Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

Although crude oil declined after the market’s open, the combination of ongoing concerns over a disruption to supplies from Iraq and upbeat U.S. data supported the commodity and pushed it higher. Did this one-day rally change anything in the very short-term picture?

Yesterday, fighting between Iraqi security forces and Sunni insurgents continued over Iraq's largest oil refinery, which serves the domestic market. Although, the country's oil production and exports haven't been disrupted, if the rebels succeed in holding the Beiji refinery, they would cut off a vital lifeline of petroleum to the rest of Iraq and further destabilize the country. Crude oil got an extra boost after President Obama said that American troops wouldn't be fighting in Iraq again, though he is prepared to take targeted military action in the country.

As we mentioned earlier, upbeat U.S. data supported the commodity as well.

Yesterday, the Federal Reserve Bank of Philadelphia showed that its manufacturing index rose to an eight-month high of 17.8 in June from 15.4 in May, while analysts had expected the index to dip to 14.0 in June. Additionally, the U.S. Department of Labor reported that the number of individuals filing for initial jobless benefits in the week ending June 14 declined by 6,000 to 312,000, beating analysts’ forecasts of 4,000 drop.

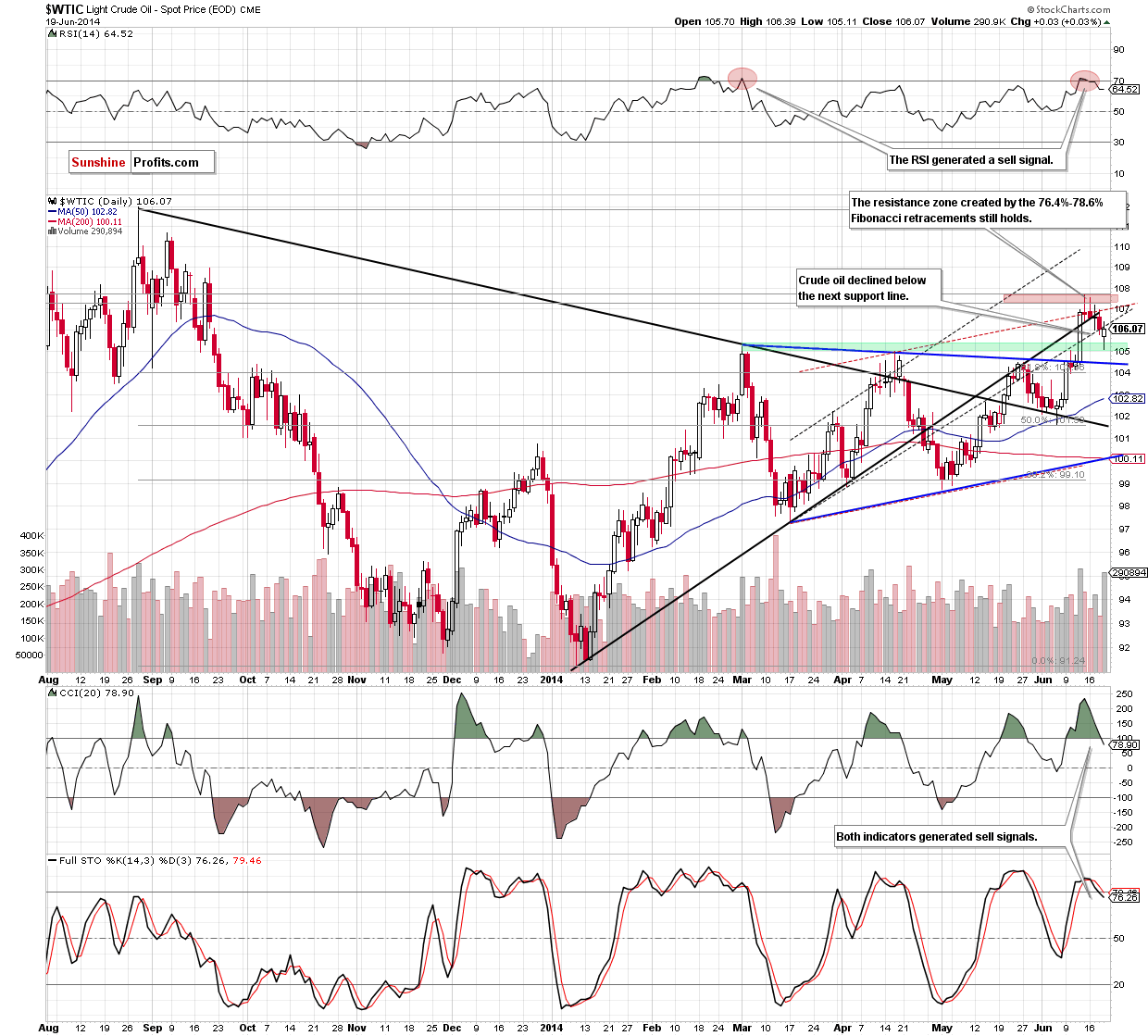

Despite all these bullish fundamental factors, the overall situation hasn’t changed much as crude oil finished the day only 3 cents above Wednesday closing price. Nevertheless, let’s take a closer look at the daily chart (charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on Wednesday, we wrote the following:

(…) the commodity declined under the medium-term black rising line, closing the day slightly below it. In our opinion, this is a bearish signal, which suggests further deterioration. We are convinced that the current correction will accelerate, if light crude drops under the black dashed support line (currently around $105.95) and the CCI and Stochastic Oscillator generate sell signals. In this case, the (…) downside target around $104.55 will be in play.

From this perspective, we see that oil bears realized the above-mentioned scenario partly as light crude declined below the black dashed support line and both indicators generated sell signals. Additionally, although the support zone created by the previous highs (marked with green) triggered a corrective upswing, the commodity closed the day below the rising black support line for the third time in a row, which means that the breakdown is confirmed. Taking all these negative signals into account, we still believe that crude oil will reach its downside target in the nearest future.

Summing up, we remain bearish as crude oil extended losses and confirmed the breakdown below the medium-term black line. As we mentioned earlier, light crude also declined under the next support line, while both indicators generated sell signals, which suggests further deterioration and a realization of the above-mentioned bearish scenario in the coming day (or days).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts