Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Wednesday, crude oil bounced off the Tuesday’s low after the Energy Information Administration report showed that U.S. crude oil inventories dropped more-than-expected. Thanks to this news, light crude gained 0.12% and tested the barrier of $50. Will it manage to stop oil bulls in the coming days?

Although the EIA reported that crude oil inventories fell by 3.641 million, beating expectations of a draw of 1.661 million barrels, the report also showed that gasoline inventories rose by 3.369 million, missing expectations for a drop of 1.020 million barrels and distillate stockpiles increased by 2.651 million barrels also missing expectations of a 1.037 million decline. As a result, light crude tested the barrier of $50, but then reversed and decline, invalidating the earlier tiny breakout. What does it mean for the black gold?

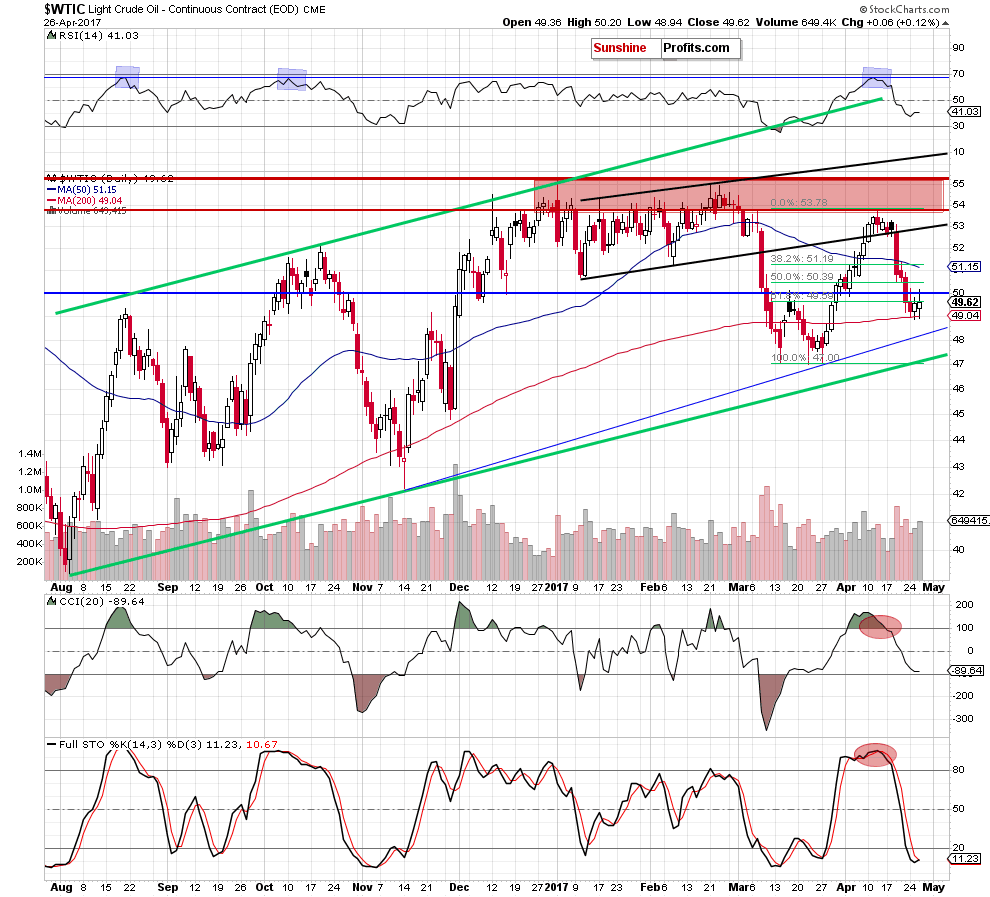

Let’s take a closer look at the daily chart below and find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil re-tested the 200-day moving average and rebounded to an intraday high of $50.20. Despite this improvement, light crude closed yesterday’s session under the barrier of $50, invalidating the earlier tiny breakout. This suggests that another downswing should not surprise us – especially when we factor in the fact that crude oil futures extended losses and dropped to an intraday low of $48.95 earlier today.

How low could the black gold go in the coming day(s)? In our opinion, the first downside target will be the 200-day moving average (currently around 49.04). However, if it is broken, the next downside target will be the blue support line based on the November and March lows (currently around $48.30). or even we’ll see a drop to around $47-$47.15, where the recent lows and the lower border of the long-term green rising trend channel are.

Summing up, short (profitable) positions continue to be justified as crude oil verified the breakdown under the barrier of $50, which suggests another attempt to move lower in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts