On Wednesday, crude oil gained 0.46% and climbed to its intraday high of $94.54 as hopes for a bullish U.S. supply report and expectations of declines in refined-products stocks weighted on price. Also supporting were comments from Israeli Prime Minister Benjamin Netanyahu warning that a "bad deal" with Iran on its nuclear program could lead to war.

Yesterday’s data from the American Petroleum Institute, released after the session's close, showed that U.S. crude stocks rose by 599,000 barrels in the week, while refinery operations dropped by 0.6 percentage point. API also said that gasoline inventories dropped by 1.67 million barrels, while distillate stocks rose 606,000 barrels.

Analysts expect a 700,000 barrel drop in gasoline stocks and a 1 million barrel fall in heating oil and diesel stocks in today’s more closely-watched U.S. Energy Information Administration report. Those declines are expected to outweigh a projected gain of 1 million barrels in crude oil stocks, which have risen by 29.8 million barrels, or more than 8%, in the past seven weeks.

Oil investors will watch the EIA data to see if recent strong gains continue in implied demand for petroleum products. Reports for the past two weeks showed U.S. oil demand topping 20 million barrels a day in back-to-back weeks for the first time since January 2009. That would suggest stronger growth in demand for products than is evident in four-week data, showing demand averaging 19.4 million barrels a day. Sustained strong growth in demand eventually would pull down lofty crude oil stocks, which ended October at their highest level since 1930.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

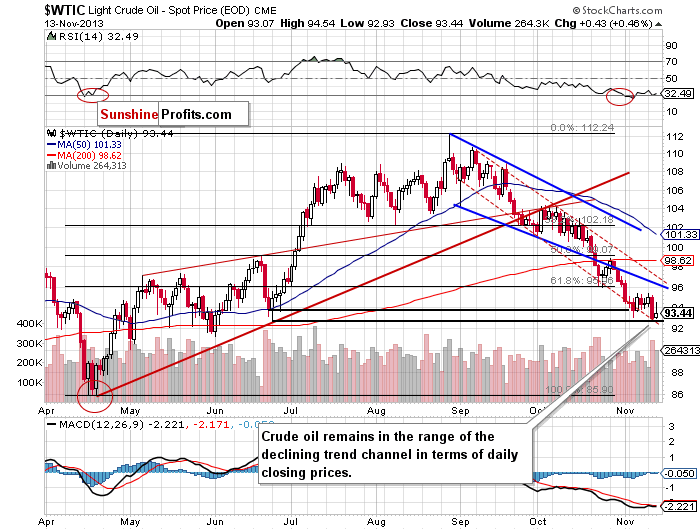

Looking at the daily chart, we see that the situation hasn’t changed much. Yesterday, after the market open crude oil rebounded from a monthly low and climbed to its daily intraday high of $94.54 in the following hours. In spite of this growth, light crude gave up the gains and declined before the session's close, which resulted in a drop below $94.

As you see on the above cart, despite Tuesday’s decline, light crude still remains in the range of the declining trend channel in terms of daily closing prices (marked with the red dashed line). Additionally, the bottom of the corrective move that we saw in June (in terms of intraday lows) at $92.67 sill serves as support.

When we take a closer look at the position of the RSI, we notice that it still remains slightly above the 30 level. Taking this fact into account we have a positive divergence between the indicator and the price of light crude, which is a bullish sign.

Once we know the current situation in crude oil, let’s move on to the XOI daily chart.

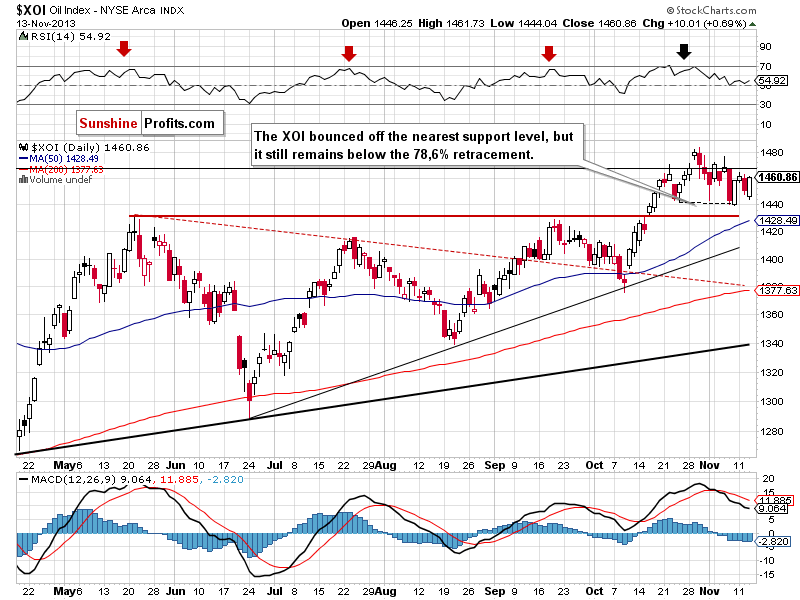

Looking at the above chart, we see that yesterday after the market open, the oil stock index dropped to its daily low at 1,444. However, it bounced off this level in the following hours and climbed to slightly below Tuesday’s top.

In spite of this growth, the XOI still remains below the previously-broken 78.6% Fibonacci retracement level at 1,467. If the buyers do not give up and push the oil stock index higher once again, we will likely see another attempt to close above this important resistance level.

Please note that a sell signal generated by the MACD is still in play and may encourage sellers to act. In this case, the nearest support level is Wednesday’s low and the next one is the bottom of the recent corrective move at 1,439. Keep in mind that the nearest resistance level is the previously-broken the 78.6% retracement and the next one is the 2013 high.

Summing up, although crude oil bounced off a monthly low the growth was too small to change the very short-term outlook, which is clearly bearish. On the other hand, we have a positive divergence between the RSI and the price of light crude, which is a bullish sign. Additionally, crude oil still remains in the declining trend channel in terms of daily closing prices and the long-, medium- and short-term support levels are still in play.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the medium- and short-term picture, we do not suggest opening any positions.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts