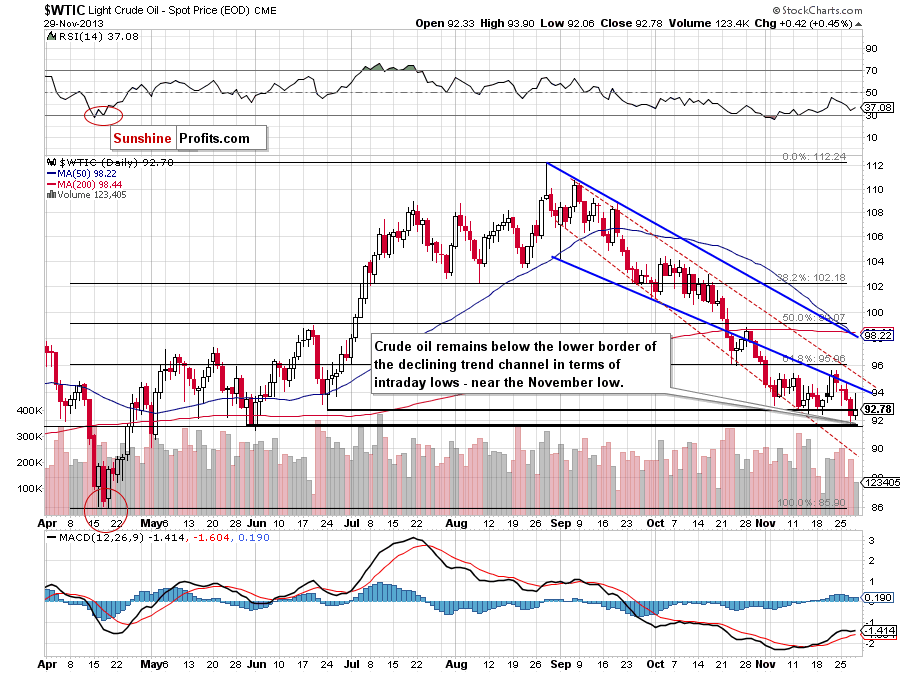

On Friday, crude oil gained 0.45% and climbed to its daily high of S$93.90. Despite this increase, light crude gave up the gains and declined in the following hours below $93.

On Friday, investors didn’t receive any economic data, so in today’s Oil Trading Alert we’ll focus only on the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

Looking at Friday’s session, we see that crude oil rebounded, but this pullback is too small to say that the worst is already behind oil bulls. Taking into account the upper shadow of Friday’s candlestick, we clearly see that the proximity to the lower border of the declining trend channel still has a negative impact on the price. Our last week’s assumption: “as long as this strong resistance is in play, further growth is limited and a bigger pullback is unlikely” remains in place.

In our previous Oil Trading Alert, we wrote the following:

(…) the oil price moved to the place where two major support lines intersect - the declining one based on the 2008 and 2011 highs, and the rising one based on the 2012 and 2013 lows. We saw an insignificant daily move below the latter, but crude oil stayed above the former. At this time, the breakdown is not confirmed.

Please note that slightly below the November low is the 78.6% Fibonacci retracement level (at $91.54) based on the entire April-August rally, which reinforces this area and serves as additional support. However, if it is broken, we might see a decline to the lower border of the declining trend channel in terms of daily closing prices (marked with the red dashed line) around $89 per barrel.

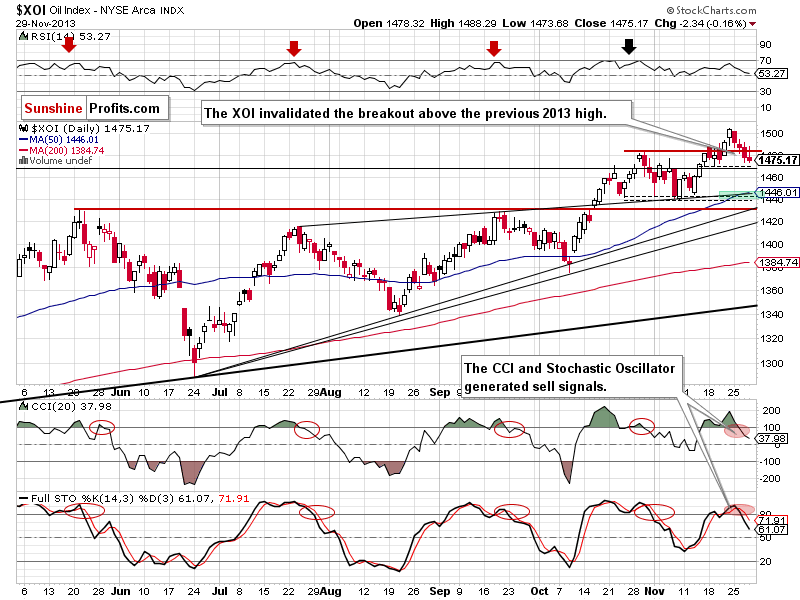

Once we know the current situation in crude oil, let’s take a look at the NYSE Arca Oil Index (XOI) weekly chart.

Looking at the above chart, we see that the XOI extended its decline on Friday and almost reached the bottom of the recent corrective move. In this way, the oil stock index corrected 50% of its November rally and, from this point of view, the correction is still shallow. Taking this fact into account and combining it with the proximity to the support level, we may see a pullback in the coming days.

However, we should keep in mind that this downswing pushed the XOI below the previous 2013 high and the breakout above this level was invalidated, which by itself is a bearish sign. On a side note, an invalidation of the breakout above the previous annual high was the first step to declines in August.

Additionally, when we take a closer look at the position of the indicators, we clearly see that they generated sell signals. We saw a similar situation at the beginning of the month. Back then, such a development had a negative impact on the XOI and we saw a correction which took oil stocks to the bottom of the previous corrective move. If history repeats itself once again, we may see similar price action in the coming week.

Please note that if the XOI drops below 1,470, we will likely see further deterioration. In this case, the downside target will be around 1,445 (marked with the green rectangle) where the upper line of the rising wedge intersects with the 50-day moving average and the bottom of the correction that we saw at the beginning of November.

Summing up, although crude oil rebounded on Friday, it still remains near its five-month low. What we wrote in our last Oil Trading alert is still up-to-date. The best approach at this time in our view is to wait and see how crude oil reacts to the current combination of the long-term support levels. If they are broken, we will likely see a major decline and we will likely suggest opening short positions. If we see a strong bounce and a beginning of a rally, we will suggest going long.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the long-term support lines, we do not suggest opening short positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts