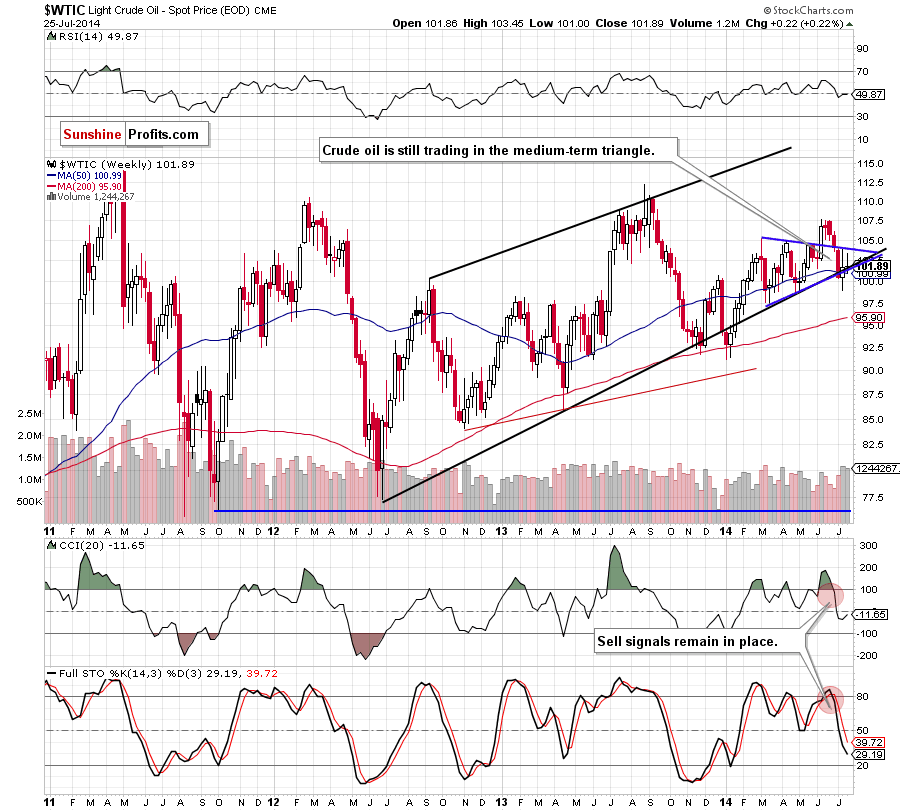

From this perspective, we see that although crude oil erased the rally that we saw in the recent days, the commodity gained 0.22% in the previous week. Looking at the above chart, some of you may wonder whether this increase change anything or not. In our opinion, the medium-term outlook remains mixed and unclear as crude oil is still trading in the blue triangle. Although we saw a small drop below the lower border of the formation, oil bears failed and light crude came back below this key support line (and also above the 50-week moving average). Therefore, we believe that what we wrote a week ago is valid:

(…) If the support zone holds, we’ll see a rebound in the coming week and another attempt to break above the upper line of the triangle. However, if it is broken, crude oil will test the strength of the psychological barrier of $100.

Can we infer something more from the very short-term chart?

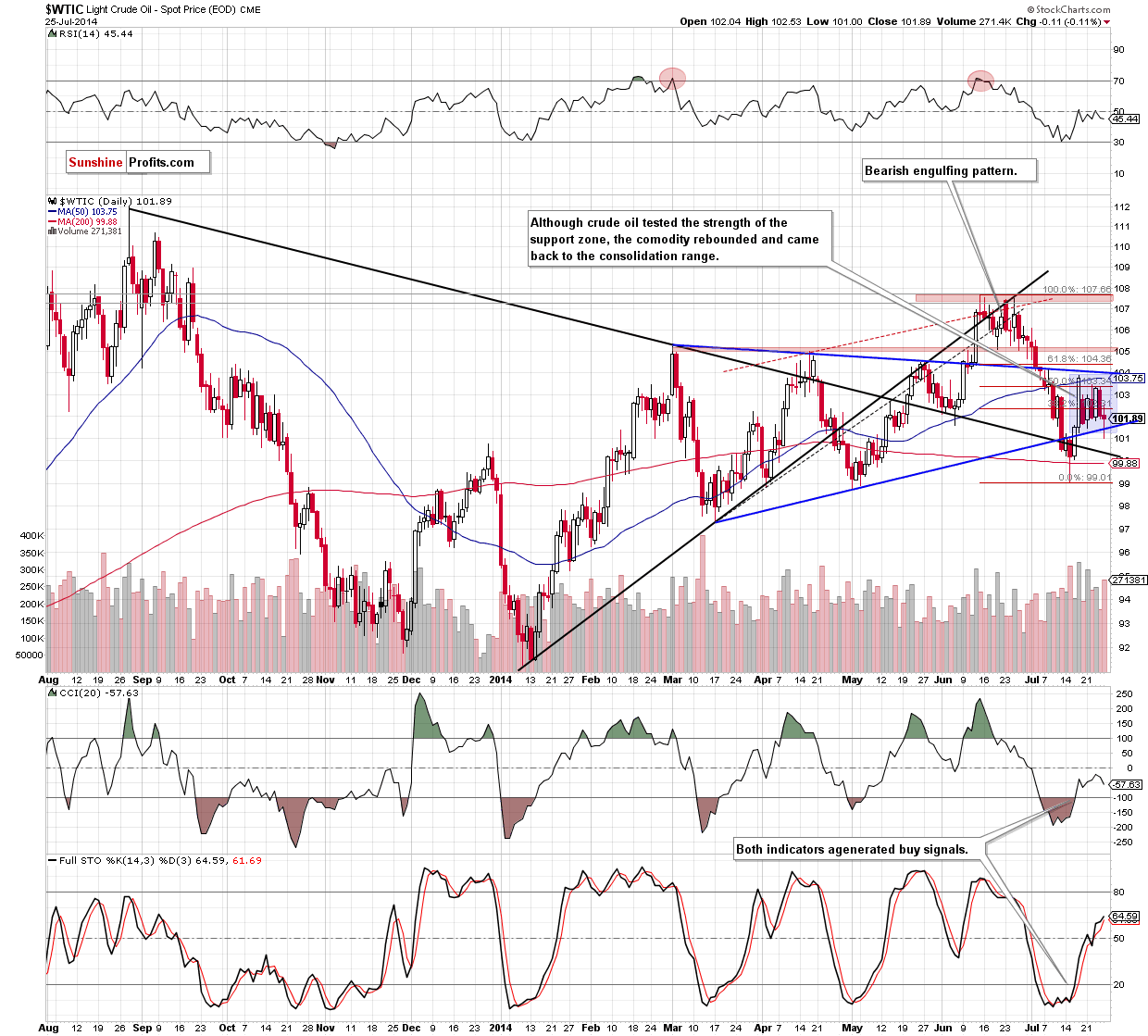

Unfortunately not. From the daily perspective, we see that oil bears tested not only the blue support line, but also the lower border of the consolidation. As we have pointed out before, they failed, which triggered a corrective upswing that took back crude oil to the levels that we saw several times in the previous week. Therefore, what we wrote in our previous Oil Trading Alert is up-to-date:

(...) we can summarize the recent week in one simple sentence: although a lot happened, nothing really has changed. (...) the commodity is still trading (...) between the strong support zone (created by the Thursday’s low and the blue support line) and the strong resistance area (based on the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonacci retracement).

Taking all the above into account, we can summarize today’s Oil Trading Alert in the same way as we did on Friday:

Summing up, just like we wrote in the recent days, yesterday’s price action didn’t change anything. Therefore, we remain convinced that as long as there is no breakout above the resistance zone or a breakdown below the support zone another sizable move is not likely to be seen. Opening any position at the moment is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

On an administrative note, there will be no regular Oil Trading Alerts in the final days of this week: on Wednesday, Thursday, and Friday. Tomorrow's alert will be posted normally, and then we will post the following one next Monday. We apologize for inconvenience and thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts